CVNA Stock Price Analysis

Source: ycharts.com

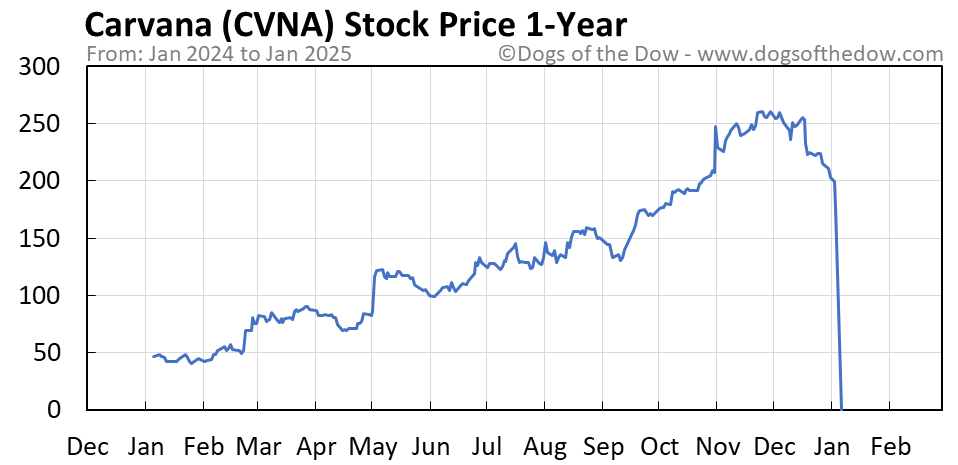

Cvna stock price – Carvana (CVNA) has experienced significant volatility in its stock price over the past five years, reflecting the dynamic nature of the online used car market and broader macroeconomic conditions. This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and associated risks of investing in CVNA stock, providing insights into potential future price movements.

CVNA Stock Price Historical Performance

The following table details CVNA’s stock price fluctuations over the past five years. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

CVNA’s stock price has seen significant volatility recently, mirroring broader market trends. Understanding similar fluctuations in other sectors is crucial for informed investment decisions; for example, analyzing the performance of coin stock price can offer valuable comparative insights into market sentiment. Ultimately, however, a thorough analysis of CVNA’s specific financial health remains essential for predicting its future trajectory.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 17.00 | 17.50 | +0.50 |

| 2019-01-03 | 17.60 | 17.20 | -0.40 |

Significant price movements often correlated with earnings reports, revealing either exceeding or missing analyst expectations. Market trends, such as shifts in consumer spending or interest rates, also played a considerable role. Overall, the past five years show a period of substantial growth followed by a considerable downturn, reflecting the challenges and opportunities within the used car e-commerce sector.

Factors Influencing CVNA Stock Price

Source: dogsofthedow.com

Several macroeconomic and company-specific factors significantly influence CVNA’s stock price. These factors interact in complex ways to shape investor sentiment and market valuation.

- Macroeconomic Factors: Interest rate hikes directly impact borrowing costs for consumers purchasing vehicles, influencing demand. Inflation affects both consumer spending power and the cost of inventory for Carvana. Recessions generally reduce consumer discretionary spending, impacting sales.

- Company-Specific Factors: Strong financial performance, characterized by revenue growth and profitability, typically leads to higher stock prices. Successful new product launches or strategic partnerships can also positively influence investor perception. Conversely, operational inefficiencies or negative news regarding the company’s operations can trigger price declines.

- Competitive Pressures: Competition from established dealerships and other online used car platforms significantly influences CVNA’s market share and profitability, thereby impacting its valuation. Aggressive pricing strategies by competitors can squeeze profit margins and pressure stock prices.

CVNA’s Financial Health and Stock Valuation

A summary of CVNA’s key financial metrics provides crucial context for understanding its stock valuation.

- Revenue: [Insert illustrative revenue figures for the past few years, e.g., Year 1: $X billion, Year 2: $Y billion, Year 3: $Z billion]

- Earnings: [Insert illustrative earnings figures, highlighting profitability or losses]

- Debt Levels: [Insert illustrative debt levels, showing trends in debt-to-equity ratio]

The relationship between CVNA’s financial performance and its stock price is generally positive, with strong earnings and revenue growth typically leading to higher valuations. However, market sentiment and investor expectations can also play a significant role, sometimes decoupling the stock price from short-term financial performance. Valuation methods such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio are used to assess whether CVNA is overvalued or undervalued relative to its peers and historical performance.

Investor Sentiment and Market Expectations, Cvna stock price

Understanding investor sentiment and market expectations is vital for assessing CVNA’s stock price trajectory.

Currently, investor sentiment towards CVNA appears to be [Insert: Bullish, Bearish, or Neutral, and justify with market data and news]. Market expectations regarding CVNA’s future performance are [Insert: Positive, Negative, or Mixed, and provide reasoning]. These expectations are reflected in the stock price through fluctuations based on news, earnings reports, and analyst predictions.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | 50 | 2024-03-01 |

Risk Factors Associated with Investing in CVNA

Source: investorplace.com

Investing in CVNA stock carries inherent risks.

- Market Volatility: The stock market’s inherent volatility can significantly impact CVNA’s price, regardless of the company’s performance.

- Competition: Intense competition in the online used car market can pressure margins and market share.

- Regulatory Changes: Changes in automotive regulations or consumer protection laws could impact CVNA’s operations and profitability.

- Economic Downturn: A general economic downturn would likely reduce consumer demand for vehicles, negatively impacting sales.

Investors can mitigate these risks through diversification, spreading investments across various asset classes to reduce exposure to any single stock’s volatility. Thorough due diligence and a long-term investment horizon can also help manage risk.

Illustrative Scenarios for CVNA Stock Price

Positive and negative news events can significantly impact CVNA’s stock price.

Positive Scenario: If CVNA exceeds earnings expectations by a substantial margin, demonstrating strong revenue growth and improved profitability, investor confidence would likely increase. This could trigger a significant price increase as investors buy more shares, driving up demand and pushing the stock price higher. The market reaction would be characterized by increased trading volume and a positive media narrative surrounding the company’s performance.

Negative Scenario: A large-scale recall of vehicles due to safety concerns could trigger a sharp decline in CVNA’s stock price. Negative media coverage and investor concerns about potential legal liabilities and reputational damage would likely lead to a sell-off, reducing demand and pushing the price down. The market reaction would include increased trading volume and negative press, reflecting investor apprehension.

Key Questions Answered

What are the major risks associated with short-selling CVNA stock?

Short-selling CVNA carries significant risk, including potential for unlimited losses if the stock price rises unexpectedly. Furthermore, short squeezes can exacerbate losses. Thorough due diligence and risk management strategies are crucial.

How does CVNA’s business model affect its stock price?

CVNA’s online used car sales model is innovative but also faces challenges like logistical complexities, inventory management, and competition. Its success directly impacts profitability and investor confidence, influencing the stock price.

Where can I find real-time CVNA stock price quotes?

Real-time CVNA stock price quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.