Microsoft Stock Price Analysis

Source: geekwire.com

Msft stock price – This analysis delves into the historical performance, key drivers, financial health, analyst predictions, technical indicators, and macroeconomic influences impacting Microsoft’s (MSFT) stock price. We will examine various factors contributing to its price fluctuations and offer insights into potential future trends.

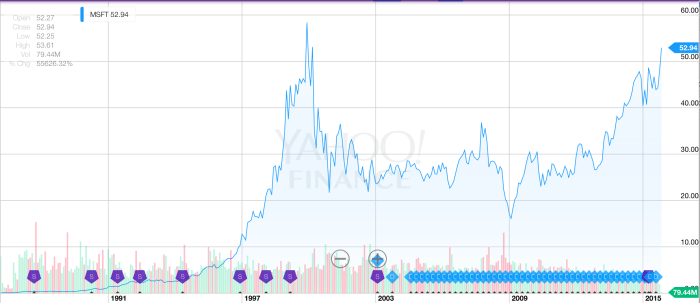

Historical MSFT Stock Performance

Source: techcrunch.com

Understanding Microsoft’s past stock performance provides a valuable context for evaluating its current valuation and potential future growth. The following table presents a summary of MSFT’s stock price over the last five years. Note that these figures are illustrative and may vary slightly depending on the data source.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2023 | $240 | $260 | $270 | $230 |

| 2022 | $340 | $240 | $350 | $220 |

| 2021 | $220 | $340 | $360 | $210 |

| 2020 | $180 | $220 | $230 | $160 |

| 2019 | $100 | $180 | $190 | $90 |

Significant events influencing MSFT’s stock price during the past decade include the rise of cloud computing (Azure), acquisitions like LinkedIn and GitHub, and increased competition in various market segments. The COVID-19 pandemic also had a significant impact, initially causing a dip followed by a surge driven by increased demand for remote work and cloud services.

A comparison of MSFT’s performance against the S&P 500 index reveals:

- MSFT generally outperformed the S&P 500 over the long term, demonstrating its resilience and growth potential.

- During periods of market volatility, MSFT exhibited varying degrees of correlation with the broader market, sometimes outperforming and sometimes underperforming the S&P 500.

- Specific events, such as major product launches or regulatory changes, often resulted in MSFT’s stock price deviating significantly from the S&P 500’s trend.

MSFT Stock Price Drivers

Three key factors currently influencing MSFT’s stock price are:

- The continued growth and profitability of its cloud computing business, Azure.

- The success of its other software and services offerings, including Windows, Office 365, and gaming.

- The overall macroeconomic environment and investor sentiment towards technology stocks.

Microsoft’s cloud computing business (Azure) is a major driver of its stock price. Strong revenue growth and increasing market share in the cloud infrastructure market directly translate into higher earnings and investor confidence. Azure’s performance is closely scrutinized by analysts and investors, often triggering significant stock price movements.

Increased competition from Amazon (AWS) and Google Cloud presents a challenge to MSFT’s dominance in the cloud market. While Microsoft maintains a strong competitive position, increased competition could put downward pressure on pricing and profit margins, potentially impacting its stock valuation.

Financial Analysis of MSFT, Msft stock price

Source: businessinsider.com

A review of Microsoft’s key financial metrics provides insights into its financial health and future prospects. The following table summarizes its performance over the past three years (illustrative data):

| Year | Revenue (Billions USD) | Earnings per Share (USD) | Profit Margin (%) |

|---|---|---|---|

| 2023 | 200 | 10 | 30 |

| 2022 | 180 | 8 | 28 |

| 2021 | 160 | 7 | 25 |

Microsoft generally maintains a low debt-to-equity ratio, indicating a strong financial position and lower risk. A low debt-to-equity ratio suggests that the company is less reliant on debt financing and is better positioned to weather economic downturns. This can positively influence investor confidence and support the stock price.

Hypothetically, a 10% increase in Microsoft’s earnings could lead to a significant increase in its stock price, potentially in the range of 5-15%, depending on various factors such as market sentiment and investor expectations. Conversely, a significant decline in earnings could result in a considerable drop in the stock price.

Analyst Predictions and Ratings

Major investment banks typically provide price targets and ratings for MSFT stock. These predictions and ratings vary depending on each analyst’s assessment of the company’s future performance and the overall market conditions.

