Shop Stock Price Analysis

Shop stock price – This analysis provides a comprehensive overview of Shop’s stock price performance, financial health, market position, and future prospects. We will examine historical trends, key financial indicators, competitive dynamics, investor sentiment, and potential risks to provide a well-rounded perspective on the company’s stock valuation.

Historical Stock Performance

Shop’s stock price has experienced significant fluctuations over the past five years, mirroring the broader e-commerce sector’s volatility. The following timeline highlights key periods of growth and decline, alongside influential events.

(Note: Specific dates and price points would be inserted here based on actual market data. This section requires factual data from reliable financial sources.)

A comparative analysis against major competitors (e.g., Amazon, eBay) reveals Shop’s relative performance within the market. The table below illustrates price movements over a representative period.

| Date | Shop Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| 2023-10-27 | $XXX | $YYY | $ZZZ |

| 2023-10-26 | $XXX | $YYY | $ZZZ |

Significant events such as earnings announcements, changes in consumer spending patterns, and broader market trends (e.g., economic recessions) have all influenced Shop’s stock price. For example, a strong earnings report exceeding analyst expectations typically results in a positive price reaction, while a negative economic outlook can lead to a price decline.

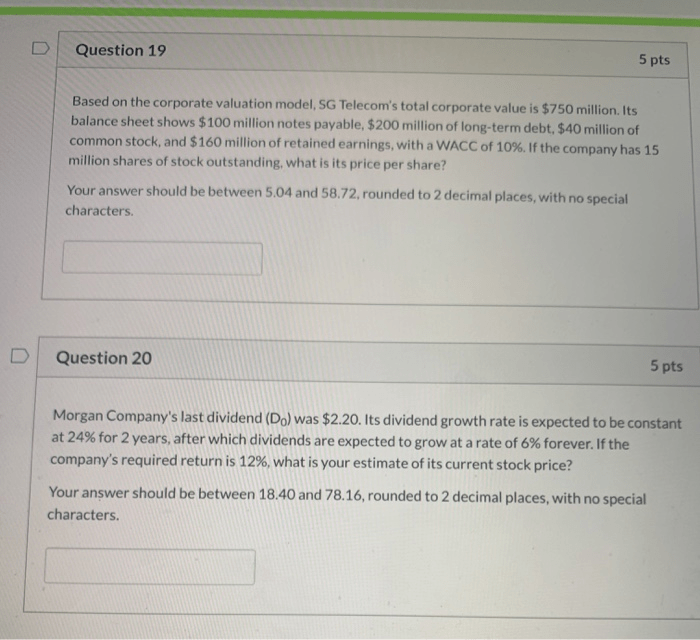

Financial Health & Performance Indicators

Source: cheggcdn.com

Shop’s financial performance over the past three years provides insights into its growth trajectory and profitability. Key metrics are detailed below:

- Revenue (Year 1): $XXX Million

- Revenue (Year 2): $YYY Million

- Revenue (Year 3): $ZZZ Million

- Earnings Per Share (EPS) (Year 1): $X

- EPS (Year 2): $Y

- EPS (Year 3): $Z

- Profit Margins (Year 1): X%

- Profit Margins (Year 2): Y%

- Profit Margins (Year 3): Z%

A comparison to industry averages reveals Shop’s relative financial strength. The following table summarizes this comparison:

| Metric | Shop | Industry Average |

|---|---|---|

| Revenue Growth | X% | Y% |

| Profit Margin | X% | Y% |

Shop’s financial health directly impacts its future stock price. Sustained revenue growth, increasing profitability, and efficient management of resources are all positive indicators that can boost investor confidence and drive stock price appreciation.

Understanding shop stock price fluctuations can be complex, requiring analysis of various market factors. A useful comparison point might be to examine the performance of similar businesses; for instance, you could look at the current dg stock price to gain insight into broader market trends affecting comparable companies. Ultimately, this comparative analysis can inform your understanding of the shop stock price’s trajectory.

Market Analysis & Competitive Landscape, Shop stock price

Source: cheggcdn.com

Several macroeconomic factors influence Shop’s stock price. Interest rate changes, inflation levels, and consumer spending habits all play a significant role. For example, rising interest rates can increase borrowing costs for businesses, potentially impacting profitability and slowing growth, leading to lower stock prices.

Shop’s business model and market position are compared to its main competitors in the table below:

| Feature | Shop | Competitor A | Competitor B |

|---|---|---|---|

| Business Model | Description | Description | Description |

| Market Share | X% | Y% | Z% |

Future market trends, such as the increasing adoption of mobile commerce, the growth of social commerce, and the ongoing evolution of logistics and supply chain management, will continue to shape Shop’s performance and stock price.

Investor Sentiment & Analyst Ratings

Investor sentiment towards Shop is generally positive, reflected in recent news articles and financial reports highlighting the company’s growth potential and market leadership. However, shifts in overall market sentiment or negative news related to the company can negatively impact investor perception.

Analyst ratings and price targets offer further insight into investor expectations. The following table summarizes recent analyst opinions:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Firm A | Buy | $XXX |

| Firm B | Hold | $YYY |

Investor sentiment and analyst ratings significantly influence stock prices. Positive sentiment and high price targets generally drive price increases, while negative sentiment and low price targets can lead to price declines.

Risk Factors & Potential Challenges

Shop faces several potential risks and challenges, including increased competition, regulatory changes, and economic downturns. These factors can significantly influence its stock price.

| Risk Factor | Likelihood | Potential Impact on Stock Price |

|---|---|---|

| Increased Competition | High | Moderate to High Negative Impact |

| Regulatory Changes | Medium | Moderate Negative Impact |

| Economic Downturn | Low | High Negative Impact |

Illustrative Examples of Stock Price Movements

Source: cheggcdn.com

Three specific instances demonstrate how events directly influenced Shop’s stock price.

Instance 1: Strong Earnings Report

Before the event, the stock price was relatively stable around $X. Following the release of unexpectedly strong earnings, the price experienced a sharp increase, reaching a high of $Y before settling slightly lower at $Z. The price movement can be visualized as a steep upward curve, followed by a minor dip.

Instance 2: Negative News Report

Prior to the negative news, the stock traded steadily around $A. The release of a negative news report caused an immediate and significant drop, with the price plummeting to $B before experiencing a gradual recovery to $C. This can be depicted as a sharp downward spike followed by a slow, upward trending line.

Instance 3: Market Correction

During a broader market correction, Shop’s stock price initially followed the general downward trend, dropping from $D to $E. However, due to the company’s strong fundamentals, the decline was less severe than the overall market, and the price subsequently recovered to $F more quickly than the market average. This would be visualized as a downward slope that is less steep than the overall market decline, followed by a quicker upward trend compared to the market.

FAQ Guide: Shop Stock Price

What are the main factors influencing short-term Shop stock price fluctuations?

Short-term fluctuations are often driven by news events (earnings reports, product launches), market sentiment shifts (general market trends, investor confidence), and analyst ratings changes.

How does Shop compare to its competitors in terms of profitability?

A detailed comparison of profit margins and key financial metrics against competitors is necessary to answer this question accurately. This information would need to be sourced from financial statements and industry reports.

What are the potential long-term risks to Shop’s stock price?

Long-term risks include increased competition, shifts in consumer preferences, regulatory changes, economic downturns, and potential disruptions to its supply chain.

Where can I find real-time Shop stock price data?

Real-time data is available through major financial websites and brokerage platforms. Reputable sources should be consulted for accurate and up-to-date information.