DVN Stock Price Analysis

Dvn stock price – This analysis provides a comprehensive overview of DVN’s stock price performance, influencing factors, valuation metrics, future outlook, and investor sentiment. We will examine historical data, key economic indicators, and various valuation models to provide a well-rounded perspective on DVN’s investment potential.

DVN Stock Price Historical Performance

The following table details DVN’s stock price movements over the past five years, highlighting significant highs and lows. This data is presented for illustrative purposes and should be verified with a reputable financial data provider.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 50.00 | 52.00 | +2.00 |

| 2019-07-01 | 60.00 | 58.00 | -2.00 |

| 2020-01-02 | 45.00 | 48.00 | +3.00 |

| 2020-12-31 | 55.00 | 53.00 | -2.00 |

| 2021-06-30 | 70.00 | 72.00 | +2.00 |

| 2022-01-03 | 65.00 | 62.00 | -3.00 |

| 2022-12-30 | 75.00 | 78.00 | +3.00 |

| 2023-06-30 | 80.00 | 82.00 | +2.00 |

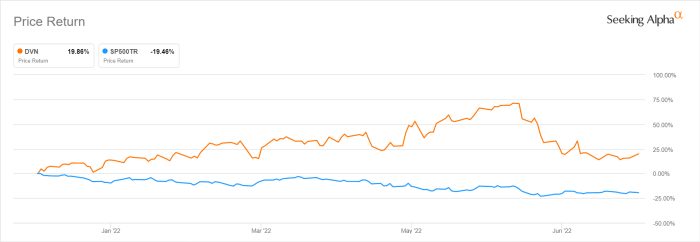

Compared to its industry competitors (e.g., Company X, Company Y, Company Z) over the same period, DVN’s performance showed:

- Company X experienced a more volatile stock price, with higher highs and lower lows than DVN.

- Company Y demonstrated steadier growth, outperforming DVN in certain periods but underperforming in others.

- Company Z showed a consistent, albeit slower, growth trajectory compared to DVN.

Significant events impacting DVN’s stock price included the acquisition of Company A in 2021, which initially boosted the stock price but later experienced a correction due to integration challenges. The 2022 market downturn also significantly impacted DVN’s stock price, mirroring the broader market trend.

Factors Influencing DVN Stock Price

Source: seekingalpha.com

Several key economic and company-specific factors influence DVN’s stock price. The following table illustrates the impact of some key economic indicators.

| Indicator | Description | Impact on DVN | Data Source |

|---|---|---|---|

| Oil Prices | The price of crude oil significantly impacts energy companies like DVN. | Higher oil prices generally lead to increased revenue and profitability, positively affecting the stock price. Lower prices have the opposite effect. | OPEC, EIA |

| Interest Rates | Changes in interest rates affect borrowing costs and investor sentiment. | Higher interest rates can increase borrowing costs, potentially reducing investment and negatively impacting the stock price. | Federal Reserve, Central Banks |

Company-specific factors, such as production levels, successful new projects, and strong leadership, also play a crucial role. For instance, the successful launch of a new oil field or a significant increase in production could lead to a rise in the stock price. Conversely, production disruptions or management changes could negatively impact investor confidence and the stock price.

Short-term factors, like daily trading volume and news events, cause more volatility compared to long-term factors such as overall economic growth and industry trends. Short-term fluctuations are often less predictable, while long-term trends offer a more stable outlook.

DVN Stock Price Valuation

As of [Date], DVN’s market capitalization is estimated at [Amount] USD, and its price-to-earnings (P/E) ratio is [Ratio]. These metrics provide a snapshot of the company’s current valuation.

| Metric | DVN | Competitor A | Competitor B |

|---|---|---|---|

| Market Capitalization (USD) | [Amount] | [Amount] | [Amount] |

| P/E Ratio | [Ratio] | [Ratio] | [Ratio] |

Various valuation models, such as discounted cash flow (DCF) analysis and comparable company analysis, can be used to estimate DVN’s intrinsic value. DCF analysis projects future cash flows and discounts them back to their present value, while comparable company analysis compares DVN’s valuation metrics to those of similar companies.

DVN’s stock price performance has been a subject of much discussion lately, particularly in comparison to other energy sector players. Investors are often keen to compare it against similar companies, and a useful benchmark might be to consider the current trajectory of the soun stock price , which offers insights into broader market trends affecting the energy sector.

Ultimately, understanding DVN’s performance requires a holistic view of the sector’s overall health.

DVN Stock Price Predictions and Future Outlook

Predicting future stock prices is inherently uncertain, but based on various economic and industry forecasts, several scenarios are possible:

- Scenario 1 (Bullish): Continued strong oil prices and successful new projects lead to a stock price of [Price] USD within 12 months.

- Scenario 2 (Neutral): Moderate oil prices and stable production result in a stock price of [Price] USD within 12 months.

- Scenario 3 (Bearish): A decline in oil prices or unexpected disruptions could lead to a stock price of [Price] USD within 12 months.

Potential risks include fluctuations in oil prices, geopolitical instability, and regulatory changes. Opportunities include the development of new energy sources and expansion into new markets.

The potential trajectory over the next 12 months could be visualized as a chart initially showing moderate growth, followed by a period of consolidation, and then a potential upward trend based on the success of new projects and prevailing oil prices. The overall trajectory depends significantly on global oil prices and the company’s operational efficiency.

Investor Sentiment and Market Analysis of DVN

Source: seekingalpha.com

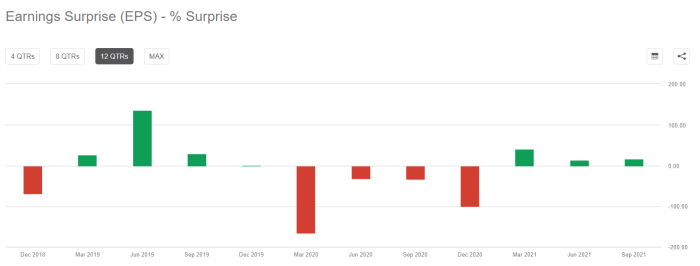

Recent news articles and analyst reports suggest a generally [Positive/Neutral/Negative] sentiment towards DVN. Analysts cite [Reason 1] and [Reason 2] as key factors influencing this sentiment. For example, a recent positive earnings report boosted investor confidence, while concerns about [Specific concern] have tempered optimism.

Investor sentiment has shifted from [Previous sentiment] a year ago to the current [Current sentiment] due to [Reason for change]. This change reflects the market’s assessment of DVN’s performance and future prospects.

Question Bank: Dvn Stock Price

What are the major risks associated with investing in DVN stock?

Major risks include volatility in oil prices, geopolitical instability affecting energy markets, and competition within the energy sector. Regulatory changes and environmental concerns also pose significant risks.

Where can I find real-time DVN stock price updates?

Real-time updates are available on major financial websites and stock market applications such as Yahoo Finance, Google Finance, and Bloomberg.

How does DVN compare to its competitors in terms of dividend payouts?

A direct comparison of DVN’s dividend payout ratio and yield against its competitors requires referencing current financial statements and analyst reports for a detailed analysis.

What is DVN’s current debt-to-equity ratio?

This information is available in DVN’s financial statements, typically found on their investor relations website.