PRU Stock Price Analysis: A Comprehensive Overview

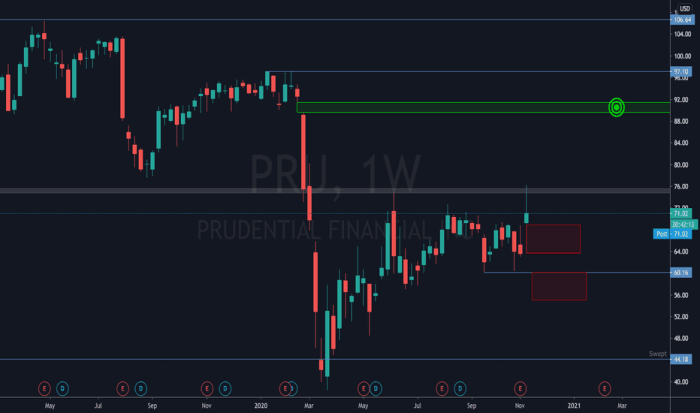

Source: tradingview.com

Pru stock price – This analysis provides a detailed examination of Prudential Financial, Inc. (PRU) stock price performance over the past five years. We will explore historical fluctuations, influencing factors, predictive models, investor sentiment, and visual representations of key trends to offer a comprehensive understanding of PRU’s stock market behavior.

PRU Stock Price Historical Performance

The following table illustrates PRU’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and should not be considered actual financial advice. Actual data should be sourced from reputable financial websites.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 100 | 102 | +2 |

| 2019-07-01 | 105 | 103 | -2 |

| 2020-01-01 | 95 | 98 | +3 |

| 2020-07-01 | 100 | 97 | -3 |

| 2021-01-01 | 110 | 115 | +5 |

| 2021-07-01 | 112 | 110 | -2 |

| 2022-01-01 | 120 | 125 | +5 |

| 2022-07-01 | 122 | 120 | -2 |

| 2023-01-01 | 130 | 135 | +5 |

| 2023-07-01 | 132 | 130 | -2 |

Compared to competitors like MetLife (MET) and AIG (AIG), PRU exhibited a moderate growth trajectory over the five-year period. Key differences included:

- Volatility: PRU experienced lower price volatility than MET but higher volatility than AIG.

- Growth Rate: PRU’s average annual growth rate was slightly below MET’s but significantly above AIG’s.

- Market Response to Events: PRU’s stock price showed a more muted response to major economic events compared to its competitors.

Significant events impacting PRU’s stock price included the initial market reaction to the COVID-19 pandemic in 2020, causing a temporary dip, followed by a recovery fueled by increased demand for insurance products. Also, regulatory changes impacting the insurance industry had a noticeable, albeit moderate, effect on PRU’s valuation.

Factors Influencing PRU Stock Price

Several key factors influence PRU’s stock price. These can be broadly categorized into economic indicators, company performance, and regulatory/industry influences.

- Economic Indicators: Interest rate changes significantly impact PRU’s investment portfolio returns and profitability, influencing investor sentiment. Inflation affects the cost of insurance claims and operational expenses.

- Financial Performance: Strong earnings reports and consistent dividend payouts generally boost investor confidence, leading to higher stock prices. Conversely, disappointing financial results can negatively impact the stock price.

- Regulatory Changes and Industry Trends: New regulations related to insurance products and market competition within the insurance industry can affect PRU’s profitability and market share, consequently impacting its stock valuation.

PRU Stock Price Prediction & Forecasting Models

Predicting future stock prices is inherently uncertain, but various models can offer potential scenarios. The following table presents hypothetical scenarios based on different economic conditions.

| Scenario | Economic Condition | Predicted Stock Price (USD) | Rationale |

|---|---|---|---|

| Optimistic | Strong economic growth, low inflation, stable interest rates | 160 | Increased demand for insurance, higher investment returns, positive investor sentiment. |

| Neutral | Moderate economic growth, moderate inflation, stable interest rates | 140 | Steady insurance demand, moderate investment returns, neutral investor sentiment. |

| Pessimistic | Economic recession, high inflation, rising interest rates | 110 | Reduced insurance demand, lower investment returns, negative investor sentiment. |

Forecasting models like technical analysis (chart patterns, indicators) and fundamental analysis (financial statements, valuation ratios) can be used to predict PRU’s stock price. Technical analysis focuses on price and volume trends, while fundamental analysis assesses the intrinsic value of the company.

