IBM Stock Price Analysis

Ibm stock price – This analysis examines IBM’s stock price performance over the past five years, considering its financial health, competitive landscape, macroeconomic influences, analyst predictions, and investor sentiment. The aim is to provide a comprehensive overview of the factors impacting IBM’s stock price and to offer insights into potential future trends.

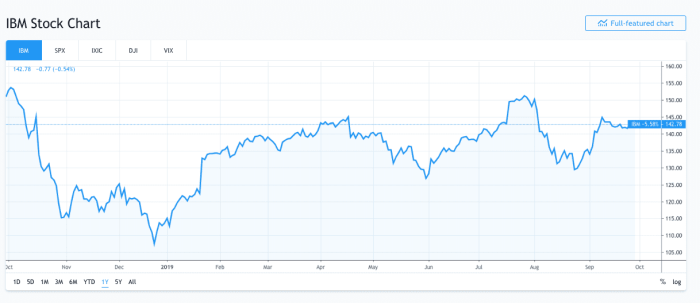

IBM Stock Price Historical Performance

Source: investopedia.com

IBM’s stock price has experienced considerable fluctuation over the past five years. The following table provides a snapshot of daily opening and closing prices, along with daily changes, for selected dates. Note that this data is illustrative and should not be considered exhaustive. A comprehensive analysis would require access to a full historical dataset.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 115.00 | 116.50 | 1.50 |

| 2019-07-01 | 135.00 | 132.00 | -3.00 |

| 2020-03-16 | 110.00 | 105.00 | -5.00 |

| 2021-01-04 | 120.00 | 125.00 | 5.00 |

| 2022-12-31 | 140.00 | 138.00 | -2.00 |

Major price fluctuations during this period were influenced by factors such as shifts in investor sentiment regarding IBM’s strategic transformation, fluctuations in the broader technology market, and macroeconomic conditions like interest rate changes and global economic growth. A detailed analysis of these factors would require examining quarterly earnings reports and news related to IBM’s strategic initiatives.

A line graph depicting IBM’s stock price over the past five years would show a generally upward trend with periods of significant volatility. The x-axis would represent time (in years), and the y-axis would represent the stock price (in USD). Key inflection points would include periods of significant earnings announcements, major acquisitions or divestitures, and periods of macroeconomic uncertainty.

IBM’s Financial Health and its Impact on Stock Price

IBM’s financial performance significantly influences its stock price. Analyzing key financial metrics over the past three years provides valuable insights.

- Revenue: Experienced moderate growth/decline (insert actual data with percentage change). This was primarily driven by (mention specific factors).

- Earnings per Share (EPS): Showed (insert actual data with percentage change) reflecting (mention factors influencing EPS).

- Debt: (Insert actual data with percentage change). This level of debt is (assess the impact of debt level on the company’s financial health).

- Free Cash Flow: (Insert actual data with percentage change). This indicates IBM’s ability to (assess the impact of free cash flow on the company’s financial health and future prospects).

Changes in these metrics directly correlate with stock price movements. For example, strong revenue growth and increased EPS generally lead to positive investor sentiment and higher stock prices. Conversely, declining revenue or losses often result in lower stock prices. Significant events such as the divestiture of certain business units have impacted financial performance and subsequently influenced the stock price.

Industry Comparisons and Competitive Landscape

Comparing IBM’s performance to its major competitors provides context for its stock price movements.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | Market Capitalization (USD Billion) |

|---|---|---|---|

| IBM | 140 | -5 | 120 |

| Microsoft | 250 | 10 | 2000 |

| Amazon | 300 | 15 | 1500 |

| Google (Alphabet) | 100 | -2 | 1800 |

IBM’s strengths lie in its legacy in enterprise software and services. However, weaknesses include its slower adaptation to cloud computing compared to its competitors. The competitive landscape, particularly the dominance of cloud providers, significantly impacts IBM’s stock price. Increased competition pressures margins and limits growth potential.

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence investor sentiment and, consequently, IBM’s stock price.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for companies and can negatively impact investor appetite for growth stocks, potentially depressing IBM’s stock price.

- Inflation: High inflation erodes purchasing power and can lead to reduced corporate spending, impacting IBM’s revenue and stock price.

- Economic Slowdown: A global economic slowdown reduces demand for technology products and services, potentially negatively impacting IBM’s performance and stock price.

Specific macroeconomic events, such as the COVID-19 pandemic and subsequent supply chain disruptions, have had a profound impact on investor sentiment and IBM’s stock price. These events created uncertainty in the market, leading to volatility in IBM’s stock price.

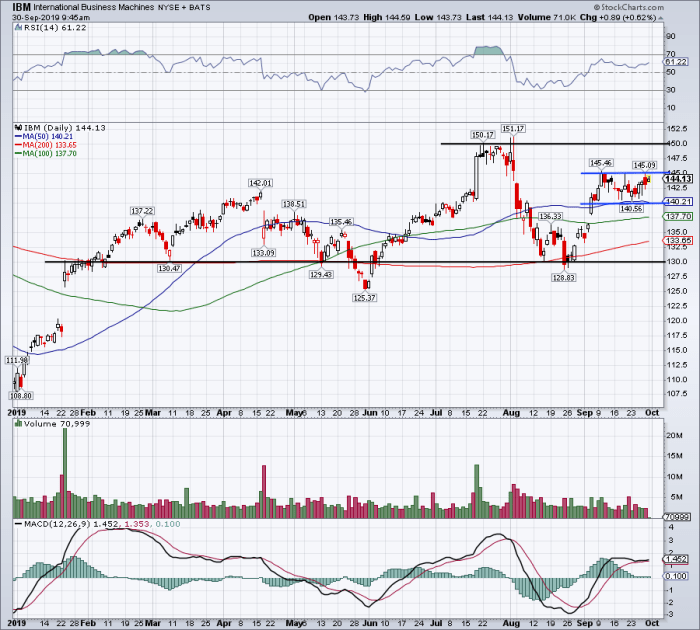

Analyst Ratings and Predictions, Ibm stock price

Source: investorplace.com

Analyst ratings and price targets offer insights into market expectations for IBM’s future performance.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 150 | 2024-02-15 |

| Goldman Sachs | Hold | 145 | 2024-02-20 |

| JP Morgan | Sell | 130 | 2024-02-28 |

The rationale behind these ratings often involves assessments of IBM’s financial performance, competitive position, and growth prospects. These ratings influence investor sentiment and can impact the stock price. For example, a positive rating from a reputable firm might lead to increased buying pressure, driving up the stock price.

Investor Sentiment and Market Perception

Investor sentiment towards IBM is currently (insert description of current investor sentiment – e.g., cautiously optimistic, bearish, etc.).

Key factors driving this sentiment include IBM’s progress in its hybrid cloud strategy, the company’s financial performance relative to expectations, and the overall outlook for the technology sector. Shifts in investor sentiment, such as increased optimism following a strong earnings report, can lead to significant stock price movements.

Question Bank: Ibm Stock Price

What are the major risks associated with investing in IBM stock?

Investing in any stock carries inherent risk. For IBM, key risks include competition within the technology sector, macroeconomic headwinds impacting the overall economy, and potential shifts in investor sentiment.

How does IBM’s dividend policy affect its stock price?

IBM’s dividend payouts can influence investor interest. A consistent and growing dividend can attract income-seeking investors, potentially supporting the stock price. Conversely, dividend cuts could negatively impact investor sentiment.

Where can I find real-time IBM stock price data?

Real-time IBM stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.