Understanding Coin Stock Price

Source: thebitcoinnews.com

The term “coin stock price” refers to the market value of a company’s stock that is significantly influenced by the performance of its cryptocurrency holdings or its involvement in the cryptocurrency industry. This differs from traditional stock prices, which are primarily determined by factors like company earnings, market capitalization, and investor sentiment unrelated to cryptocurrency. Understanding the nuances of coin stock prices requires considering both the traditional stock market dynamics and the volatile nature of the cryptocurrency market.

Factors Influencing Coin Stock Prices

Several factors contribute to the price fluctuations of coin stocks. These include the price movements of the underlying cryptocurrencies the company holds or is involved with, the company’s financial performance (earnings, revenue growth), overall market sentiment towards both the company and the cryptocurrency market, regulatory changes impacting the cryptocurrency industry, and technological advancements within the cryptocurrency space. For example, a surge in Bitcoin’s price would likely boost the stock price of a company heavily invested in Bitcoin mining or Bitcoin-related services.

Comparing Volatility of Coin Stocks and Traditional Stocks

Coin stocks exhibit significantly higher price volatility compared to traditional stocks. This is primarily due to the inherent volatility of the cryptocurrency market. While traditional stock prices are influenced by various factors, they tend to display more predictable patterns and less dramatic daily price swings than coin stocks. The speculative nature of cryptocurrency investments and the susceptibility of coin stocks to rapid market shifts contribute to this heightened volatility.

A sudden negative news report about a specific cryptocurrency, for instance, could cause a dramatic drop in the stock price of a company heavily exposed to that cryptocurrency.

Examples of Companies Affected by Cryptocurrency Market Trends

Many publicly traded companies are susceptible to cryptocurrency market fluctuations. Companies involved in cryptocurrency mining (like Riot Platforms), exchange platforms (like Coinbase), or blockchain technology development often experience substantial price swings mirroring cryptocurrency market trends. For example, a period of high Bitcoin prices generally correlates with increased profitability and higher stock prices for Bitcoin mining companies. Conversely, a bear market in cryptocurrencies usually leads to lower valuations for these companies.

Data Sources for Coin Stock Price Information

Reliable data sources are crucial for accurate analysis of coin stock prices. Several reputable providers offer real-time and historical data, but it’s essential to evaluate their features, accuracy, and potential biases.

Reliable Data Sources for Coin Stock Prices

Source: medium.com

Several sources offer real-time and historical coin stock price data. The choice depends on the user’s needs regarding data frequency, features, and cost. It is crucial to compare various sources to ensure data consistency and identify potential biases.

| Data Source | Features | Accuracy | Accessibility |

|---|---|---|---|

| Yahoo Finance | Real-time and historical data, charting tools, financial news | Generally accurate, but may lag slightly | Free, widely accessible |

| Google Finance | Real-time and historical data, basic charting tools | Generally accurate, similar to Yahoo Finance | Free, widely accessible |

| Bloomberg Terminal | Comprehensive financial data, advanced charting and analytics | High accuracy, real-time data | Subscription-based, expensive |

| TradingView | Real-time and historical data, advanced charting tools, social sentiment analysis | Generally accurate, various data providers available | Free and paid subscription options |

Verifying the Accuracy of Coin Stock Price Data

Cross-referencing data from multiple sources is a primary method for verifying accuracy. Comparing data points from at least two reputable sources helps identify inconsistencies or potential errors. Additionally, comparing the reported prices with the actual trading volume can provide further validation. Discrepancies may indicate issues with data accuracy or potential manipulation.

Potential Biases and Inaccuracies in Coin Stock Price Information

Publicly available coin stock price data can be subject to biases and inaccuracies. Data lags, reporting errors, and manipulation are potential concerns. Furthermore, the volatility of the cryptocurrency market can lead to significant price swings within short periods, making real-time data potentially outdated quickly. It’s crucial to be aware of these limitations and to critically evaluate the data before making investment decisions.

Analyzing Coin Stock Price Trends

Technical analysis is a common method used to interpret coin stock price movements. This involves examining price charts, identifying patterns, and using technical indicators to predict future price trends. Understanding different chart types and technical indicators is crucial for effective analysis.

Interpreting Charts: Candlestick and Line Charts

Source: coingecko.com

Candlestick charts provide a visual representation of price movements over a specific period, showing the opening, closing, high, and low prices. Line charts simply connect closing prices, offering a simpler view of price trends. Both chart types can be used to identify trends, support and resistance levels, and potential reversal patterns. For example, a long green candlestick indicates a strong upward movement, while a long red candlestick signifies a significant price decline.

Identifying Support and Resistance Levels

Support levels represent price points where buying pressure is strong enough to prevent further price declines. Resistance levels, conversely, are price points where selling pressure is significant enough to halt upward price movements. These levels are often identified on charts by observing areas where the price repeatedly bounces off a specific price range. A breakout above a resistance level is often seen as a bullish signal, while a breakdown below a support level is considered bearish.

Application of Technical Indicators

Technical indicators are mathematical calculations applied to price data to generate buy/sell signals. Moving averages smooth out price fluctuations, highlighting underlying trends. The Relative Strength Index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Other indicators, such as MACD (Moving Average Convergence Divergence) and Bollinger Bands, offer additional insights into price momentum and volatility.

