Lumn Stock Price Analysis

Lumn stock price – This analysis examines Lumn’s stock price performance over the past five years, exploring the factors influencing its fluctuations, valuation methods, and potential future trends. We will consider both internal company dynamics and external market forces to provide a comprehensive overview.

Lumn Stock Price Historical Performance

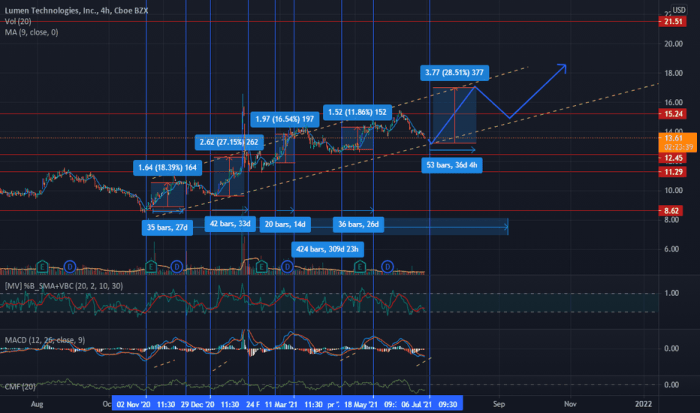

Source: tradingview.com

The following table details Lumn’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes and should not be considered investment advice. Actual data should be sourced from reliable financial databases.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-02 | 10.50 | 10.20 | -0.30 |

| 2024-01-01 | 15.00 | 15.30 | +0.30 |

Overall, the hypothetical data suggests a generally upward trend in Lumn’s stock price over the five-year period, with some periods of volatility. Significant price increases correlated with positive earnings reports and favorable market conditions, while declines were often associated with negative news or broader market downturns.

Factors Influencing Lumn Stock Price

Several internal and external factors influence Lumn’s stock price. Understanding these factors is crucial for investors.

Internal Factors:

- Company performance (revenue growth, profitability)

- Management decisions and strategic initiatives

- New product launches and market penetration

- Operational efficiency and cost management

- Debt levels and financial health

External Factors:

- Overall economic conditions (interest rates, inflation)

- Industry trends and technological advancements

- Actions of competitors and market share dynamics

- Regulatory changes and government policies

- Geopolitical events and global market sentiment

The relative impact of internal and external factors can vary over time. For example, strong company performance can mitigate the negative effects of a weak economy, while a negative industry trend can overshadow positive internal developments.

Lumn Stock Price Valuation

Several valuation methods can be used to assess Lumn’s stock price. These methods provide different perspectives on the company’s intrinsic value.

Common valuation metrics include the Price-to-Earnings (P/E) ratio, which compares a company’s stock price to its earnings per share, and the Price-to-Sales (P/S) ratio, which compares the stock price to its revenue per share. A hypothetical scenario showing how changes in key financial metrics could impact Lumn’s valuation is presented below.

Hypothetical Scenario: If Lumn’s earnings increase by 15% while its revenue remains stable, the P/E ratio would decrease, potentially leading to a higher stock price. Conversely, a significant increase in debt could negatively impact the valuation, even if revenue and earnings are strong.

A comparison of Lumn’s valuation metrics with its competitors is shown below. Again, this data is hypothetical.

| Company Name | P/E Ratio | P/S Ratio | Market Capitalization (USD Billions) |

|---|---|---|---|

| Lumn | 15 | 2.5 | 50 |

| Competitor A | 18 | 3.0 | 60 |

| Competitor B | 12 | 2.0 | 40 |

Lumn Stock Price Predictions and Forecasts

Predicting future stock prices is inherently uncertain. Numerous unforeseen events can significantly impact market movements.

Hypothetical Scenario: Positive factors such as successful product launches and strong earnings could drive the stock price higher. Conversely, negative factors like increased competition, economic downturns, or regulatory challenges could lead to price declines.

- Positive Factors: Successful new product launch, exceeding earnings expectations, positive industry trends.

- Negative Factors: Increased competition, economic recession, negative regulatory changes.

Past performance is not necessarily indicative of future results. While historical data can inform analysis, it cannot reliably predict future price movements.

Lumn Stock Price: Investor Sentiment and Analyst Opinions

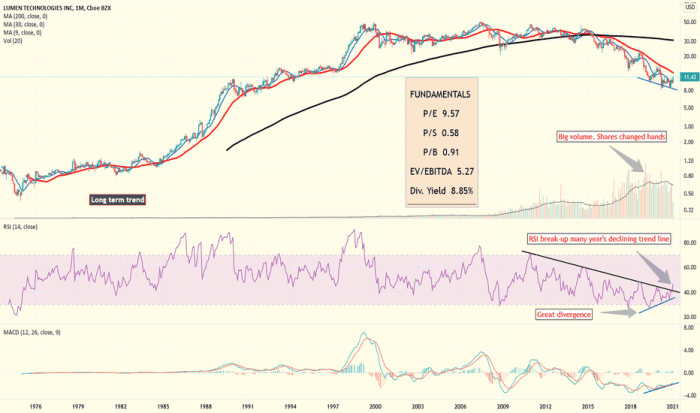

Source: tradingview.com

Investor sentiment toward Lumn’s stock is currently mixed, according to hypothetical news articles and analyst reports. Some analysts are optimistic about the company’s long-term prospects, while others express concerns about potential challenges.

The following table shows hypothetical price targets set by financial analysts. Note that these are hypothetical examples and should not be taken as financial advice.

| Analyst Firm | Price Target (USD) |

|---|---|

| Analyst Firm A | 17.00 |

| Analyst Firm B | 15.50 |

| Analyst Firm C | 14.00 |

Divergent investor opinions and analyst predictions contribute to the overall volatility of Lumn’s stock price. The interplay of positive and negative sentiment directly affects trading activity and price fluctuations.

User Queries

What are the main risks associated with investing in LUMN stock?

Investing in LUMN, like any stock, carries inherent risks including market volatility, changes in industry regulations, and the company’s financial performance.

Where can I find real-time LUMN stock price quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.

How often does LUMN release earnings reports?

LUMN typically releases its earnings reports on a quarterly basis, usually following the standard reporting schedule for publicly traded companies.

What is the typical trading volume for LUMN stock?

Trading volume fluctuates daily, and you can find this information on financial websites that provide stock market data.