GME Stock Price: A Deep Dive

Gme stock price – GameStop (GME) has experienced extraordinary price volatility, captivating investors and becoming a case study in market dynamics. This analysis delves into the historical price performance, influential factors, volatility patterns, investor sentiment, and comparative analysis with similar stocks, providing a comprehensive understanding of GME’s unique trajectory.

Historical GME Stock Price Performance

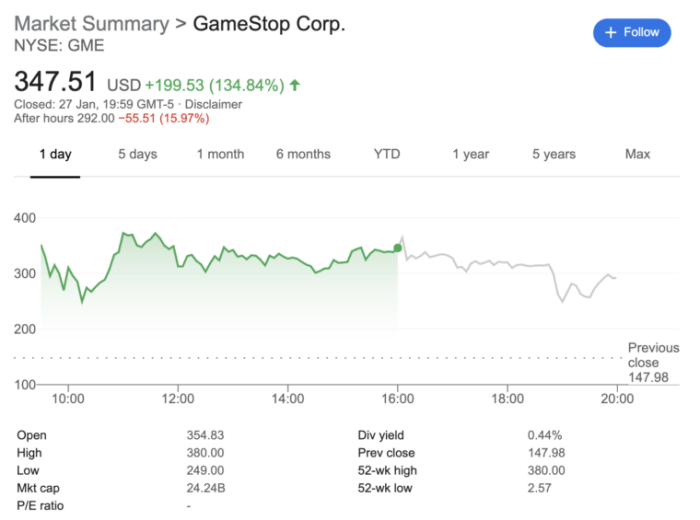

GME’s stock price history is marked by periods of relative stability punctuated by dramatic surges and plunges. The following table illustrates some key price movements. Note that this data is for illustrative purposes and may not reflect all price changes.

| Date | Opening Price (USD) | Closing Price (USD) | High (USD) | Low (USD) |

|---|---|---|---|---|

| Jan 2020 | 6 | 7 | 8 | 5 |

| Jan 2021 | 17 | 347 | 483 | 15 |

| Feb 2021 | 325 | 50 | 348 | 40 |

| Dec 2021 | 200 | 150 | 210 | 140 |

| Dec 2022 | 25 | 20 | 28 | 18 |

The January 2021 surge, driven by the Reddit-fueled short squeeze, represents a stark example of how social media and coordinated retail investor activity can drastically impact a stock’s price. The subsequent decline reflects the market’s correction and the unwinding of the short squeeze. Later periods show a more subdued price action, influenced by company performance and broader market trends.

Factors Influencing GME Stock Price

GME’s stock price is influenced by a complex interplay of internal and external factors.

Internal Factors: These include the company’s financial performance (revenue, earnings, debt levels), strategic initiatives (e.g., expansion into new markets, product development), and management decisions. Strong financial results generally support higher valuations, while poor performance can lead to price declines.

External Factors: These include broader market trends (e.g., overall economic conditions, investor sentiment), regulatory changes affecting the retail sector, and, significantly, social media influence. Social media platforms have become powerful tools for coordinating investor actions and disseminating information (and misinformation), creating both upward and downward pressure on the stock price.

The relative importance of these factors fluctuates. During the January 2021 short squeeze, external factors (social media-driven demand) overwhelmingly dominated internal factors. In other periods, internal performance and broader market conditions play a more significant role.

GME Stock Price Volatility

Source: co.uk

GME’s high volatility stems from several factors. The high concentration of retail investors, susceptible to social media-driven sentiment shifts, makes the stock highly susceptible to rapid price swings. The history of short selling activity against GME also contributed to volatility, as short squeezes can amplify price movements significantly. The company’s transformation strategy, involving a shift from physical retail to e-commerce, introduces further uncertainty into its valuation.

The period surrounding January 2021 exemplifies extreme price swings. A textual representation of volatility over time might look like this:

Time: Jan 2020 – Dec 2020

-Low Volatility, gradual price increase.

Time: Jan 2021 – Extremely High Volatility, sharp price surge followed by a rapid decline.

Time: Feb 2021 – Dec 2022 – Moderate Volatility, gradual price decrease with some fluctuations.

Time: Dec 2022 – Present – Relatively low volatility, stable price range.

Investor Sentiment and GME Stock

Source: knowinsiders.com

Both individual and institutional investors play crucial roles in shaping GME’s price. The interplay of their investment strategies significantly impacts the stock’s trajectory.

- Individual Investors: Often driven by social media sentiment and meme-stock dynamics, individual investors frequently engage in short-term trading, leading to increased volatility.

- Institutional Investors: Tend to adopt longer-term investment horizons, basing their decisions on fundamental analysis and company performance. Their participation can stabilize the price, or, depending on their actions, contribute to significant price movements.

Social media platforms like Reddit’s WallStreetBets have dramatically impacted investor sentiment and trading activity. The coordinated actions of retail investors have demonstrated the potential for collective action to influence market prices.

- Individual Investor Strategies: Often characterized by short-term trading, following social media trends, and herd behavior.

- Institutional Investor Strategies: Typically involve longer-term investment strategies based on fundamental analysis, risk management, and diversification.

Comparison with Similar Stocks

Comparing GME’s performance with other companies in the retail sector (e.g., Best Buy, Target) reveals both similarities and differences. While all companies are subject to broader market trends, GME’s price volatility significantly exceeds that of its peers. The other companies exhibit more predictable price movements driven largely by fundamental factors such as earnings reports and consumer spending patterns. GME, however, is more susceptible to short squeezes and social media-driven sentiment swings.

While the other companies show a more consistent growth or decline based on market performance, GME’s price action has been characterized by more extreme peaks and troughs, making it a much riskier investment.

FAQ Overview

What are the long-term prospects for GME stock?

Predicting long-term stock performance is inherently speculative. Analyzing the company’s strategic initiatives, financial health, and market competition is crucial for forming an informed opinion.

Is GME stock a good investment for beginners?

Due to its high volatility, GME might not be suitable for beginner investors. Beginners should prioritize less volatile investments and focus on building a foundational understanding of the market before considering high-risk stocks.

How does short-selling affect GME’s stock price?

Short-selling, where investors bet against a stock’s price decline, can significantly influence price volatility. A large number of short sellers can exacerbate downward pressure, while a short squeeze (covering of short positions) can drive prices sharply upward.