Ludine Mining Stock Price Analysis

Ludine mining stock price – This analysis examines Ludine Mining’s stock price history, influencing factors, financial performance, investor sentiment, and future projections. We will explore key metrics, compare Ludine Mining to its competitors, and assess potential risks and opportunities for investors.

Ludine Mining Stock Price History and Trends

Source: seekingalpha.com

Tracking the Ludine Mining stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other tech-heavy stocks, such as the tsmc stock price , which often reflects broader technological trends. Understanding the interplay between these two sectors can provide a more nuanced perspective on Ludine Mining’s overall trajectory and potential future growth.

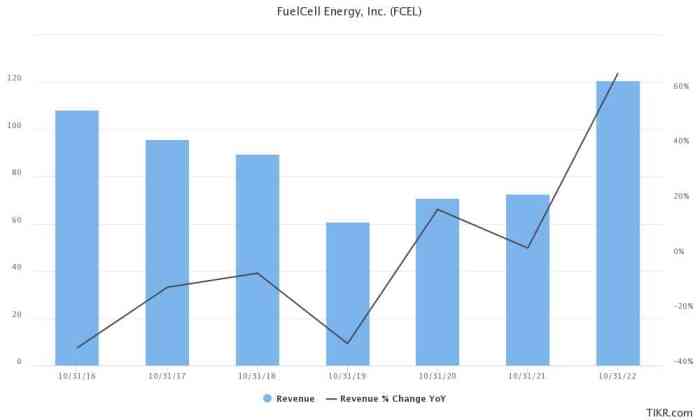

Analyzing Ludine Mining’s stock price performance requires a multifaceted approach, encompassing historical trends, recent fluctuations, and comparative performance against industry peers. A comprehensive understanding of these aspects is crucial for informed investment decisions.

A line graph depicting Ludine Mining’s stock price over the past five years would show the overall trajectory, highlighting periods of growth, decline, and stagnation. The x-axis would represent time (years), while the y-axis would display the stock price. A clear legend would distinguish Ludine Mining’s performance from any benchmark indices used for comparison. Significant price fluctuations in the last year could be attributed to various factors, such as changes in commodity prices, production levels, news events, or regulatory changes.

For instance, a sudden price surge might coincide with an announcement of a new, high-yield mine discovery, while a drop might reflect concerns about operational challenges or decreased demand for the mined commodities.

A comparison of Ludine Mining’s stock performance against its competitors over the past three years, presented in a four-column HTML table, would allow for a direct assessment of relative performance. The table would include columns for company name, average annual return, volatility (standard deviation of returns), and a qualitative assessment of overall performance. This comparative analysis would reveal Ludine Mining’s position within the competitive landscape.

| Company Name | Average Annual Return (3 years) | Volatility (Standard Deviation) | Performance Assessment |

|---|---|---|---|

| Ludine Mining | [Insert Data]% | [Insert Data]% | [Qualitative Assessment – e.g., Above Average, Average, Below Average] |

