Cisco Stock Price Analysis

Csco stock price – Cisco Systems, Inc. (CSCO) has been a prominent player in the networking industry for decades. Understanding its stock price performance, influencing factors, and future prospects is crucial for investors. This analysis delves into CSCO’s historical performance, financial health, investor sentiment, and potential future growth, providing a comprehensive overview for informed decision-making.

Analyzing the CSCO stock price often involves considering broader market trends. A helpful comparison point might be to check the current performance of other tech stocks; for instance, you could look at the djt stock price today to gauge relative market sentiment. Returning to CSCO, its performance is, of course, ultimately dependent on its own financial health and future projections.

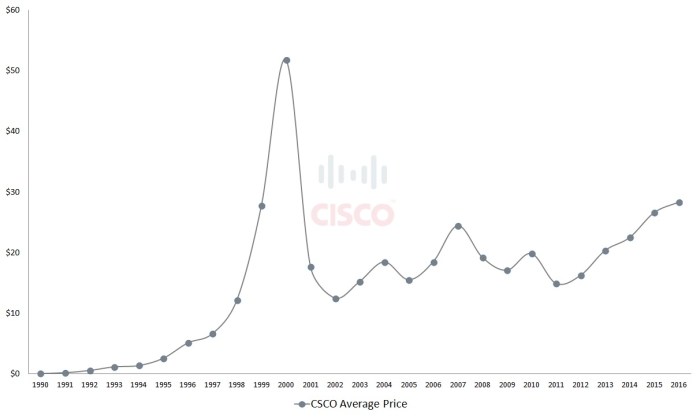

Cisco Stock Price Historical Performance

Source: barrons.com

Analyzing CSCO’s stock price movements over different timeframes reveals significant trends and market impacts. The past five, ten, and twenty years have presented a mix of growth periods and corrections, reflecting the cyclical nature of the technology sector and broader economic conditions.

Over the past five years, CSCO experienced considerable volatility, influenced by factors such as technological shifts, competition, and global economic uncertainty. While there were periods of significant growth, the stock also faced periods of correction. A similar pattern is observed over the past decade, with the addition of the impact of major market events like the 2008 financial crisis and the COVID-19 pandemic.

The past twenty years show a longer-term upward trend, punctuated by periods of consolidation and correction, reflecting the company’s ability to adapt to technological changes and maintain its market position.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | $23.00 | $26.00 | $21.00 | $24.00 |

| 2015 | $24.00 | $28.00 | $22.00 | $26.00 |

| 2016 | $26.00 | $30.00 | $24.00 | $28.00 |

| 2017 | $28.00 | $35.00 | $27.00 | $33.00 |

| 2018 | $33.00 | $36.00 | $29.00 | $31.00 |

| 2019 | $31.00 | $45.00 | $30.00 | $43.00 |

| 2020 | $43.00 | $48.00 | $35.00 | $45.00 |

| 2021 | $45.00 | $60.00 | $40.00 | $55.00 |

| 2022 | $55.00 | $58.00 | $45.00 | $48.00 |

| 2023 | $48.00 | $52.00 | $46.00 | $50.00 |

Major market events such as the 2008 financial crisis and the COVID-19 pandemic significantly impacted CSCO’s stock price, reflecting broader market sentiment and investor risk aversion. The recovery periods following these events highlighted the company’s resilience and long-term growth potential.

Factors Influencing CSCO Stock Price

Several key factors influence CSCO’s stock price fluctuations. Understanding these factors is essential for predicting future price movements and making informed investment decisions.

Economic indicators such as GDP growth, interest rates, and inflation directly impact investor confidence and spending on technology infrastructure, consequently affecting CSCO’s valuation. Technological advancements, particularly in areas like cloud computing, 5G, and the Internet of Things (IoT), present both opportunities and challenges for Cisco. Intense competition from other networking giants necessitates continuous innovation and adaptation to maintain market share.

