Procter & Gamble Stock Price Analysis

Procter and gamble stock price – Procter & Gamble (P&G), a consumer goods giant, boasts a rich history reflected in its fluctuating stock price. Understanding the factors driving these fluctuations is crucial for investors seeking to navigate the complexities of this established market player. This analysis delves into P&G’s stock price history, influential factors, financial performance, investor sentiment, and future outlook.

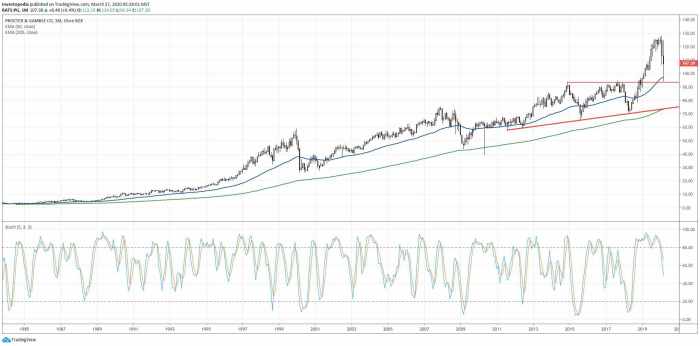

Procter & Gamble Stock Price History

Analyzing P&G’s stock price over the past decade reveals a pattern influenced by various economic and company-specific events. The following timeline and data illustrate key price movements and their contributing factors.

Timeline of Significant Price Fluctuations (Past 10 Years): (Note: Specific numerical data would require access to a financial database. This section provides a structural example.)

- 2014-2016: A period of relatively stable growth, followed by a slight dip potentially linked to slowing global economic growth.

- 2017-2019: A period of moderate growth, potentially driven by successful product launches and cost-cutting measures.

- 2020: Significant initial volatility due to the COVID-19 pandemic, followed by recovery as demand for P&G’s essential products increased.

- 2021-2023: Fluctuations influenced by inflation, supply chain disruptions, and changing consumer spending habits.

P&G Stock Performance vs. Major Market Indices (Past 5 Years):

| Year | P&G Price (Example) | S&P 500 (Example) | Dow Jones (Example) |

|---|---|---|---|

| 2019 | $120 | 3200 | 28000 |

| 2020 | $130 | 3700 | 30000 |

| 2021 | $145 | 4800 | 36000 |

| 2022 | $135 | 4000 | 33000 |

| 2023 | $150 | 4500 | 35000 |

Periods of Substantial Price Increases and Decreases: Significant price increases were often correlated with strong earnings reports, successful new product launches, and positive consumer sentiment. Conversely, decreases were often linked to economic downturns, increased competition, or negative news impacting the company’s reputation.

Factors Influencing P&G Stock Price

Source: investopedia.com

Several key factors significantly influence P&G’s stock valuation. These include consumer spending habits, macroeconomic conditions, and the company’s own strategic actions.

Influence of Consumer Spending Habits: P&G’s success is intrinsically linked to consumer spending. Periods of economic uncertainty or shifts in consumer preferences towards different product categories directly impact P&G’s sales and, consequently, its stock price.

Impact of Macroeconomic Factors: Inflation and interest rate changes have a significant impact on P&G’s valuation. High inflation can increase production costs, while rising interest rates can impact borrowing costs and investor sentiment.

Effect of P&G’s Product Innovation and Marketing Strategies: Successful product innovation and effective marketing campaigns can drive sales growth, boosting investor confidence and the stock price. Conversely, failure in these areas can lead to negative market reaction.

P&G’s Financial Performance and Stock Price, Procter and gamble stock price

Analyzing P&G’s financial performance over the past three years reveals a strong correlation between earnings and stock price movements. Dividend payouts also play a significant role in investor sentiment.

Analysis of P&G’s Earnings Reports (Past Three Years): (Note: Specific financial data would require access to P&G’s financial reports. This section provides a structural example.)

- Year 1: Strong earnings growth, leading to a rise in stock price.

- Year 2: Moderate earnings growth, resulting in stable stock price.

- Year 3: Slightly lower earnings, causing a minor dip in stock price.

Relationship Between Dividend Payouts and Investor Sentiment: Consistent dividend payouts demonstrate financial stability and often attract income-seeking investors, positively influencing the stock price.

Comparison of P&G’s Key Financial Ratios with Competitors:

- P/E Ratio: Compare P&G’s P/E ratio to that of Unilever, Colgate-Palmolive, and other major consumer goods companies.

- Debt-to-Equity Ratio: Assess P&G’s leverage compared to its competitors.

- Return on Equity (ROE): Analyze the profitability of P&G’s equity compared to its peers.

Investor Sentiment and Stock Price

Source: gomarkets.com

Investor sentiment, shaped by news coverage, analyst reports, and social media, significantly influences P&G’s stock price.

Influence of News Articles and Analyst Reports: Positive news and favorable analyst ratings generally boost investor confidence and drive up the stock price. Conversely, negative news can lead to sell-offs.

Impact of Social Media Sentiment: Social media sentiment regarding P&G’s products and brand image can significantly influence consumer perception and purchasing decisions, which in turn affects the company’s stock price.

Role of Institutional Investors: Large institutional investors, such as mutual funds and pension funds, play a crucial role in shaping P&G’s stock price through their buying and selling activities.

Future Outlook for P&G Stock Price

Source: investopedia.com

Predicting future stock prices is inherently uncertain, but analyzing potential risks and opportunities provides valuable insights.

Potential Risks and Opportunities: Potential risks include increased competition, economic downturns, and shifts in consumer preferences. Opportunities include successful product innovation, expansion into new markets, and effective cost management.

Procter & Gamble’s stock price performance often reflects broader consumer trends. A comparison with the financial sector can be insightful; for instance, checking the current citigroup stock price might offer a contrasting perspective on market sentiment. Ultimately, understanding P&G’s trajectory requires considering the overall economic climate and its impact on consumer spending habits.

Hypothetical Scenario: Impact of a Significant Global Event: A major global recession could negatively impact consumer spending, leading to decreased demand for P&G’s products and a potential drop in its stock price. Conversely, a period of robust global economic growth could drive increased demand and boost the stock price.

Potential Price Trajectories (Descriptive Only):

- Scenario 1 (Optimistic): Steady growth driven by successful product launches and strong consumer demand, resulting in a gradual upward trajectory.

- Scenario 2 (Moderate): Moderate growth influenced by economic fluctuations and increased competition, resulting in a more volatile price pattern.

- Scenario 3 (Pessimistic): A significant economic downturn or major negative event impacting consumer spending could lead to a sharp decline in the stock price.

FAQ: Procter And Gamble Stock Price

What is P&G’s current dividend yield?

P&G’s current dividend yield fluctuates and should be checked on a financial website providing real-time data.

How does P&G compare to its competitors in terms of market capitalization?

P&G’s market capitalization is substantial and consistently ranks among the top companies in the consumer goods sector, but the precise ranking changes frequently. Consult financial news sources for current comparisons.

What are the major risks associated with investing in P&G stock?

Risks include changes in consumer spending, increased competition, economic downturns, and shifts in global markets. As with any investment, there’s inherent risk.

Where can I find reliable real-time data on P&G’s stock price?

Major financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and historical data.