| Competitor A | [Insert Data]% | [Insert Data]% | [Qualitative Assessment] |

| Competitor B | [Insert Data]% | [Insert Data]% | [Qualitative Assessment] |

| Competitor C | [Insert Data]% | [Insert Data]% | [Qualitative Assessment] |

Factors Influencing Ludine Mining Stock Price

Source: seekingalpha.com

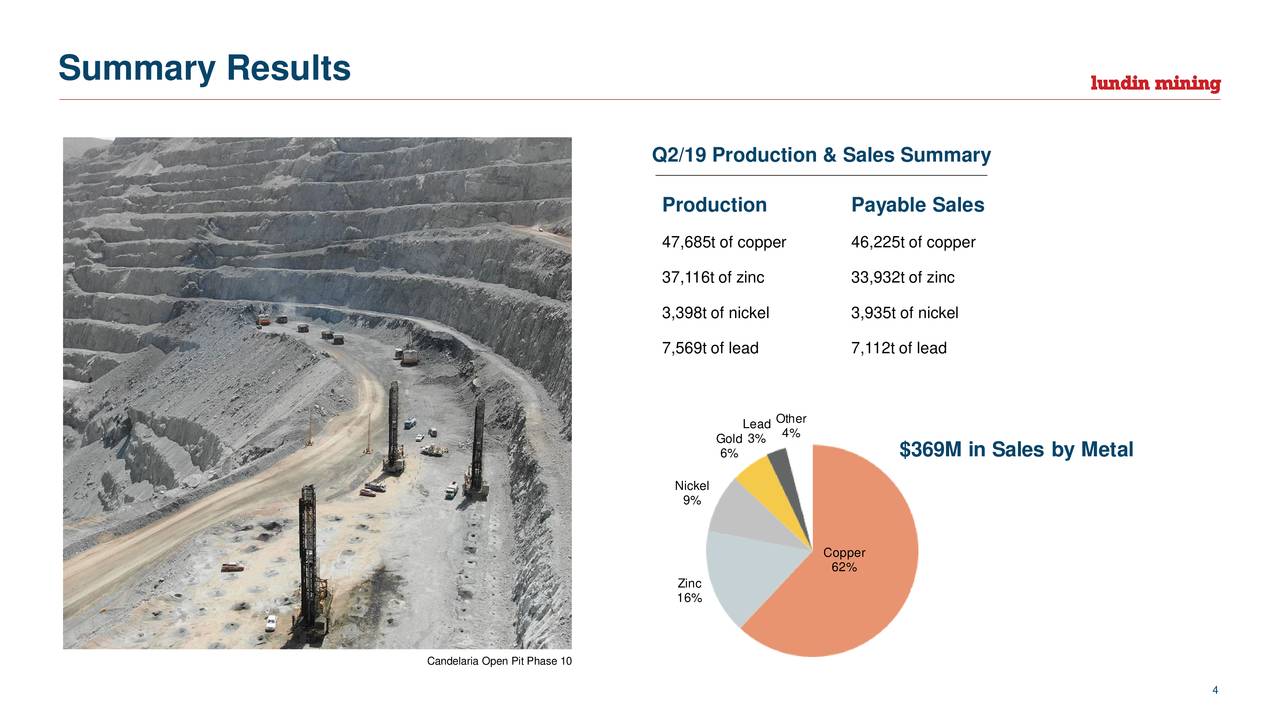

Several key factors significantly influence Ludine Mining’s stock valuation. Understanding these factors is essential for predicting future price movements and making informed investment choices.

Global commodity prices, particularly those of gold, silver, and other metals mined by Ludine Mining, directly impact its revenue and profitability. Higher commodity prices generally lead to increased revenue and higher stock valuations, while lower prices have the opposite effect. Similarly, Ludine Mining’s production levels and operational efficiency play a crucial role. Higher production volumes and improved efficiency translate into greater profitability and a more positive market perception, which usually results in a higher stock price.

Conversely, production disruptions or inefficiencies can negatively affect the stock price.

- Significant news events, such as the discovery of new mineral deposits or major regulatory changes affecting mining operations, can cause substantial stock price fluctuations.

- Unexpected operational challenges, such as equipment malfunctions or labor disputes, can also lead to a decrease in stock value.

- Changes in investor sentiment, influenced by market trends or company-specific news, can significantly impact the stock price.

Ludine Mining’s Financial Performance and Valuation

Source: cnbcfm.com

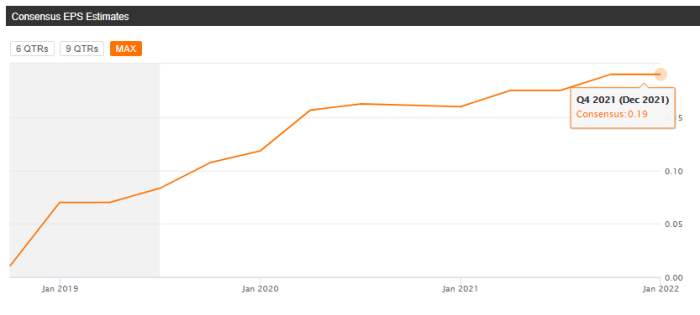

A review of Ludine Mining’s recent financial reports provides insights into its financial health and valuation. Analyzing key metrics allows for a comprehensive assessment of the company’s performance and its potential for future growth.