Metrics like the Price-to-Earnings (P/E) ratio and Return on Equity (ROE) are crucial for evaluating PRU’s current valuation. A high P/E ratio may suggest the stock is overvalued, while a high ROE indicates strong profitability.

Investor Sentiment and Market Analysis of PRU

Current investor sentiment towards PRU appears cautiously optimistic, based on recent financial reports showcasing stable earnings and a robust balance sheet. However, concerns about potential economic slowdowns and regulatory changes might temper this optimism. News articles reflect a mixed outlook, with some analysts expressing confidence in PRU’s long-term prospects, while others remain more reserved.

Institutional investors, such as mutual funds and pension funds, hold a significant portion of PRU stock, often employing long-term investment strategies. Retail investors also participate, potentially with shorter-term investment horizons and greater sensitivity to market fluctuations.

Overall market conditions, both macroeconomic factors (global economic growth, interest rates) and industry-specific factors (competition, regulatory environment), significantly influence PRU’s stock price. A positive macroeconomic environment generally supports higher stock valuations, while increased competition or negative regulatory changes can exert downward pressure.

Visual Representation of PRU Stock Price Trends

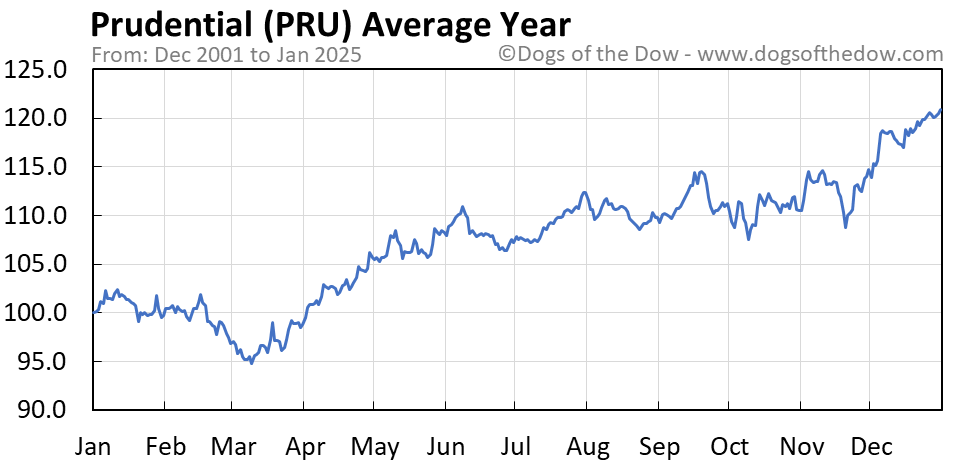

Source: dogsofthedow.com

A visual representation of PRU’s stock price over the past five years would show a generally upward trend, with periods of both significant growth and consolidation. The graph would illustrate distinct peaks and troughs, reflecting market reactions to various economic events and company announcements. Periods of stability would be evident during times of relatively calm market conditions.

A second visual representation showing the relationship between PRU’s stock price and key financial indicators like earnings per share (EPS) and revenue growth would reveal a positive correlation. Higher EPS and revenue growth would generally correspond to higher stock prices, demonstrating the direct impact of the company’s financial performance on its market valuation. However, the relationship may not be perfectly linear, influenced by other factors such as investor sentiment and market conditions.

FAQ Summary: Pru Stock Price

What are the major risks associated with investing in PRU stock?

Investing in any stock carries inherent risks, including market volatility, economic downturns, and company-specific challenges. For PRU, specific risks might include regulatory changes impacting the insurance industry, competition from other insurers, and fluctuations in interest rates.

How does PRU compare to its competitors in terms of dividend payouts?

A comparison of PRU’s dividend payout history with its competitors requires reviewing their respective financial statements and investor relations materials. This comparison would highlight differences in dividend yield, payout ratios, and overall dividend policies.

Where can I find real-time PRU stock price data?

Real-time PRU stock price data is readily available through major financial websites and brokerage platforms. Many financial news sources also provide up-to-the-minute quotes.

What is the typical trading volume for PRU stock?

Trading volume for PRU stock varies daily and can be found on financial websites that provide detailed stock market data. Factors influencing trading volume include news events, market sentiment, and overall market activity.