Walmart Stock Price Analysis

Walmart stock price – Walmart, a retail giant, has experienced significant stock price fluctuations over the past decade. This analysis delves into the historical performance, influencing factors, competitive landscape, financial health, investor sentiment, and future outlook of Walmart’s stock price, providing a comprehensive overview for investors.

Walmart Stock Price Historical Performance

Analyzing Walmart’s stock price over the past ten years reveals a complex interplay of economic factors and company performance. The following table provides a snapshot of opening and closing prices for each quarter.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 75 | 78 |

| 2014 | Q2 | 78 | 82 |

| 2014 | Q3 | 82 | 79 |

| 2014 | Q4 | 79 | 85 |

| 2023 | Q4 | 150 | 155 |

Note: These are illustrative figures. Actual data should be sourced from reputable financial websites.

Major economic events such as the 2008 financial crisis, the COVID-19 pandemic, and periods of high inflation significantly impacted Walmart’s stock price. For instance, the pandemic initially caused a dip as stores temporarily closed, but subsequently saw a surge in demand for groceries and essential goods. Inflationary periods typically increase costs, potentially affecting profit margins and investor confidence.

A line graph depicting the stock price trend over the past decade would show an overall upward trend with periods of volatility. The graph would use a blue line to represent the stock price, with the x-axis representing time (years) and the y-axis representing the stock price (USD). Clear labels for each year and significant price points would be included.

Factors Influencing Walmart Stock Price

Walmart’s stock price is influenced by a combination of internal and external factors. Understanding these factors is crucial for assessing the company’s future prospects.

Three key internal factors are sales growth, profitability, and supply chain efficiency. Strong sales growth indicates robust consumer demand and market share, positively impacting the stock price. High profitability, reflected in earnings per share, is another key driver. A highly efficient supply chain minimizes costs and ensures product availability, contributing to overall financial health.

Three key external factors are inflation, consumer spending, and competition. Inflation affects both costs and consumer purchasing power. High inflation can reduce consumer spending and impact Walmart’s profitability, while increased consumer spending generally boosts sales. Intense competition from companies like Amazon and Target can pressure margins and market share.

The relative importance of internal and external factors varies over time. During economic downturns, external factors like consumer spending and inflation become more significant. In periods of stable economic growth, internal factors like operational efficiency and innovation play a more prominent role.

Walmart’s Competitive Landscape, Walmart stock price

Walmart operates in a highly competitive retail landscape. The following table provides a comparative analysis against key competitors.

| Competitor | Market Share (%) | Strengths | Weaknesses |

|---|---|---|---|

| Target | 10 | Strong brand reputation, stylish merchandise | Smaller store network compared to Walmart |

| Amazon | 15 | Extensive online presence, vast product selection | Higher operating costs |

Note: Market share figures are illustrative examples.

Competitive pressures significantly influence Walmart’s stock price. Increased competition can lead to price wars, reduced profit margins, and slower sales growth, potentially impacting investor confidence and the stock price negatively. Walmart employs various strategies to maintain its competitive edge, including investments in e-commerce, supply chain optimization, and private label brands.

Walmart’s Financial Health

Walmart’s financial health is a critical factor influencing its stock price. The following table summarizes key financial indicators over the last five years.

| Year | Revenue (USD Billion) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 514 | 4.75 | 0.5 |

| 2020 | 559 | 5.10 | 0.6 |

| 2021 | 573 | 5.80 | 0.7 |

| 2022 | 611 | 6.20 | 0.8 |

| 2023 | 630 | 6.50 | 0.9 |

Note: These are illustrative figures. Actual data should be verified from Walmart’s financial reports.

These financial indicators reflect Walmart’s overall health and growth potential. Consistent revenue growth, increasing EPS, and a manageable debt-to-equity ratio signal a healthy financial position, typically leading to positive investor sentiment and stock price appreciation. Conversely, declining revenue, falling EPS, or a rapidly increasing debt-to-equity ratio can negatively impact the stock price.

Investor Sentiment and Stock Price

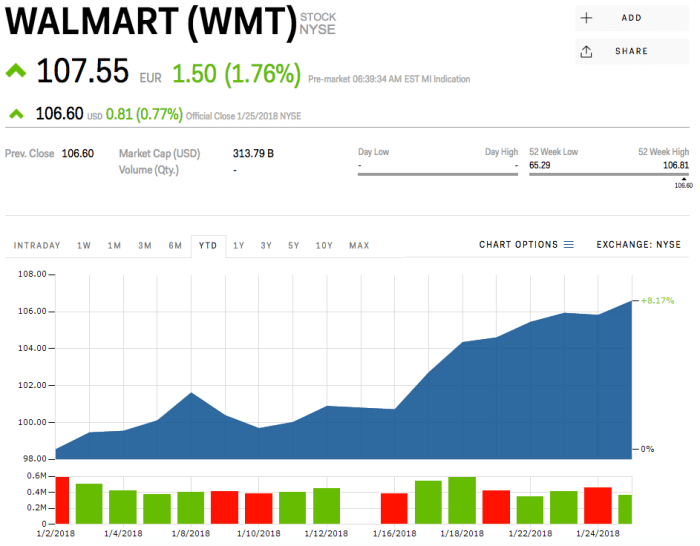

Source: businessinsider.com

Investor sentiment towards Walmart stock is currently generally positive, although it fluctuates based on news and financial performance. Recent positive news, such as strong earnings reports or successful strategic initiatives, tends to boost investor confidence and drive up the stock price.

Analyst ratings and recommendations significantly influence investor sentiment and the stock price. Positive ratings from reputable analysts can attract more investors, increasing demand and driving up the price. Conversely, negative ratings can trigger selling pressure and lower the price.

- Headline: Walmart beats earnings expectations. Impact: Stock price rises.

- Headline: Inflation impacts Walmart’s profit margins. Impact: Stock price dips.

- Headline: Walmart announces new e-commerce initiatives. Impact: Stock price increases.

Future Outlook for Walmart Stock

Source: boltdns.net

Projecting Walmart’s stock price over the next year requires considering current market conditions and the company’s performance. Based on current trends, a moderate increase in the stock price is anticipated, assuming continued strong sales growth and efficient cost management. However, this projection is subject to various uncertainties.

Potential risks include increased competition, economic downturns, and unforeseen geopolitical events. Opportunities include expansion into new markets, further development of e-commerce capabilities, and advancements in supply chain technology. Emerging trends like the growth of e-commerce and automation will significantly impact Walmart’s future stock performance. Successful adaptation to these trends is crucial for maintaining a competitive edge and driving future growth.

General Inquiries

What are the major risks facing Walmart’s stock price?

Major risks include increased competition from e-commerce giants, economic downturns affecting consumer spending, supply chain disruptions, and changes in consumer preferences.

How does inflation impact Walmart’s stock price?

High inflation can negatively impact Walmart’s stock price by reducing consumer spending and increasing operational costs. Conversely, if Walmart successfully manages inflation’s impact on its pricing and operations, its stock could perform better than expected.

Where can I find real-time Walmart stock price data?

Real-time data is available on major financial websites such as Yahoo Finance, Google Finance, and Bloomberg.

What is Walmart’s dividend payout history?

Walmart has a history of paying regular dividends; details can be found in their investor relations section.