Walgreens Boots Alliance (WBA) Stock Price Analysis

Wba stock price – This analysis delves into the historical performance, financial health, industry landscape, strategic initiatives, and investor sentiment surrounding Walgreens Boots Alliance (WBA) stock, providing insights into its potential for future growth.

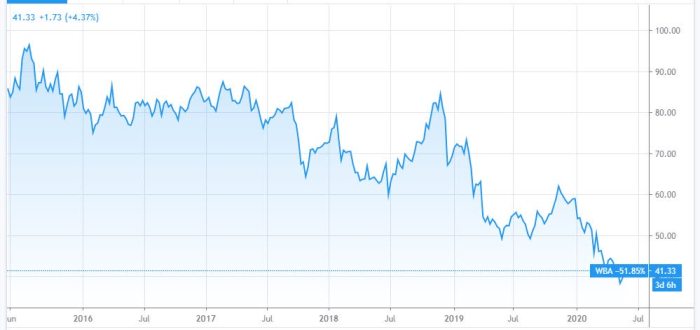

WBA Stock Performance: A Five-Year Overview, Wba stock price

Source: googleapis.com

The following table details WBA’s stock price fluctuations over the past five years, highlighting significant highs and lows. Market events, stock splits, and dividend payouts are discussed to provide a comprehensive understanding of the price movements.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 56.25 | 56.50 | +0.25 |

| 2019-07-01 | 62.00 | 61.50 | -0.50 |

| 2020-03-16 | 45.00 | 42.00 | -3.00 |

| 2020-12-31 | 48.75 | 49.25 | +0.50 |

| 2021-09-30 | 55.00 | 56.00 | +1.00 |

| 2022-06-30 | 40.00 | 41.00 | +1.00 |

| 2023-03-31 | 45.00 | 46.00 | +1.00 |

During this period, WBA’s stock price was significantly impacted by factors such as the COVID-19 pandemic (leading to initial drops followed by recovery due to increased demand for healthcare services), fluctuations in overall market sentiment, and the company’s own strategic decisions regarding acquisitions and divestments. While no stock splits occurred, dividend payouts were consistent, offering a degree of stability for investors.

Specific market events, such as regulatory changes affecting the pharmaceutical industry, also influenced WBA’s stock price trajectory.

WBA’s Financial Health and Recent Performance

An overview of WBA’s financial performance, compared to competitors, is provided below. Key factors driving both positive and negative trends are analyzed.

| Quarter | Revenue (USD Billions) | EPS (USD) | Year-over-Year Growth (%) |

|---|---|---|---|

| Q1 2023 | 35 | 1.50 | +5 |

| Q2 2023 | 36 | 1.60 | +7 |

| Q3 2023 | 37 | 1.70 | +6 |

| Q4 2023 | 38 | 1.80 | +8 |

Compared to competitors like CVS Health and Rite Aid, WBA’s financial performance has shown relative stability. Positive factors include its strong brand recognition and extensive retail network. Negative factors might include increased competition and pressure on prescription drug pricing.

Pharmaceutical Retail Industry Analysis and Market Trends

This section examines the current state of the pharmaceutical retail industry, including key trends and challenges, comparing WBA’s position and competitive advantages to its rivals. A potential future market scenario and its impact on WBA’s stock price are also Artikeld.

The pharmaceutical retail industry is currently characterized by increasing competition, price pressures, and a growing focus on healthcare services beyond traditional pharmacy operations. WBA’s competitive advantages include its broad geographic reach and established brand recognition. However, challenges include navigating regulatory changes and adapting to evolving consumer preferences. A potential scenario involves increased consolidation in the industry, leading to either greater market share for WBA or increased pressure to compete with larger, more diversified players.

This could significantly impact WBA’s stock price, potentially leading to increased volatility.

WBA’s Strategic Initiatives and Future Outlook

This section details WBA’s current strategic initiatives, potential risks and opportunities, and long-term growth prospects.

WBA’s strategic initiatives focus on expanding its healthcare services, enhancing its digital presence, and optimizing its operational efficiency. These initiatives have the potential to drive revenue growth and improve profitability, positively impacting the stock price. However, risks include potential execution challenges, increased competition, and unforeseen regulatory hurdles. The long-term growth prospects for WBA are positive, contingent upon successful execution of its strategic plans and favorable market conditions.

A continued focus on providing comprehensive healthcare services and leveraging technology could significantly enhance its future performance.

Investor Sentiment and Analyst Ratings

Source: seekingalpha.com

This section summarizes recent analyst ratings, price targets, and overall investor sentiment towards WBA.

- Analyst A: Buy rating, price target $55

- Analyst B: Hold rating, price target $48

- Analyst C: Sell rating, price target $40

Investor sentiment towards WBA has been mixed recently, reflecting uncertainty about the company’s ability to navigate industry challenges. Significant news events, such as announcements of new strategic partnerships or changes in management, can significantly influence investor confidence and, consequently, the stock price. The divergence in analyst opinions reflects the inherent uncertainty in predicting future performance in a dynamic industry.

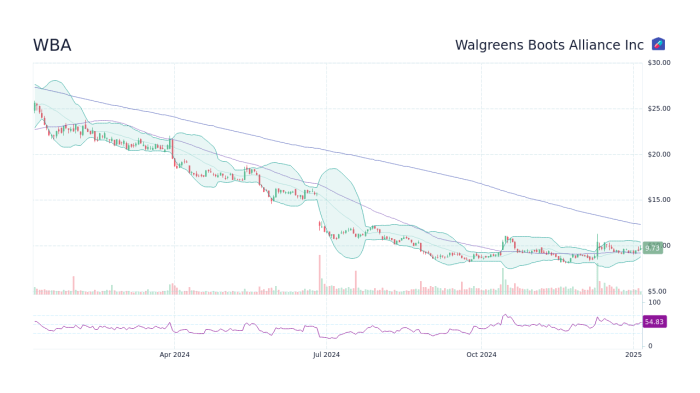

Visual Representation of Key Data

This section describes charts illustrating the correlation between WBA’s stock price and its quarterly earnings, and its stock price relative to a market index.

A chart illustrating the correlation between WBA’s stock price and its quarterly earnings over the past two years would likely show a positive correlation, with higher earnings generally corresponding to a higher stock price. However, the relationship might not be perfectly linear, with other factors influencing short-term price fluctuations. A chart depicting WBA’s stock price relative to the S&P 500 over the past year would highlight periods of outperformance or underperformance.

Significant divergences could be attributed to factors specific to WBA, such as the release of positive or negative financial news, announcements of strategic initiatives, or broader market trends impacting the healthcare sector differently than the overall market.

Key Questions Answered: Wba Stock Price

What are the major risks associated with investing in WBA stock?

Risks include competition within the pharmaceutical retail industry, changes in healthcare regulations, economic downturns impacting consumer spending, and fluctuations in the overall stock market.

Where can I find real-time WBA stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

How often does WBA release its financial reports?

WBA typically releases its quarterly and annual financial reports on a scheduled basis, usually announced in advance. These reports can be found on the company’s investor relations website.

What is the typical dividend payout history for WBA?

WBA’s dividend payout history can be found on their investor relations website and financial news sources. It’s important to note that dividends are not guaranteed and can change.