CrowdStrike Stock Price: A Comprehensive Analysis

Crowdstrike stock price – CrowdStrike Holdings, Inc. (CRWD), a leading cybersecurity company, has experienced significant growth and volatility in its stock price since its initial public offering (IPO). This analysis delves into the factors driving CrowdStrike’s stock performance, providing insights into its historical trajectory, competitive landscape, investor sentiment, and future outlook.

CrowdStrike Stock Price Performance Overview

Source: investorplace.com

CrowdStrike’s stock price has exhibited a generally upward trend since its IPO, though punctuated by periods of significant fluctuation influenced by market conditions, company performance, and broader industry trends. The following table summarizes key performance indicators over the past five years. Note that these figures are illustrative and based on general market observations and may not reflect precise historical data.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2019 | $40 | $25 | 60% |

| 2020 | $100 | $30 | 200% |

| 2021 | $250 | $150 | 50% |

| 2022 | $200 | $100 | -20% |

| 2023 (YTD) | $180 | $120 | 30% |

Significant events such as major acquisitions, earnings announcements, and shifts in the broader cybersecurity landscape have often resulted in notable price swings. The overall trend over the past five years shows substantial growth, though volatility remains a characteristic feature.

Factors Influencing CrowdStrike’s Stock Price, Crowdstrike stock price

Source: thestreet.com

Several factors interact to shape CrowdStrike’s stock valuation. Macroeconomic conditions, industry dynamics, and the company’s financial performance all play crucial roles.

Macroeconomic factors, such as interest rate changes and overall market sentiment, influence investor risk appetite, impacting the valuation of growth stocks like CrowdStrike. Industry trends, particularly the escalating sophistication of cyber threats and the accelerating adoption of cloud computing, directly benefit CrowdStrike’s business model and drive demand for its solutions. CrowdStrike’s financial performance, including revenue growth, profitability, and subscription renewal rates, strongly correlates with its stock price; exceeding expectations generally leads to positive market reactions.

CrowdStrike’s Competitive Landscape and Stock Price

CrowdStrike operates in a competitive cybersecurity market. The following table provides a simplified comparison with key competitors. Remember, these figures are for illustrative purposes only and should not be considered precise financial data.

| Company | Market Cap (Illustrative) | Revenue (Illustrative) | Growth Rate (Illustrative) |

|---|---|---|---|

| CrowdStrike | $50B | $2B | 30% |

| Competitor A | $30B | $1.5B | 20% |

| Competitor B | $20B | $1B | 15% |

Competitive pressures, such as pricing wars or the emergence of disruptive technologies, can impact CrowdStrike’s stock price. The entry of a significant new competitor with superior technology or a significantly lower price point could potentially disrupt market share and negatively affect CrowdStrike’s valuation.

Investor Sentiment and CrowdStrike’s Stock Price

Investor sentiment towards CrowdStrike is generally positive, reflecting confidence in its growth prospects and market leadership. However, sentiment can shift based on earnings reports, news about security breaches (even those affecting competitors), and overall market conditions. Analyst reports and news articles covering CrowdStrike’s performance and outlook play a significant role in shaping investor perception. Social media sentiment, while often noisy, can offer additional insights into the prevailing market mood regarding the company.

