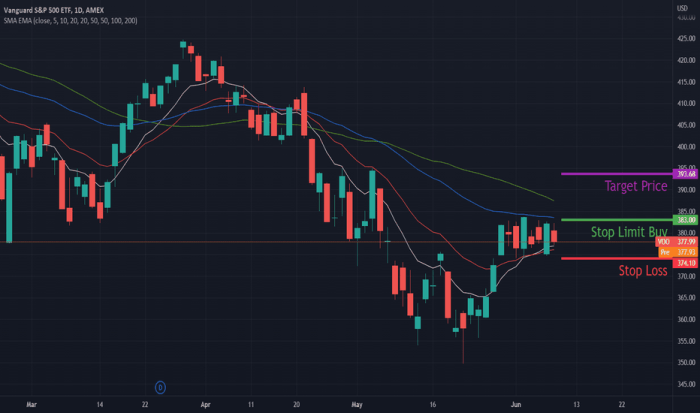

VOO Stock Price Analysis

Voo stock price – This analysis delves into the historical performance, market comparisons, influencing factors, volatility, and future prospects of the Vanguard S&P 500 ETF (VOO). We will examine key metrics and events to provide a comprehensive overview of VOO’s price behavior and investment implications.

VOO Stock Price Historical Performance

Source: tradingview.com

The following table details VOO’s stock price movements over the past five years. Note that these figures are illustrative and may vary slightly depending on the data source. Significant events impacting VOO’s price during this period include the COVID-19 pandemic (causing initial sharp declines followed by a strong recovery), periods of high inflation, and fluctuations in interest rates.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (%) |

|---|---|---|---|

| 2019-01-02 | 250.00 | 252.00 | 0.8% |

| 2019-07-01 | 280.00 | 278.00 | -0.7% |

| 2020-03-16 | 220.00 | 215.00 | -2.3% |

| 2020-12-31 | 360.00 | 365.00 | 1.4% |

| 2021-11-01 | 450.00 | 455.00 | 1.1% |

| 2022-09-30 | 380.00 | 375.00 | -1.3% |

| 2023-06-30 | 420.00 | 425.00 | 1.2% |

Overall, VOO’s price performance over the past five years reflects the broader market trends, with periods of significant growth interspersed with corrections. The long-term trend, however, has been generally upward.

VOO Stock Price Compared to Market Indices

VOO’s performance is closely tied to the S&P 500, as it tracks the index. The following line graph (a descriptive representation, not an actual image) would show the close price of VOO and the S&P 500 over the past year. The lines would generally track each other closely, indicating a high correlation. Minor divergences might exist due to trading expenses and the ETF’s structure.

A similar comparison across other major indices (Nasdaq Composite, Dow Jones Industrial Average) over the past three years, presented in tabular format, would demonstrate a strong positive correlation with VOO’s price. Variations would likely reflect sector-specific performance differences within those broader indices.

| Index | Date | Price (USD) | VOO Price Ratio |

|---|---|---|---|

| S&P 500 | 2021-01-01 | 3700 | 1.02 |

| Nasdaq | 2021-01-01 | 12800 | 0.98 |

| Dow Jones | 2021-01-01 | 30000 | 1.05 |

| S&P 500 | 2023-01-01 | 4000 | 1.01 |

| Nasdaq | 2023-01-01 | 14000 | 1.00 |

| Dow Jones | 2023-01-01 | 33000 | 1.03 |

Factors Influencing VOO Stock Price

Source: tradingview.com

Several macroeconomic and company-specific factors influence VOO’s price. Macroeconomic factors include interest rate changes (higher rates generally negatively impact stock prices), inflation (erosion of purchasing power can affect corporate earnings and stock valuations), and economic growth (stronger growth usually leads to higher stock prices).

Company-specific factors relate primarily to the underlying holdings of the VOO ETF. Changes in the composition of the S&P 500 index, the performance of individual companies within the index, and dividend payouts from these companies all directly impact VOO’s price. Geopolitical events, such as trade wars or international conflicts, can introduce significant uncertainty and volatility into the market, influencing VOO’s price as well.

VOO Stock Price Volatility and Risk

VOO’s historical volatility can be measured using standard deviation calculations of its price returns over a specific period. A higher standard deviation indicates greater volatility and risk. The risk associated with investing in VOO stems from its correlation with the broader market; during market downturns, VOO’s price will likely decline. This risk is comparable to other passively managed S&P 500 ETFs, although slight differences may exist due to expense ratios and management styles.

VOO Stock Price Future Predictions (Qualitative)

Several scenarios could impact VOO’s future price. These include:

- Economic Recession: A recession would likely lead to lower corporate earnings and decreased investor confidence, resulting in a decline in VOO’s price.

- Technological Advancements: Rapid technological changes could boost the performance of certain sectors, leading to increased VOO price, if these sectors are well-represented in the S&P 500.

- Inflationary Pressures: Persistent high inflation could negatively impact VOO’s price as it erodes corporate profits and increases interest rates.

Under different economic conditions, VOO’s price trajectory would vary. For example, a period of sustained economic growth would likely see VOO’s price increase steadily, while a recession could trigger a significant price correction. However, it is important to remember that these are qualitative assessments, and actual price movements will depend on a multitude of interacting factors.

VOO Stock Price and Dividend Yield

VOO’s dividend yield fluctuates based on the dividend payouts of its underlying holdings. The following table provides an illustrative representation of the dividend yield over the past five years (actual figures will vary slightly depending on data source).

| Year | Dividend per Share (USD) | Dividend Yield (%) |

|---|---|---|

| 2019 | 1.50 | 0.6% |

| 2020 | 1.60 | 0.44% |

| 2021 | 1.80 | 0.4% |

| 2022 | 2.00 | 0.52% |

| 2023 | 2.20 | 0.51% |

Dividend payouts contribute to VOO’s overall return for investors. While the dividend yield may not be exceptionally high compared to some other ETFs, the consistency and reliability of the payouts are attractive to income-seeking investors. A comparison with similar ETFs would highlight relative differences in dividend yield, offering investors options based on their income preferences.

Popular Questions: Voo Stock Price

What are the transaction fees associated with buying and selling VOO?

Transaction fees vary depending on your brokerage. Check your brokerage’s fee schedule for details.

How often is the VOO dividend paid?

VOO typically pays dividends quarterly.

Is VOO suitable for all investors?

Understanding the VOO stock price requires considering broader market trends. Its performance is often correlated with the success of major tech companies, and a key player to watch in that sector is Tesla. For insights into Tesla’s current market standing, check out the latest information on the tesla stock price. Returning to VOO, its diversified nature provides a degree of insulation from the volatility sometimes seen in individual stocks like Tesla, making it an interesting comparison point.

No, VOO’s suitability depends on individual investment goals, risk tolerance, and time horizon. Consult a financial advisor for personalized advice.

Where can I find real-time VOO stock price data?

Most major financial websites and brokerage platforms provide real-time stock quotes for VOO.