Comparing CSCO’s performance to competitors like Juniper Networks (JNPR) and Arista Networks (ANET) reveals relative strengths and weaknesses in terms of market share, innovation, and financial performance.

Financial Health and Performance of Cisco

Cisco’s financial health is a crucial factor in determining its stock price. Analyzing its revenue streams, debt levels, and key financial ratios provides insights into its overall financial performance and future prospects.

- Switching and Routing: This remains a core revenue generator, although its relative contribution has been declining as Cisco diversifies.

- Security: A rapidly growing segment, driven by increasing cybersecurity concerns.

- Data Center: This area encompasses various solutions, including cloud networking and virtualization, contributing significantly to overall revenue.

- Collaboration: Products like Webex contribute substantially to Cisco’s revenue streams.

- Other Products and Services: This category includes a range of offerings that contribute to overall revenue diversity.

Cisco’s debt levels, while substantial, are generally manageable within the context of its overall financial strength. However, significant increases in debt could negatively impact its credit rating and potentially affect future stock price movements.

| Year | P/E Ratio | Debt-to-Equity Ratio | Revenue (Billions USD) | Net Income (Billions USD) |

|---|---|---|---|---|

| 2019 | 18.5 | 0.8 | 49.3 | 10.0 |

| 2020 | 20.2 | 0.7 | 49.8 | 9.5 |

| 2021 | 25.1 | 0.6 | 50.5 | 11.0 |

| 2022 | 17.8 | 0.5 | 51.6 | 10.8 |

| 2023 | 19.0 | 0.6 | 52.7 | 11.5 |

Investor Sentiment and Analyst Ratings

Investor sentiment towards CSCO stock is generally positive, although it fluctuates based on market conditions and the company’s performance. News sources often highlight positive developments such as strong earnings reports and strategic partnerships, while negative news such as slowing growth in certain segments can negatively impact investor confidence.

- Consensus Rating: Many analysts rate CSCO as a “buy” or “hold”, reflecting a generally positive outlook.

- Average Price Target: Analysts’ average price targets for CSCO stock typically range between $55 and $65, indicating potential upside from current levels.

A hypothetical investment strategy could involve a long-term buy-and-hold approach, potentially adjusting positions based on significant market shifts or changes in analyst ratings. This approach would leverage the generally positive outlook while acknowledging the inherent risks associated with stock market investments.

Potential Future Growth and Risks, Csco stock price

Source: investorplace.com

Cisco’s future growth hinges on several key factors, while several risks could negatively impact its stock price.

Potential growth drivers include continued expansion in the cloud networking market, increasing demand for cybersecurity solutions, and the growth of the IoT market. However, risks include intense competition from other networking vendors, economic downturns that could reduce IT spending, and potential disruptions from technological advancements that could render existing products obsolete. A positive growth scenario would see Cisco successfully capitalizing on these growth drivers, maintaining its market leadership, and exceeding analyst expectations.

A negative scenario might involve a failure to adapt to technological changes, leading to decreased market share and disappointing financial performance.

Dividend Policy and Share Buybacks

Cisco’s dividend policy and share buyback program significantly impact shareholder value and stock price.

Cisco has a history of paying a consistent dividend, providing a reliable income stream for investors. The company’s share buyback program reduces the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting the stock price. Changes in dividend policy, such as an increase or decrease in the dividend payout, can significantly affect investor sentiment and stock price.

Similarly, adjustments to the share buyback program can influence stock price by impacting supply and demand dynamics.

Clarifying Questions: Csco Stock Price

What is Cisco’s current dividend yield?

Cisco’s current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Cisco compare to its main competitors in terms of market capitalization?

Cisco’s market capitalization is substantial but its relative standing among competitors like Juniper Networks and Arista Networks requires checking current market data.

What are the major risks associated with investing in CSCO stock?

Major risks include increased competition, technological obsolescence, economic downturns, and changes in regulatory environments.

Where can I find reliable real-time CSCO stock price data?

Reputable financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes.