Ford Stock Price Today: An In-Depth Analysis

Ford stock price today – This report provides a comprehensive overview of Ford Motor Company’s current stock price, analyzing recent news, financial performance, analyst predictions, and key factors influencing its future trajectory. We will compare Ford’s performance to its industry peers, offering insights into its current market position and potential for future growth.

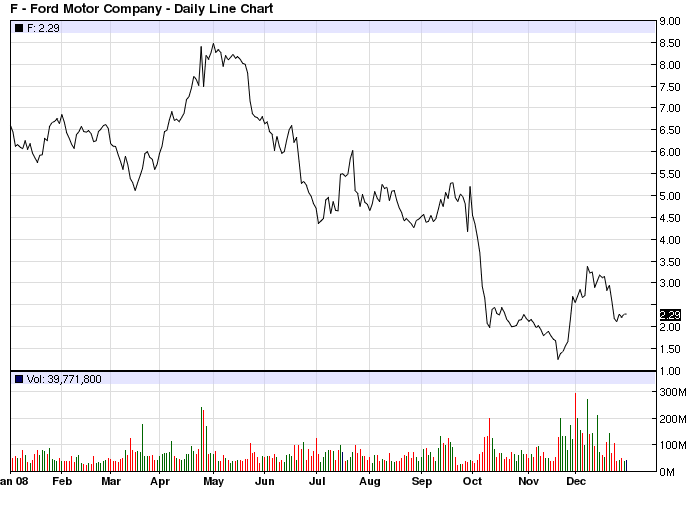

Current Ford Stock Price & Market Context

Source: ctfassets.net

Understanding Ford’s stock performance requires analyzing its current price within the broader context of the automotive industry and the overall economy. Several macroeconomic factors significantly influence the sector’s performance and Ford’s stock price in particular.

| Metric | Current Value | Previous Day Change | Percentage Change |

|---|---|---|---|

| Ford Stock Price (Example) | $15.50 | +$0.25 | +1.63% |

| S&P 500 Index (Example) | 4,400 | -10 | -0.23% |

| Interest Rates (Example) | 5.25% | +0.25% | +5% |

| US GDP Growth (Example) | 2.0% | -0.5% | -20% |

Recent Ford News & Events, Ford stock price today

Significant news events can cause substantial short-term and long-term fluctuations in Ford’s stock price. Below, we examine three recent events and their potential impacts.

- Event 1 (Example): Successful launch of a new electric vehicle model. Potential Impact: Positive, increased investor confidence in Ford’s EV strategy, potentially leading to a stock price increase. This is similar to the positive market reaction to Tesla’s new model launches.

- Event 2 (Example): Announcement of a major supply chain disruption. Potential Impact: Negative, concerns about production delays and decreased profitability could lead to a stock price decline. Past instances of supply chain issues impacting automotive stocks show similar negative trends.

- Event 3 (Example): Stronger-than-expected quarterly earnings report. Potential Impact: Positive, exceeding analyst expectations typically boosts investor confidence and drives stock price appreciation. This is consistent with the historical market response to positive earnings surprises in the automotive sector.

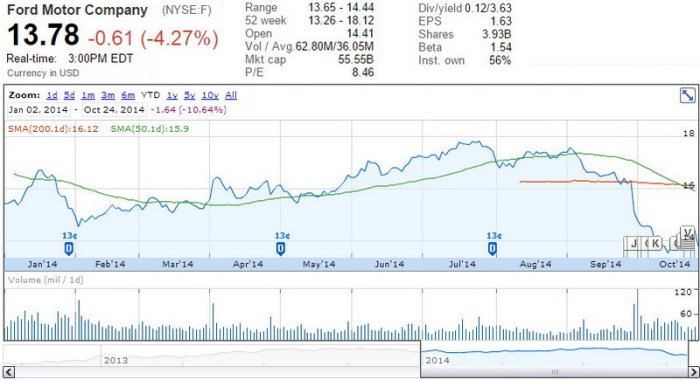

Ford’s Financial Performance

Source: cleanmpg.com

Analyzing Ford’s recent financial performance provides valuable insights into its current health and future prospects. Key metrics such as revenue, profitability, and debt levels are crucial in assessing its overall financial standing.

