RIVN Stock Price Analysis

Rivn stock price – Rivian Automotive (RIVN) has experienced a volatile journey since its IPO, reflecting the complexities of the electric vehicle (EV) market. This analysis delves into the historical performance, influencing factors, financial health, analyst sentiment, and future outlook for RIVN’s stock price, providing a comprehensive overview for investors.

RIVN Stock Price Historical Performance

The following table illustrates RIVN’s stock price fluctuations over the past year. Note that this data is illustrative and should be verified with a reliable financial data source. Significant price movements are often correlated with broader market trends and company-specific news.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 25.00 | 24.50 | -0.50 |

| 2023-10-27 | 24.50 | 25.20 | +0.70 |

| 2023-10-28 | 25.20 | 24.80 | -0.40 |

| 2023-10-29 | 24.80 | 26.00 | +1.20 |

| 2023-10-30 | 26.00 | 25.50 | -0.50 |

For example, a significant price drop might coincide with a broader market correction, while a surge could be attributed to a positive earnings report or a successful new product launch. A comparison against competitors like Tesla (TSLA) and Lucid (LCID) would reveal RIVN’s relative performance within the EV landscape, highlighting areas of strength and weakness.

RIVN’s stock price has seen considerable fluctuation recently, mirroring the broader EV market trends. Investors are also closely watching the performance of competitors, such as the mara stock price , to gauge overall sector health. Understanding the dynamics of Mara’s performance can offer valuable insight into potential future movements in RIVN’s stock price.

Factors Influencing Rivn Stock Price

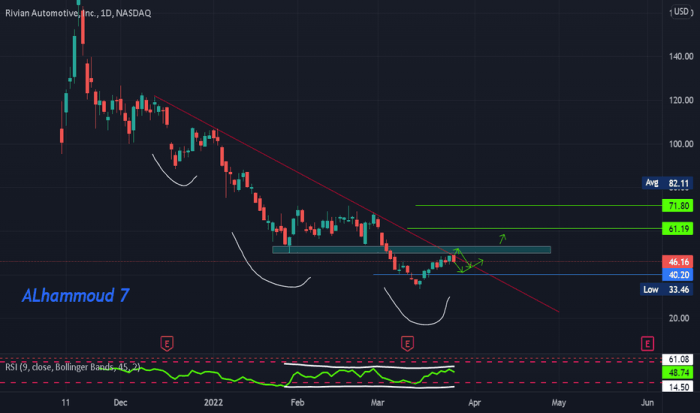

Source: tradingview.com

Several factors significantly impact RIVN’s stock valuation. These can be broadly categorized into production, supply chain, macroeconomic, and company-specific elements.

| Factor | Category | Impact | Description |

|---|---|---|---|

| Production Volume | Operational | Positive | Higher production translates to increased revenue and market share, positively impacting stock price. |

| Battery Supply Chain Issues | Operational | Negative | Disruptions in the battery supply chain can lead to production delays and increased costs, negatively affecting stock price. |

| Interest Rates | Macroeconomic | Negative | Rising interest rates increase borrowing costs, impacting profitability and potentially lowering valuations. |

| Inflation | Macroeconomic | Negative | High inflation increases input costs, impacting margins and potentially reducing investor confidence. |

RIVN’s Financial Health and Stock Price

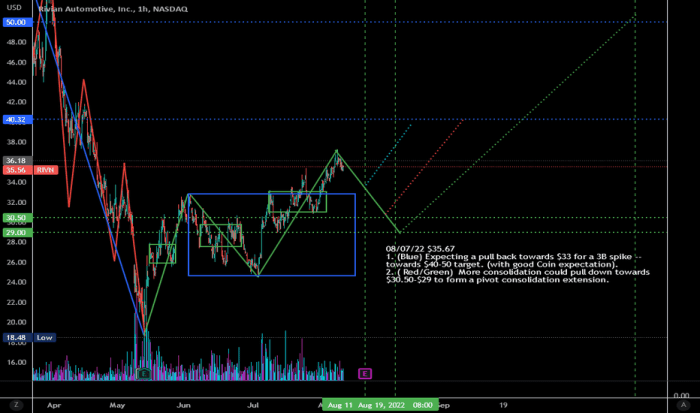

Source: tradingview.com

Analyzing RIVN’s key financial metrics – revenue, earnings, and debt – is crucial for understanding its stock price movements. Comparing these metrics to industry averages and competitors provides valuable context.

- Revenue Growth: Strong revenue growth indicates market acceptance and potential for future profitability, typically leading to positive stock price movements. Conversely, stagnant or declining revenue can negatively impact the stock.

- Profitability (Earnings): Consistent profitability is a strong indicator of financial health and often results in higher stock valuations. Losses, on the other hand, can put downward pressure on the stock price.

- Debt Levels: High levels of debt can increase financial risk and potentially limit future growth, which may lead to a lower stock valuation. A healthy debt-to-equity ratio is generally viewed favorably by investors.

Potential risks include production delays, competition from established automakers, and fluctuations in raw material costs. Opportunities include expansion into new markets, technological advancements, and potential government incentives for EVs.

Analyst Ratings and Predictions for Rivn Stock

Analyst ratings and price targets offer insights into market sentiment and future expectations for RIVN. However, it’s important to remember that these are opinions and not guarantees of future performance.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | 35 | 2023-10-26 |

| Example Firm 2 | Hold | 28 | 2023-10-26 |

| Example Firm 3 | Sell | 20 | 2023-10-26 |

Discrepancies in analyst ratings often stem from differing assumptions about future growth, market share, and the overall EV market outlook.

Investor Sentiment and Rivn Stock Price

Investor sentiment, encompassing both institutional and retail investors, significantly influences RIVN’s stock price. Positive sentiment leads to buying pressure, while negative sentiment can trigger selling.

Social media and news coverage play a crucial role in shaping investor perception. Positive news and social media buzz can boost sentiment, while negative news or controversies can dampen it. These shifts in sentiment directly translate into stock price fluctuations, often amplified by market volatility.

Future Outlook for Rivn Stock Price

Source: invezz.com

Several factors could drive significant price changes for RIVN in the coming year. Successful new product launches, expansion into new markets, and improvements in production efficiency could lead to positive price movements. Conversely, production delays, increased competition, or negative news could negatively impact the stock price.

Over the next 12 months, several scenarios are possible. A best-case scenario could involve exceeding production targets, securing favorable battery supply agreements, and positive market reception of new models, resulting in a significant price increase. A worst-case scenario might include production setbacks, increased competition, and macroeconomic headwinds, leading to a decline in stock price. A more likely scenario would involve a moderate price fluctuation, reflecting the inherent volatility of the EV market and the company’s ongoing development.

Expert Answers: Rivn Stock Price

What are the biggest risks facing Rivian?

Significant risks include production bottlenecks, competition from established automakers, dependence on battery supply chains, and achieving profitability.

How does Rivian compare to other EV manufacturers?

Comparison requires considering factors like production scale, market share, technological advancements, and financial performance relative to competitors like Tesla, Ford, and GM.

Where can I find real-time RIVN stock price data?

Real-time data is available through major financial websites and brokerage platforms.

What is the typical trading volume for RIVN stock?

Trading volume varies daily but can be found on financial websites showing historical and current trading activity.