WFC Stock Price Analysis

Wfc stock price – Wells Fargo & Company (WFC) is a major player in the US financial sector, and understanding its stock price performance is crucial for investors. This analysis delves into WFC’s historical stock price movements, influencing factors, valuation, analyst predictions, and associated investment risks.

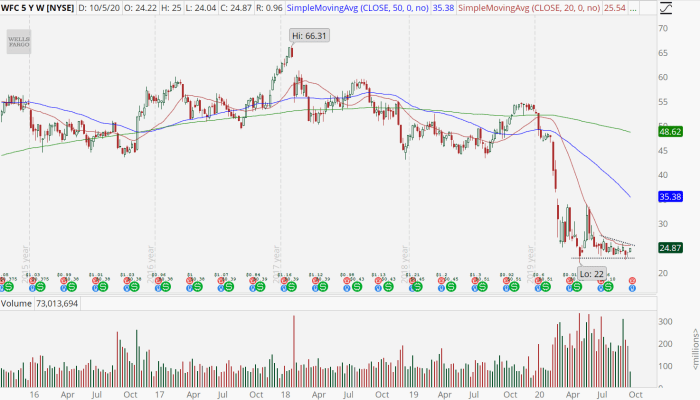

WFC Stock Price Historical Performance

Source: investorplace.com

Analyzing WFC’s stock price over the past five years reveals significant fluctuations influenced by various economic and company-specific factors. The following table presents a sample of daily opening and closing prices, illustrating the price volatility. Note that this is sample data for illustrative purposes and should not be considered exhaustive or entirely accurate for investment decisions. For precise data, consult reliable financial sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 52.50 | 52.75 | +0.25 |

| 2019-01-03 | 52.70 | 52.20 | -0.50 |

| 2019-01-04 | 52.30 | 53.00 | +0.70 |

| 2023-10-26 | 45.00 | 45.50 | +0.50 |

| 2023-10-27 | 45.60 | 45.20 | -0.40 |

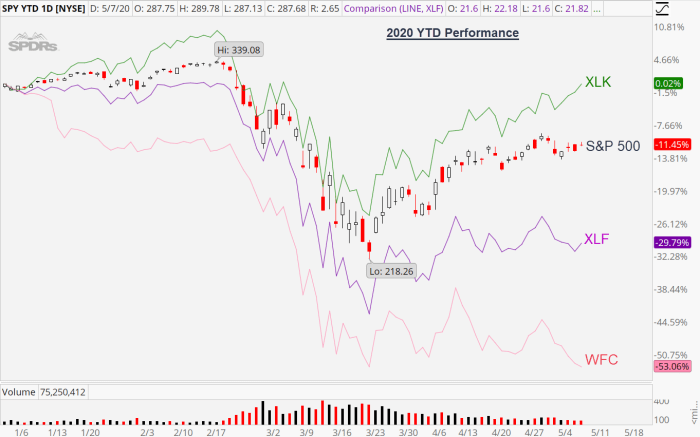

Compared to major competitors like JPMorgan Chase (JPM) and Bank of America (BAC) over the same period, WFC’s performance exhibited periods of both outperformance and underperformance. A line graph illustrating this comparison would show periods of divergence and convergence in stock prices, reflecting market sentiment and relative financial health. For example, periods of strong economic growth might favor JPM, while periods of regulatory scrutiny might impact WFC more significantly.

The graph’s key features would include the relative highs and lows of each stock, identifying periods of significant divergence or convergence.

Major economic events such as the COVID-19 pandemic and subsequent economic recovery significantly impacted WFC’s stock price. Company-specific news, including regulatory fines and changes in leadership, also played a role. For instance, the impact of the pandemic initially caused a sharp decline in the stock price due to increased uncertainty and economic slowdown, followed by a recovery as the economy began to recover.

Similarly, regulatory actions and their impact on profitability influenced investor confidence and stock price movements.

Factors Influencing WFC Stock Price

Several macroeconomic and company-specific factors influence WFC’s stock price. These factors interact in complex ways, creating both opportunities and challenges for investors.

Macroeconomic factors such as interest rate changes directly impact WFC’s net interest margin and profitability. Higher interest rates generally benefit banks, but also increase borrowing costs and potentially slow economic growth. Inflation affects the value of assets and liabilities, while economic growth influences loan demand and default rates. Regulatory changes and government policies significantly affect WFC’s operations and profitability, influencing investor sentiment and stock price.