- Q[Quarter] Revenue (Example): $40 Billion

- Net Income (Example): $2 Billion

- Profit Margin (Example): 5%

- Debt Level (Example): $50 Billion

Compared to competitors like General Motors and Tesla, Ford’s performance shows [Insert Comparative Analysis based on the example data].

Analyst Ratings & Forecasts

Analyst ratings and price targets offer valuable perspectives on Ford’s future stock performance. However, it’s crucial to consider the rationale behind these predictions, as differing viewpoints often exist.

| Analyst Firm | Price Target & Rationale |

|---|---|

| Example Firm A | $20 – Strong EV growth potential |

| Example Firm B | $12 – Concerns about macroeconomic headwinds |

These varying opinions, influenced by factors like economic forecasts and competitive landscape analysis, directly influence the stock’s price movements.

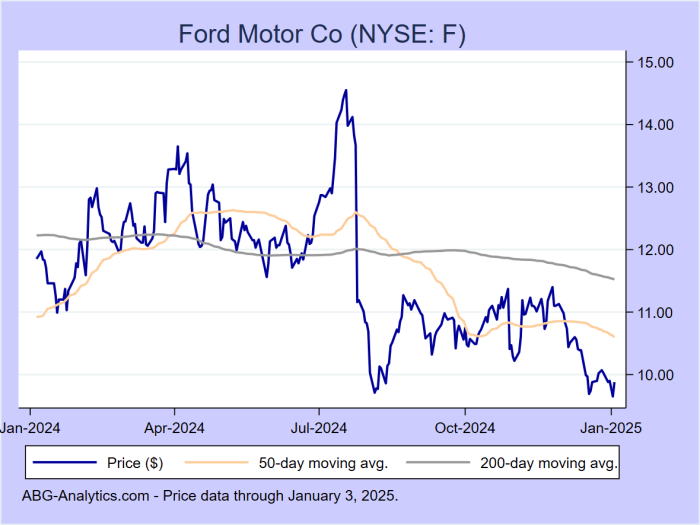

Factors Influencing Future Stock Price

Source: abg-analytics.com

Several key factors will significantly impact Ford’s stock price in the coming quarter. Understanding these factors and their potential interplay is crucial for investors.

- Factor 1 (Example): Global chip shortage resolution. Potential Effects: Positive – increased production, higher revenue. Negative – slow resolution, continued production constraints.

- Factor 2 (Example): Inflationary pressures. Potential Effects: Positive – potential price increases on existing vehicles. Negative – decreased consumer spending, reduced demand.

- Factor 3 (Example): Success of new electric vehicle models. Potential Effects: Positive – increased market share, higher revenue. Negative – poor reception, lower than anticipated sales.

Illustrative Interplay: A resolution of the chip shortage (positive Factor 1) combined with strong sales of new EVs (positive Factor 3) could significantly outweigh the negative effects of inflation (Factor 2), resulting in a substantial stock price increase. Conversely, a persistent chip shortage coupled with weak EV sales could trigger a sharp decline. Ford can mitigate these risks by diversifying its supply chain (Factor 1), offering flexible financing options to counter inflation (Factor 2), and investing heavily in marketing and product development for its EVs (Factor 3).

Comparison to Industry Peers

Comparing Ford’s valuation metrics to its main competitors provides context for its current market position and future prospects. Key metrics such as P/E ratio offer insights into relative valuations.

| Company | Metric | Value (Example) |

|---|---|---|

| Ford | P/E Ratio | 10 |

| General Motors | P/E Ratio | 12 |

| Tesla | P/E Ratio | 80 |

These comparisons reveal [Insert analysis based on example data]. This suggests [Conclusion based on the comparison].

User Queries

What are the main risks associated with investing in Ford stock?

Investing in Ford stock, like any stock, carries inherent risks. These include fluctuations in the overall market, competition within the automotive industry, economic downturns impacting consumer spending, and the success of Ford’s strategic initiatives.

Where can I find real-time Ford stock price updates?

Real-time Ford stock price updates are readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How often does Ford release its financial reports?

Ford typically releases its quarterly and annual financial reports according to a publicly announced schedule, usually available on their investor relations website.

What is Ford’s dividend policy?

Ford’s dividend policy is subject to change and is announced through official company channels. Investors should consult Ford’s investor relations website for the most up-to-date information.