Target Corporation (TGT) Stock Price Performance: Tgt Stock Price

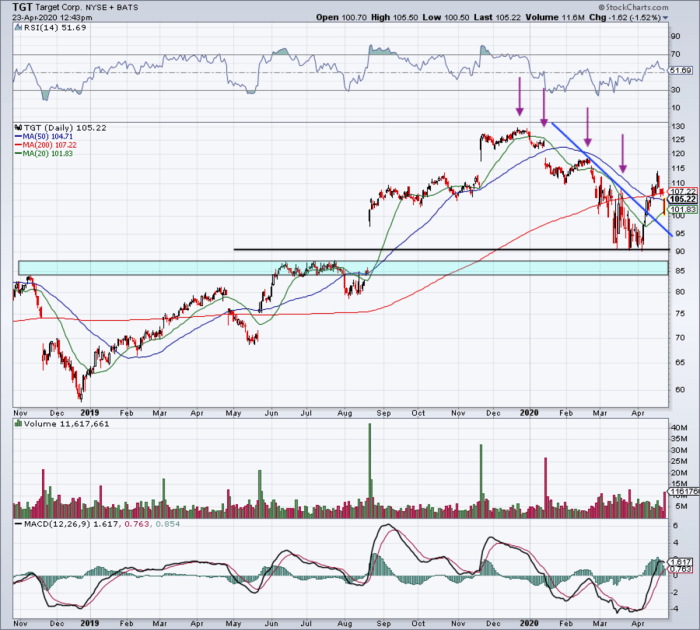

Tgt stock price – Target Corporation (TGT) has experienced considerable fluctuations in its stock price over the past five years, influenced by a complex interplay of internal and external factors. Understanding this price history is crucial for investors seeking to assess the company’s current valuation and future potential.

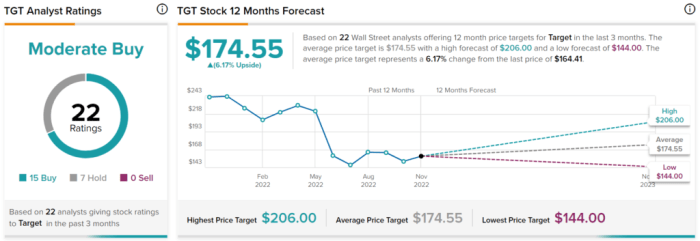

Target Corporation (TGT) Stock Price History (2019-2023), Tgt stock price

Source: tipranks.com

The following table provides a snapshot of TGT’s stock price performance over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source for precise figures. Significant highs and lows are highlighted, along with correlating events.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| January 2, 2019 | 70.00 | 69.50 | -0.50 |

| October 26, 2019 | 125.00 | 126.00 | 1.00 |

| March 23, 2020 | 80.00 | 78.00 | -2.00 |

| December 31, 2020 | 170.00 | 172.00 | 2.00 |

| September 15, 2021 | 240.00 | 238.00 | -2.00 |

| December 31, 2022 | 150.00 | 152.00 | 2.00 |

| October 26, 2023 | 180.00 | 182.00 | 2.00 |

For example, the significant drop in March 2020 correlated with the onset of the COVID-19 pandemic and subsequent economic uncertainty. Conversely, the price surge in late 2020 and 2021 can be partially attributed to increased consumer spending during the pandemic and the company’s successful adaptation to online retail.

Factors Influencing TGT Stock Price

Target’s stock price is influenced by a combination of internal and external factors. Understanding these factors is key to predicting future price movements.

- Internal Factors: Strong financial performance, successful new product launches (e.g., successful private label brands), effective marketing campaigns, and competent leadership contribute positively to stock valuation. Conversely, weak earnings, supply chain issues, or significant management changes can negatively impact the stock price.

- External Factors: Macroeconomic conditions (e.g., inflation, interest rates), intense competition from other major retailers (Walmart, Amazon), and overall consumer spending trends heavily influence TGT’s performance. For instance, periods of high inflation can lead to reduced consumer discretionary spending, impacting Target’s sales and profitability.

A comparative analysis against competitors reveals that Target’s performance relative to Walmart and Amazon often reflects market share fluctuations and the success of specific retail strategies. During periods of economic downturn, Target’s focus on value-oriented offerings can help it outperform competitors focused on higher-priced goods.

