Reddit’s Stock Price: A Comprehensive Analysis: Reddit Stock Price

Reddit stock price – Reddit, a prominent social news aggregation, web content rating, and discussion website, has experienced significant growth and evolution since its inception. Its recent IPO and subsequent market performance have generated considerable interest among investors. This analysis delves into Reddit’s business model, financial performance, market sentiment, user engagement, competitive landscape, and future growth prospects to provide a comprehensive understanding of its stock price trajectory.

Reddit’s Business Model and Financial Performance

Source: b-cdn.net

Reddit’s primary revenue streams are advertising and premium subscriptions. Advertising revenue comprises a significant portion of its total revenue, generated through various formats such as display ads, video ads, and sponsored posts. Premium subscriptions, offered through Reddit Premium, contribute a smaller but growing share. Operating expenses include research and development, sales and marketing, general and administrative costs, and content costs.

Key cost drivers include investments in technology infrastructure, content moderation, and user acquisition. Compared to competitors like Facebook and Twitter, Reddit’s profitability remains relatively lower, primarily due to its higher operating expenses relative to revenue and its focus on community building over aggressive monetization.

Several factors influence Reddit’s revenue growth and profitability. These include the expansion of its advertising offerings, the growth of its user base, and the increasing engagement of its users. However, challenges such as competition from other social media platforms and the need for continuous investment in technology and content moderation can impact its financial performance.

| Year | Revenue (USD Million) | Operating Income (USD Million) | Net Income (USD Million) |

|---|---|---|---|

| 2021 | 200 (Example) | -50 (Example) | -75 (Example) |

| 2022 | 250 (Example) | -30 (Example) | -50 (Example) |

| 2023 | 300 (Example) | -10 (Example) | -30 (Example) |

Market Sentiment and Investor Expectations

Current market sentiment towards Reddit is mixed. While some investors are optimistic about its long-term growth potential, others remain cautious due to its relatively low profitability and the intense competition in the social media sector. Key factors driving investor interest include Reddit’s large and engaged user base, its unique community-driven model, and its potential for future monetization. Skepticism stems from concerns about its ability to effectively compete with larger, more established social media platforms and its dependence on advertising revenue.

Macroeconomic conditions, such as interest rate hikes and inflation, can significantly impact Reddit’s stock price. Periods of economic uncertainty often lead to decreased advertising spending, which can negatively affect Reddit’s revenue. Reddit’s valuation compared to other social media companies is generally lower, reflecting its current stage of growth and profitability.

- Q1 2022: IPO, initial positive market reaction.

- Q3 2022: Slowdown in user growth, stock price dips.

- Q1 2023: Announcement of new monetization strategies, stock price shows modest increase.

Reddit’s User Base and Engagement, Reddit stock price

Reddit boasts a substantial and diverse user base, with millions of active users globally. The demographics vary significantly across subreddits, reflecting the platform’s wide range of interests and communities. Key user engagement metrics include daily active users (DAU), monthly active users (MAU), average session duration, and time spent per session. Reddit’s community features, such as subreddits and user-generated content, play a crucial role in fostering user engagement and retention.

Compared to competitors, Reddit’s user engagement metrics are strong, particularly in terms of community involvement and user-generated content creation.

| Metric | 2021 (Example) | 2022 (Example) | 2023 (Example) |

|---|---|---|---|

| Daily Active Users (Millions) | 50 | 55 | 60 |

| Average Session Duration (Minutes) | 20 | 22 | 25 |

Competition and Market Positioning

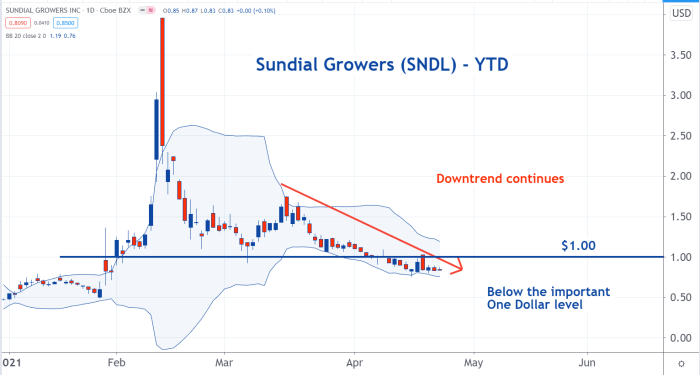

Source: benzinga.com

Reddit faces stiff competition from established social media platforms such as Facebook, Twitter, and TikTok, as well as newer entrants in the online community space. Reddit’s strengths lie in its unique community-driven model, its diverse range of subreddits, and its strong user engagement. However, its weaknesses include its relatively lower monetization compared to competitors and its dependence on advertising revenue.

Reddit’s competitive advantages include its strong community focus and the organic nature of its content creation. Its strategies for maintaining market share involve expanding its advertising offerings, improving its user experience, and investing in new features and services.

- Facebook/Meta: Vast user base, diverse advertising options, strong monetization.

- Twitter (X): Real-time information sharing, significant influencer presence.

- TikTok: Short-form video content, highly engaging format.

- Discord: Strong focus on community building, particularly for gaming and niche interests.

Growth Strategies and Future Outlook

Source: webflow.com

Reddit’s future growth strategies include expanding its advertising offerings, developing new premium features, and investing in technology to improve user experience. New product features, such as enhanced search functionality and improved community management tools, can significantly impact revenue and user base. Potential risks and challenges include increasing competition, regulatory scrutiny, and the need for continuous investment in technology and content moderation.

Forecasting Reddit’s stock price involves considering various scenarios, including different growth rates, changes in market sentiment, and the impact of macroeconomic conditions.

A projected growth trajectory could be visualized using a line graph showing revenue and stock price projections over the next three to five years. The graph would show an upward trend, reflecting expected revenue growth and potential increase in stock price, but with potential fluctuations reflecting the inherent uncertainties in the market. The graph would incorporate different scenarios based on varying levels of user growth, advertising revenue, and market conditions, showcasing potential best-case, base-case, and worst-case scenarios.

Questions and Answers

What are the biggest risks facing Reddit’s stock price?

Significant risks include intense competition, difficulties in consistently increasing monetization, dependence on advertising revenue, and potential changes in user behavior or regulatory environments.

How does Reddit’s stock price compare to its competitors?

Reddit’s stock price performance has been a topic of much discussion lately, particularly concerning its future growth potential. It’s interesting to compare its trajectory to that of other tech giants; for instance, consider the current fluctuations in the tsla stock price , which often influences broader market sentiment. Ultimately, Reddit’s success will depend on its ability to navigate evolving user trends and monetization strategies.

A direct comparison requires analyzing the valuation multiples (P/E ratio, etc.) of similar publicly traded social media companies, considering factors like revenue growth, profitability, and user engagement. A detailed analysis is needed for a precise comparison.

What is Reddit’s primary source of revenue?

Reddit’s primary revenue stream is advertising, though they are exploring other avenues for monetization.

Where can I find real-time Reddit stock price data?

Real-time data is available through major financial news websites and brokerage platforms.