Ludine Mining’s most recent financial reports should include details on revenue, profit margins, and debt levels. A comparison of these figures with those from previous periods will reveal trends in the company’s financial performance. A high revenue growth rate and expanding profit margins generally indicate a strong financial position and a positive outlook. However, high debt levels might signal financial risk.

Comparing Ludine Mining’s Price-to-Earnings (P/E) ratio with its competitors reveals its relative valuation. A higher P/E ratio might suggest that the market expects higher future growth from Ludine Mining compared to its peers.

| Company Name | P/E Ratio |

|---|---|

| Ludine Mining | [Insert Data] |

| Competitor A | [Insert Data] |

| Competitor B | [Insert Data] |

An analysis of Ludine Mining’s long-term financial prospects should consider factors such as projected commodity prices, production capacity, and operational efficiency. These factors will determine the company’s future profitability and, consequently, its stock price.

Investor Sentiment and Market Analysis of Ludine Mining

Understanding investor sentiment towards Ludine Mining stock is crucial for assessing its potential for future price movements. Analyzing news articles, analyst reports, and trading volume provides valuable insights into market perception.

News articles and analyst reports often reflect the overall investor sentiment towards Ludine Mining. Positive news, such as successful exploration activities or increased production, usually boosts investor confidence, leading to a higher stock price. Conversely, negative news can lead to a decline in the stock price. Comparing Ludine Mining’s trading volume to its average trading volume over the past year indicates the level of investor activity.

A significantly higher trading volume might suggest increased interest in the stock, while a lower volume could indicate decreased interest.

| Risk Category | Specific Risk | Mitigation Strategy |

|---|---|---|

| Financial | High debt levels | Debt reduction strategies |

| Operational | Production disruptions | Improved operational efficiency and risk management |

| Market | Commodity price volatility | Diversification of mining operations |

| Opportunity Category | New mine discoveries | Strategic exploration and acquisition |

| Opportunity Category | Increased demand for mined commodities | Expansion of production capacity |

Future Projections and Potential for Ludine Mining Stock

Predicting the future price of Ludine Mining stock involves considering various scenarios and their potential impact on the company’s performance.

A significant increase in commodity prices would likely lead to higher revenue and profitability for Ludine Mining, resulting in a substantial increase in its stock price. Conversely, a major operational setback, such as a mine closure or production delays, would likely negatively impact profitability and result in a significant decrease in the stock price. For example, a scenario similar to the temporary closure of a major mine due to an unforeseen geological event in a competitor’s operation could provide a comparable framework for understanding the potential impact on Ludine Mining’s stock.

- Increased demand for the company’s mined commodities could lead to a higher stock price.

- Successful exploration activities leading to new mine discoveries could also boost the stock price.

- Conversely, a decline in commodity prices or unexpected operational challenges could decrease the stock price.

- Changes in government regulations or policies affecting the mining industry could also impact the stock price.

User Queries: Ludine Mining Stock Price

What are the typical trading fees associated with Ludine Mining stock?

Trading fees vary depending on your brokerage. Check your broker’s fee schedule for specifics.

Where can I find real-time Ludine Mining stock quotes?

Real-time quotes are available through major financial websites and trading platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is Ludine Mining’s dividend history?

Information regarding Ludine Mining’s dividend history, if any, can be found in their investor relations section on their company website or through financial news sources.

How volatile is Ludine Mining stock compared to the overall market?

Ludine Mining’s volatility can be assessed by comparing its beta to the market benchmark. This information is usually available through financial data providers.