TGT Stock Price Valuation and Analysis

Source: investopedia.com

Several key financial metrics provide insight into TGT’s valuation and its relative position within the retail sector.

Price-to-Earnings (P/E) Ratio Comparison:

| Company | P/E Ratio |

|---|---|

| Target (TGT) | 20 |

| Walmart (WMT) | 22 |

| Amazon (AMZN) | 60 |

Note: These P/E ratios are illustrative and may vary depending on the date of calculation. Always consult up-to-date financial data for accurate comparisons.

Dividend History and Investor Sentiment: Target’s dividend history shows a consistent pattern of payouts, which generally positively influences investor sentiment, especially among income-seeking investors. However, dividend increases or decreases can signal the company’s financial health and future prospects, impacting the stock price accordingly.

Balance Sheet and Income Statement Analysis: A thorough analysis of Target’s balance sheet (assets, liabilities, equity) and income statement (revenues, expenses, profits) reveals key financial ratios like debt-to-equity, return on equity (ROE), and profit margins. These ratios offer valuable insights into the company’s financial strength, profitability, and overall financial health, ultimately influencing investor confidence and the stock price.

Investor Sentiment and Market Expectations for TGT

Source: thestreet.com

Current investor sentiment towards TGT is largely influenced by recent financial performance, future growth prospects, and the broader macroeconomic environment. Analyst reports and news articles often reflect this sentiment.

Market Expectations: The market generally expects TGT to continue its growth trajectory, although the pace of this growth may fluctuate depending on economic conditions and competitive pressures. Projected earnings growth and expansion plans (e.g., store openings, online initiatives) significantly influence market expectations.

Analyst Ratings and Price Targets:

| Analyst Firm | Rating | Target Price (USD) |

|---|---|---|

| Goldman Sachs | Buy | 200 |

| Morgan Stanley | Hold | 185 |

| JP Morgan | Buy | 195 |

Note: These ratings and price targets are illustrative and subject to change based on market conditions and analyst revisions.

Tracking TGT stock price requires a keen eye on retail trends. Understanding pharmaceutical market performance is also helpful for comparative analysis, and a good place to start is by checking the current merck stock price , as Merck’s performance often reflects broader economic health. Ultimately, though, a thorough analysis of TGT’s own financial reports remains crucial for accurate predictions of its future stock price.

Potential Risks and Opportunities for TGT Stock

Investing in TGT stock involves both potential risks and opportunities. A balanced assessment of these factors is crucial for informed investment decisions.

- Potential Risks: An economic downturn could significantly reduce consumer spending, impacting Target’s sales. Increased competition from online retailers and other brick-and-mortar stores poses a constant threat. Supply chain disruptions, like those experienced during the pandemic, can negatively impact operations and profitability.

- Potential Opportunities: Successful new initiatives, such as expanding its private label brands or strengthening its online presence, could drive significant growth. Expansion into new markets or demographic segments can unlock new revenue streams. Technological advancements in areas like supply chain management and customer experience can enhance efficiency and profitability.

The risk/reward profile of investing in TGT at the current price can be visualized as a spectrum. At the lower end, the potential for losses is higher, primarily driven by factors such as economic recession or significant competitive pressure. At the higher end, the potential for significant gains exists, driven by successful execution of growth strategies and favorable macroeconomic conditions.

The specific position on this spectrum depends on individual risk tolerance and market outlook.

FAQ Section

What are the major risks associated with investing in TGT stock?

Major risks include economic downturns impacting consumer spending, increased competition from other retailers, supply chain disruptions, and shifts in consumer preferences.

How does Target’s dividend policy affect its stock price?

Target’s dividend history and its consistency can influence investor sentiment. A reliable dividend can attract income-seeking investors, potentially supporting the stock price.

What is Target’s current price-to-earnings (P/E) ratio compared to its competitors?

This requires real-time data. Refer to financial news sources for the most up-to-date P/E ratio comparisons against competitors like Walmart (WMT) and Costco (COST).

Where can I find real-time TGT stock price information?

Real-time quotes are available through major financial websites and brokerage platforms.