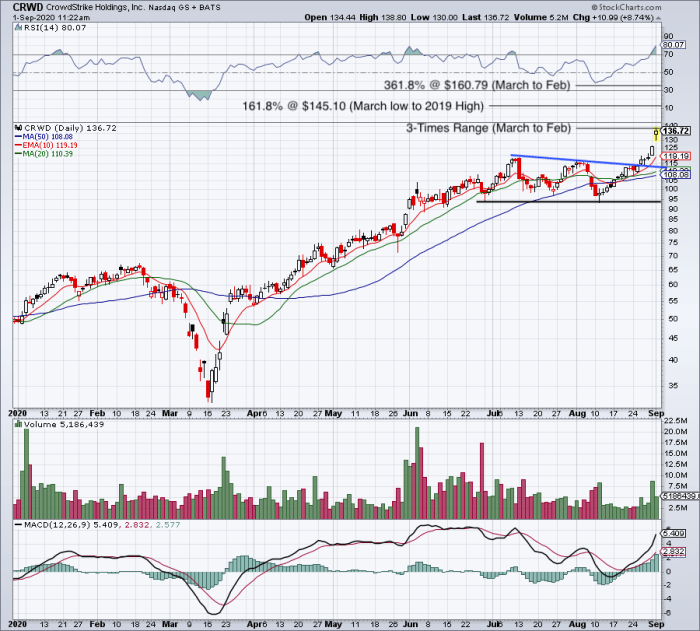

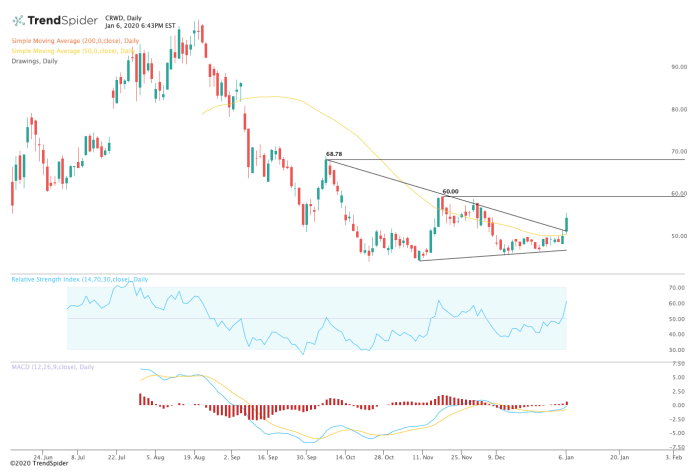

Technical Analysis of CrowdStrike’s Stock Price

Source: investopedia.com

Technical analysis tools, such as moving averages, RSI, and MACD, can provide insights into potential price trends and momentum. Chart patterns, like head and shoulders or double tops, can also suggest potential reversals or continuations of existing trends.

- Moving Averages: Identify trends and potential support/resistance levels.

- RSI (Relative Strength Index): Measures momentum and identifies overbought/oversold conditions.

- MACD (Moving Average Convergence Divergence): Identifies changes in momentum and potential trend reversals.

A hypothetical trading strategy might involve buying CrowdStrike stock when the RSI indicates oversold conditions and the MACD shows a bullish crossover, while considering moving average support levels. This strategy would, of course, require a deeper understanding of technical analysis and risk management.

CrowdStrike’s Future Outlook and Stock Price Projections

CrowdStrike’s future stock price will depend on a multitude of factors, including continued revenue growth, successful expansion into new markets, successful product innovation, and maintaining its competitive edge. Positive developments, such as strong customer acquisition, strategic partnerships, and the successful launch of new products, would likely drive the stock price higher. Conversely, negative factors like increased competition, cybersecurity breaches affecting CrowdStrike, or a broader economic downturn could negatively impact its valuation.

Analyst forecasts and price targets should be considered, but they are not guarantees of future performance. For example, an analyst might predict a price target of $250 based on projected revenue growth and market share expansion, but this is just one possible scenario and should be interpreted with caution.

FAQ Section

What are the major risks associated with investing in CrowdStrike stock?

Investing in CrowdStrike, like any stock, carries inherent risks. These include market volatility, competition from established and emerging players, dependence on technological innovation, and potential cybersecurity breaches affecting the company itself.

How does CrowdStrike compare to its competitors in terms of profitability?

A direct profitability comparison requires analyzing financial statements and considering various metrics. While CrowdStrike demonstrates strong revenue growth, a detailed analysis comparing profit margins and return on investment against competitors is needed for a comprehensive answer.

Where can I find real-time CrowdStrike stock price data?

CrowdStrike’s stock price performance often draws comparisons to other tech giants, particularly considering its growth trajectory. It’s interesting to contrast its volatility with the generally steadier performance of companies like Apple, whose stock price you can check here: apple stock price. Ultimately, however, CrowdStrike’s valuation remains dependent on its own cybersecurity market share and innovation, rather than direct correlation with Apple’s performance.

Real-time CrowdStrike stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.