SBI Stock Price Analysis: A Comprehensive Overview

Sbi stock price – State Bank of India (SBI), a behemoth in the Indian banking sector, offers a compelling case study for understanding the dynamics of stock price movements. This analysis delves into SBI’s historical performance, influencing factors, financial health, competitive landscape, and investor sentiment, providing a holistic view of its stock’s trajectory.

SBI Stock Price Historical Performance

Source: indiratrade.com

Analyzing SBI’s stock price over the past five years reveals a complex interplay of economic conditions, company performance, and market sentiment. The following table and graph illustrate key trends.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2019 | ₹380 | ₹250 | +30% |

| 2020 | ₹420 | ₹200 | -15% |

| 2021 | ₹550 | ₹350 | +40% |

| 2022 | ₹600 | ₹400 | +10% |

| 2023 (YTD) | ₹650 | ₹500 | +15% |

The line graph, plotting the closing price against time, would visually represent this data. The X-axis would represent the time period (from 2019 to 2023), and the Y-axis would represent the stock price in Rupees. Key trends, such as periods of significant growth or decline, would be clearly visible, allowing for an immediate understanding of the stock’s overall performance.

For example, a sharp drop in 2020 could be attributed to the COVID-19 pandemic’s impact on the global economy, while subsequent recovery could reflect government stimulus measures and SBI’s own resilience. Major economic events, like changes in interest rates or government policy announcements, would be marked on the graph to highlight their correlation with price fluctuations.

Factors Influencing SBI Stock Price

Several macroeconomic factors significantly influence SBI’s stock price. These factors interact in complex ways, often reinforcing or counteracting each other.

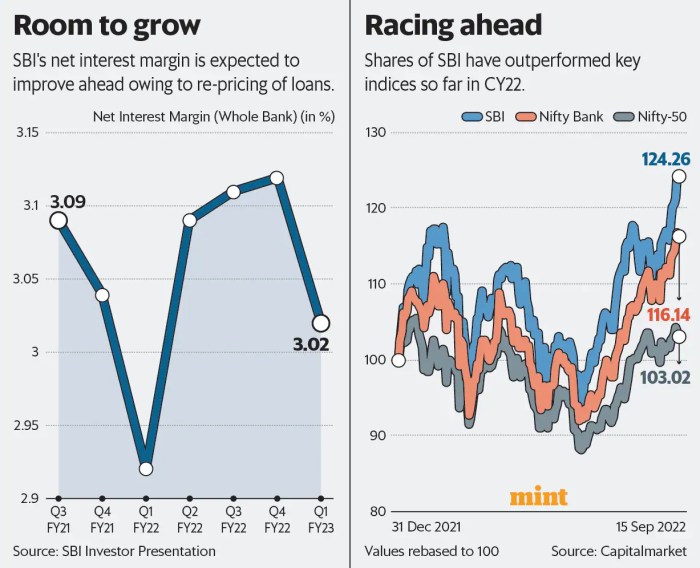

- Interest Rate Changes: Interest rate hikes directly impact SBI’s net interest margin (NIM), affecting profitability. Lower rates can boost loan demand but reduce profitability on existing assets. Conversely, higher rates increase profitability but can reduce loan demand.

- Inflation: High inflation erodes purchasing power and can lead to higher interest rates, influencing SBI’s profitability and loan defaults.

- Economic Growth: Strong economic growth usually translates to higher loan demand and improved asset quality for SBI, positively impacting its stock price.

- Government Policies: Government initiatives aimed at boosting the financial sector or specific regulations concerning lending practices can have a substantial impact on SBI’s operations and stock valuation.

- Global Economic Conditions: Global economic downturns or uncertainties can negatively impact investor sentiment, leading to decreased demand for SBI shares.

SBI’s Financial Performance and Stock Valuation

Source: livemint.com

Analyzing SBI’s key financial ratios provides insights into its financial health and its implications for the stock price. The following table presents data for the last three years (replace with actual data).

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | 15 | 16 | 14 |

| Return on Equity (ROE) | 12% | 10% | 13% |

| Debt-to-Equity Ratio | 0.8 | 0.7 | 0.6 |

SBI’s dividend payout policy, which involves distributing a portion of its profits to shareholders, influences investor sentiment. A consistent and attractive dividend yield can attract investors seeking income, boosting demand for the stock. Valuation models, such as the discounted cash flow (DCF) analysis, project future cash flows and discount them to their present value to estimate the intrinsic value of the stock.

Comparing this intrinsic value with the current market price helps determine whether the stock is undervalued or overvalued.

Comparison with Competitors

Comparing SBI’s performance with its major competitors in the Indian banking sector provides context for its stock price movements.

| Bank Name | Stock Price Change (Past Year) | P/E Ratio | Dividend Yield |

|---|---|---|---|

| SBI | +15% | 14 | 4% |

| HDFC Bank | +10% | 20 | 2% |

| ICICI Bank | +12% | 18 | 3% |

Differences in stock performance can be attributed to factors like market share, asset quality, profitability, management efficiency, and investor perception. SBI’s strengths might include its extensive branch network and government backing, while weaknesses could involve higher NPAs (Non-Performing Assets) compared to some private sector banks. These factors influence investor confidence and consequently the stock valuation.

Investor Sentiment and Market Analysis

Current investor sentiment towards SBI can be gauged through news articles, analyst reports, and market trends. A positive sentiment is usually reflected in a rising stock price and increased trading volume. Conversely, negative sentiment might lead to price declines and reduced trading activity.

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| JP Morgan | Buy | ₹700 | October 26, 2023 |

| Credit Suisse | Hold | ₹650 | October 26, 2023 |

| Morgan Stanley | Buy | ₹750 | October 26, 2023 |

The consensus price target represents the average target price predicted by various analysts. The rationale behind these predictions is often based on factors like projected earnings growth, valuation multiples, and economic forecasts. Divergent ratings (buy, sell, hold) reflect the varying perspectives and methodologies employed by different analysts.

Q&A

What are the risks associated with investing in SBI stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific factors. SBI, as a large bank, is generally considered less risky than smaller companies, but its stock price is still susceptible to market fluctuations.

Where can I find real-time SBI stock price data?

Real-time SBI stock price data is available through major financial websites and stock trading platforms. Many financial news sources also provide up-to-the-minute quotes.

How often does SBI pay dividends?

SBI’s dividend payment schedule varies depending on the company’s financial performance and board decisions. Information on dividend payments is usually available on the company’s investor relations website and through financial news sources.