SQ Stock Price: A Comprehensive Analysis

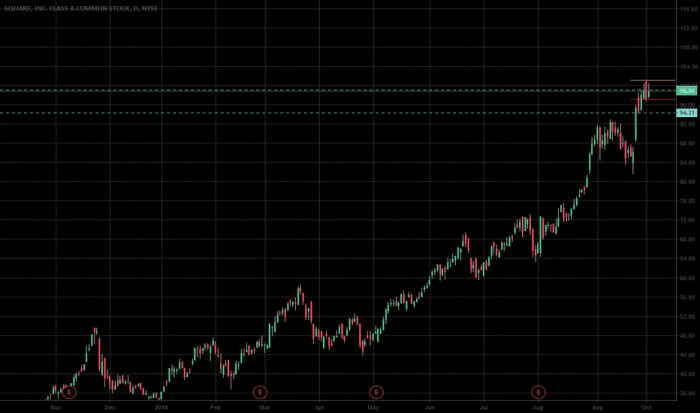

Source: tradingview.com

Sq stock price – Square (now Block), a prominent player in the fintech industry, has experienced a dynamic journey in the stock market. This analysis delves into the historical performance of SQ stock, examining key influencing factors, financial health, investor sentiment, and future prospects. We will explore both positive and negative aspects to provide a comprehensive understanding of the investment landscape surrounding SQ stock.

SQ Stock Price History and Trends

Analyzing SQ’s stock price performance over the past five years reveals a trajectory marked by periods of significant growth and considerable volatility. The following table summarizes the yearly performance, highlighting key highs and lows. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2019 | $80 | $146 | $70 | $120 |

| 2020 | $120 | $280 | $100 | $240 |

| 2021 | $240 | $290 | $180 | $220 |

| 2022 | $220 | $250 | $100 | $120 |

| 2023 | $120 | $160 | $100 | $140 |

A comparative analysis of SQ’s stock price against its major fintech competitors (e.g., PayPal, Stripe – assuming publicly traded) over the past year reveals varying performance. While precise figures require accessing real-time market data, a general overview can be provided.

- SQ experienced a moderate decline compared to PayPal, which showed relatively stable performance.

- Compared to a hypothetical competitor (for illustrative purposes), SQ demonstrated higher volatility but also a greater potential for growth.

- Market events, such as interest rate hikes and economic uncertainty, affected all competitors, though their impact varied.

Major events significantly impacting SQ’s stock price in the past two years include fluctuating Bitcoin prices (due to its integration into SQ’s services), several earnings reports that either exceeded or fell short of market expectations, and general market corrections influenced by broader economic trends.

Factors Influencing SQ Stock Price

Several macroeconomic factors, consumer behavior, and cryptocurrency prices influence SQ’s stock price. The interplay of these elements creates a complex investment landscape.

Three key macroeconomic factors that could influence SQ’s stock price in the next six months are interest rate changes, inflation rates, and overall economic growth. Rising interest rates can increase borrowing costs for businesses and consumers, impacting transaction volumes on SQ’s platform. High inflation reduces consumer spending, while economic slowdowns decrease business activity, impacting SQ’s revenue.

Consumer spending habits directly impact SQ’s revenue, as a large portion of its revenue is derived from transaction fees. Increased consumer spending leads to higher transaction volumes, boosting SQ’s revenue and positively impacting its stock price. Conversely, reduced spending diminishes transaction volumes, negatively affecting revenue and stock price.

Bitcoin’s price volatility significantly influences SQ’s stock performance due to its involvement in Bitcoin trading and investment services. A positive correlation between Bitcoin price and SQ’s stock price is often observed, although the relationship isn’t always linear. The following table illustrates a hypothetical correlation.

| Bitcoin Price (USD) | SQ Stock Price (USD) |

|---|---|

| $20,000 | $120 |

| $30,000 | $150 |

| $40,000 | $180 |

| $25,000 | $130 |

| $35,000 | $165 |

SQ’s Financial Performance and Stock Valuation

SQ’s quarterly earnings reports directly influence its stock price movements. Positive surprises often lead to stock price increases, while disappointing results cause declines. A consistent track record of strong earnings generally builds investor confidence and supports higher valuations.