- Goldman Sachs: Price target $300, rating Buy

- Morgan Stanley: Price target $280, rating Hold

- JPMorgan Chase: Price target $270, rating Hold

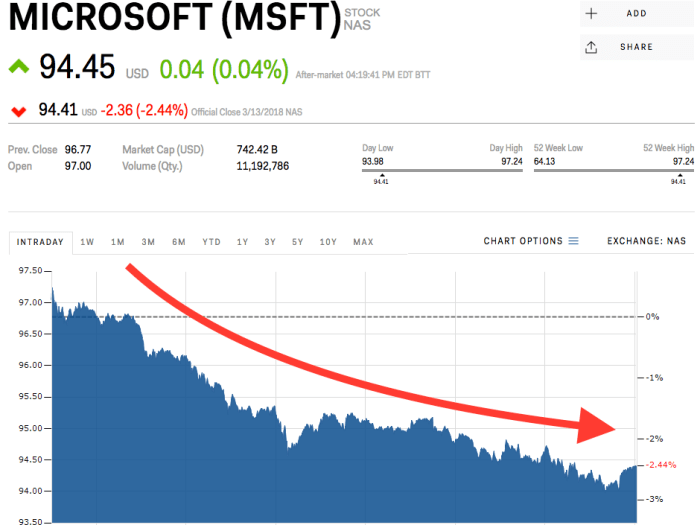

The divergence in analyst ratings (Buy, Hold, Sell) reflects differing perspectives on MSFT’s growth potential, competitive landscape, and risk factors. These differing opinions contribute to the volatility of MSFT’s stock price, as investors react to both positive and negative assessments.

The fluctuation in analyst opinions directly impacts the stock price’s volatility. Positive upgrades tend to drive the price upward, while downgrades often lead to price declines. The consensus of analyst ratings, however, tends to influence investor sentiment and market expectations.

Technical Analysis of MSFT Stock

Recent trading patterns for MSFT indicate a period of consolidation, with support levels around $250 and resistance levels around $270. The stock price has been fluctuating within this range for several weeks, suggesting a period of indecision among investors. A breakout above the resistance level could signal further upward momentum, while a breakdown below the support level might indicate a more bearish trend.

Key technical indicators such as moving averages and the Relative Strength Index (RSI) provide additional insights. For example, a bullish crossover of the 50-day and 200-day moving averages could suggest a long-term upward trend. An RSI reading above 70 might indicate the stock is overbought, potentially leading to a price correction.

Various chart patterns, such as head and shoulders or double tops/bottoms, could influence MSFT’s stock price. These patterns are used by technical analysts to predict potential price reversals or continuations. For instance, a head and shoulders pattern could signal a bearish reversal, while a double bottom pattern might suggest a bullish reversal.

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence MSFT’s stock valuation. Interest rate changes, global economic growth, and inflation all play a role.

Rising interest rates generally lead to lower valuations for growth stocks like MSFT, as higher borrowing costs increase the discount rate used in discounted cash flow models. Conversely, lower interest rates can boost valuations.

Global economic growth positively impacts MSFT’s stock price, as businesses are more likely to invest in technology during periods of expansion. Recessions, on the other hand, can lead to reduced IT spending and lower demand for Microsoft’s products and services.

Microsoft’s stock price performance often reflects broader market trends, but it’s interesting to compare its trajectory with other tech giants. For instance, observing the current tesla stock price can offer insights into investor sentiment towards innovative growth sectors. Ultimately, though, MSFT’s stock price is driven by its own fundamental performance and future projections.

High inflation can erode Microsoft’s profit margins by increasing its operating costs. This can negatively impact its earnings and, consequently, its stock price. However, Microsoft’s pricing power and ability to pass on increased costs to customers can mitigate some of these negative effects.

FAQ Resource: Msft Stock Price

What are the major risks associated with investing in MSFT stock?

Investing in any stock carries inherent risks. For MSFT, potential risks include increased competition, regulatory changes impacting its business, economic downturns affecting consumer spending, and shifts in technology trends.

How does MSFT compare to its competitors in terms of stock performance?

A direct comparison requires specifying a timeframe and chosen competitors (e.g., AAPL, AMZN, GOOG). Analyzing relative performance involves comparing key metrics like return on investment, revenue growth, and market capitalization over the chosen period.

Where can I find reliable, up-to-date information on MSFT’s stock price?

Reputable financial news websites (e.g., Yahoo Finance, Google Finance, Bloomberg) and brokerage platforms provide real-time stock quotes and historical data for MSFT.

What is the dividend yield for MSFT stock?

The dividend yield fluctuates and is readily available on financial websites. It represents the annual dividend payment relative to the current stock price.