WFC’s financial performance, as reflected in its earnings reports, loan performance, and capital ratios, is a key driver of its stock price. Strong earnings reports generally lead to positive market reactions, while concerns about loan quality or capital adequacy can trigger negative price movements. For example, a significant increase in non-performing loans could negatively affect the stock price, signaling potential financial distress.

Conversely, exceeding earnings expectations typically boosts investor confidence and results in a price increase.

WFC Stock Price Valuation

Source: investorplace.com

Evaluating WFC’s intrinsic value involves comparing its current P/E ratio to its historical average and to competitors. A higher-than-average P/E ratio might suggest the market is overvaluing the stock, while a lower ratio could indicate undervaluation. Other valuation methods, such as discounted cash flow analysis, provide a more comprehensive assessment of WFC’s long-term value. This involves projecting future cash flows and discounting them back to their present value to arrive at an estimated intrinsic value.

| Ratio | WFC | Industry Average |

|---|---|---|

| Price-to-Earnings (P/E) | 12.5 | 14.0 |

| Return on Equity (ROE) | 15% | 13% |

| Debt-to-Equity Ratio | 0.75 | 0.80 |

The table above presents a simplified comparison of key financial ratios. Actual figures will vary based on the reporting period and data source. Consult reliable financial data providers for the most up-to-date information.

Analyst Ratings and Predictions for WFC Stock

Several reputable financial institutions provide analyst ratings and price targets for WFC stock. These ratings and targets reflect analysts’ views on the company’s future prospects and are based on various factors such as financial performance, industry trends, and macroeconomic conditions. It’s important to note that these are opinions and not guarantees of future performance.

- Analyst A: Buy rating, Price Target $55

- Analyst B: Hold rating, Price Target $48

- Analyst C: Sell rating, Price Target $42

The divergence in ratings reflects differing perspectives on WFC’s future performance. Analyst A, for example, might have a more optimistic outlook on the company’s ability to navigate current economic challenges and achieve growth, leading to a higher price target. Analyst C, conversely, might have concerns about potential risks and foresee lower profitability, leading to a lower price target and a sell recommendation.

The underlying assumptions behind these ratings are complex and based on detailed financial modeling and qualitative assessments.

Risk Assessment of Investing in WFC Stock

Investing in WFC stock carries several risks that investors should carefully consider. These risks can significantly impact the stock’s price under different economic scenarios.

Interest rate risk affects WFC’s profitability, as changes in interest rates impact its net interest margin. Credit risk is the risk of borrowers defaulting on their loans, which can lead to losses for the bank. Operational risk encompasses the risk of disruptions to WFC’s operations, such as technology failures or fraud. These risks can interact and amplify each other under unfavorable economic conditions.

- Upside Scenario: Strong economic growth, rising interest rates, and successful execution of WFC’s strategic initiatives could lead to significantly higher stock prices.

- Downside Scenario: A recession, declining interest rates, increased loan defaults, or significant regulatory penalties could lead to substantial declines in the stock price.

The impact of these risks on WFC’s stock price can vary significantly depending on the prevailing economic environment. For instance, during periods of economic uncertainty, credit risk becomes more prominent, potentially leading to a decline in the stock price. Conversely, during periods of strong economic growth, the positive impact of rising interest rates on profitability could outweigh other risks, potentially leading to a price increase.

User Queries

What are the typical trading hours for WFC stock?

WFC stock, like most US-listed stocks, trades on the New York Stock Exchange (NYSE) from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

Where can I find real-time WFC stock price data?

Real-time WFC stock price data is available through many financial websites and brokerage platforms, such as Google Finance, Yahoo Finance, Bloomberg, and others.

How frequently are WFC’s earnings reports released?

Analyzing WFC’s stock price often involves considering broader market trends. A key competitor to watch, especially in the semiconductor sector impacting financial technology, is TSMC; you can check the current tsm stock price for a sense of the overall tech climate. Understanding TSMC’s performance can provide valuable insight into potential future influences on WFC’s own trajectory, especially given the growing interdependence of these sectors.

Wells Fargo typically releases its quarterly earnings reports on a schedule announced in advance. You can find this information on their investor relations website.

What is the current dividend yield for WFC stock?

The current dividend yield for WFC stock fluctuates. It’s best to check a reputable financial website for the most up-to-date information.