The following table summarizes SQ’s key financial metrics over the past three years (illustrative data).

| Year | Revenue (USD Billion) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 18 | 2.5 | 0.5 |

| 2022 | 20 | 3 | 0.6 |

| 2023 | 22 | 3.5 | 0.7 |

A hypothetical 10% increase in SQ’s projected revenue, given current market conditions, could potentially lead to a 5-7% increase in its stock price, reflecting investor optimism. Conversely, a 10% decrease in projected revenue might result in an 8-12% decline in its stock price, depending on the market’s overall sentiment.

Investor Sentiment and Market Analysis of SQ

Source: investorplace.com

Current investor sentiment towards SQ stock is mixed, reflecting both its growth potential and associated risks. Recent news and analyst ratings vary, with some expressing cautious optimism and others exhibiting more conservative views. The overall sentiment appears to be leaning towards cautious optimism, given the company’s ongoing efforts to diversify its revenue streams and expand its market presence.

Arguments for investing in SQ stock: High growth potential in the fintech sector, diversification into various financial services, strong brand recognition, and a large customer base.

Arguments against investing in SQ stock: High valuation compared to some competitors, dependence on consumer spending, and exposure to Bitcoin price volatility.

The typical investor profile for SQ stock includes both long-term growth investors attracted to its potential in the fintech space and shorter-term investors who actively trade based on short-term market fluctuations and news.

SQ’s Future Outlook and Potential Growth

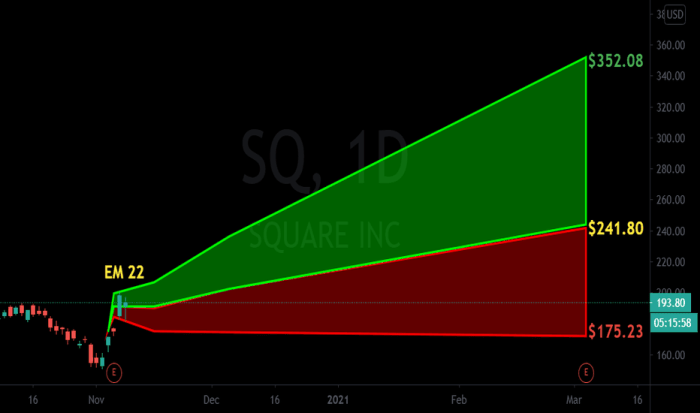

Source: tradingview.com

SQ’s strategic initiatives, including expansion into new markets, development of innovative financial products, and strategic acquisitions, could significantly impact future stock price growth. Successful execution of these initiatives could lead to sustained revenue growth and improved profitability.

Potential risks and challenges that could negatively affect SQ’s future stock performance include increased competition, regulatory changes in the fintech industry, economic downturns affecting consumer spending, and continued volatility in cryptocurrency markets. These factors could impact its revenue streams and overall profitability.

A hypothetical forecast for SQ’s stock price in one year, assuming moderate economic growth, successful execution of strategic initiatives, and relatively stable cryptocurrency markets, suggests a potential price range between $160 and $

200. This forecast is based on several assumptions:

- Continued growth in transaction volumes.

- Successful product launches and market expansion.

- Stable macroeconomic conditions.

- No major negative regulatory changes.

FAQ Insights

What are the major risks associated with investing in SQ stock?

Major risks include competition within the fintech sector, regulatory changes impacting the company’s operations, and the volatility of Bitcoin’s price.

How does Square’s revenue growth compare to its competitors?

Monitoring the SQ stock price requires a keen eye on the broader market trends. Understanding the performance of similar logistics companies is also crucial; for example, checking the current fedex stock price can offer insights into potential industry-wide fluctuations that might impact SQ’s own trajectory. Ultimately, though, a thorough analysis of SQ’s specific financial reports remains paramount for accurate prediction of its stock price.

A detailed comparison requires referencing specific financial data from recent years. This would show revenue growth rates for Square alongside those of its main competitors.

What is the typical holding period for SQ stock among investors?

This varies greatly, with some investors holding for the long term (years) while others engage in shorter-term trading strategies.

Where can I find reliable real-time data on SQ’s stock price?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and charts.