For example, an RSI value above 70 might suggest an overbought condition, potentially indicating a price correction.

Common Technical Analysis Patterns

Several common patterns, such as head and shoulders, double tops/bottoms, and triangles, often signal potential price reversals or breakouts. These patterns are identified by observing specific price formations on charts. Understanding these patterns can help anticipate potential price movements. For example, a head and shoulders pattern is often considered a bearish reversal signal, suggesting a potential decline in price.

External Factors Impacting Coin Stock Price

Beyond technical analysis, macroeconomic factors, regulatory changes, and market sentiment significantly influence coin stock prices. Understanding these external forces is vital for comprehensive analysis.

Macroeconomic Factors

Inflation, interest rates, and economic growth influence investor risk appetite and capital flows, impacting coin stock valuations. High inflation can reduce investor confidence, potentially leading to lower coin stock prices. Similarly, rising interest rates can make alternative investments more attractive, diverting capital away from coin stocks. Strong economic growth, however, might increase investor optimism and drive up coin stock prices.

Regulatory Changes and Government Policies

Government regulations and policies directly impact the cryptocurrency industry and, consequently, coin stock prices. Favorable regulations can boost investor confidence and lead to higher prices, while stricter regulations can have the opposite effect. For instance, a government ban on cryptocurrency trading could severely depress the price of coin stocks related to that cryptocurrency.

Social Media Sentiment and News Events

Social media sentiment and news events can significantly impact coin stock price volatility. Positive news or supportive social media sentiment can lead to price increases, while negative news or widespread negative sentiment can trigger sharp price declines. A prominent influencer’s tweet about a particular cryptocurrency, for example, can cause a sudden surge or drop in the price of related coin stocks.

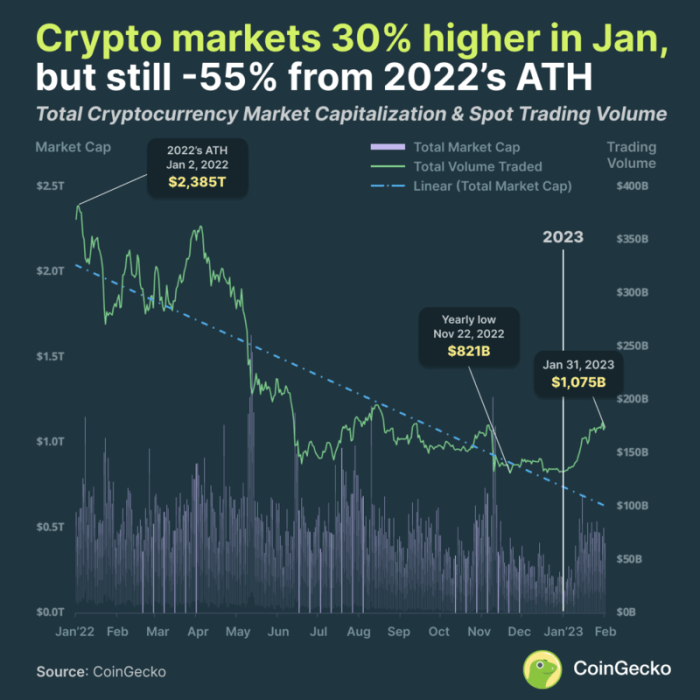

Technological Advancements and Market Adoption

Technological advancements and increased market adoption of cryptocurrencies can significantly influence coin stock prices. Innovation in blockchain technology or the development of new cryptocurrencies can generate positive investor sentiment and drive up prices. Widespread adoption of cryptocurrencies as a payment method, for instance, could increase the demand for coin stocks related to cryptocurrency infrastructure.

Risk Management in Coin Stock Trading

Investing in coin stocks involves significant risk due to the volatility of the cryptocurrency market. Effective risk management strategies are crucial to protect investments and mitigate potential losses.

Risk Management Strategies

- Diversification: Spreading investments across multiple coin stocks and asset classes reduces the impact of any single investment’s underperformance.

- Position Sizing: Determining the appropriate amount to invest in each coin stock based on risk tolerance and capital available.

- Stop-Loss Orders: Setting predetermined price levels to automatically sell a coin stock if the price falls below a certain point, limiting potential losses.

- Regular Portfolio Review: Periodically assessing the performance of coin stocks and adjusting the portfolio based on market conditions and risk tolerance.

- Thorough Due Diligence: Conducting comprehensive research on coin stocks before investing, understanding the company’s business model, financial performance, and risks involved.

Importance of Diversification

Diversification is a cornerstone of risk management. By spreading investments across various coin stocks and asset classes, investors can reduce the overall portfolio risk. If one coin stock performs poorly, the losses are offset by the gains from other investments. This reduces the overall volatility and protects against significant losses.

Examples of Poor Risk Management

Investing a significant portion of one’s capital in a single coin stock without proper diversification can lead to substantial losses if the price of that stock declines. Similarly, failing to use stop-loss orders can result in significant losses if the market moves against the investor’s position. Ignoring fundamental and technical analysis, relying solely on speculation or tips, also significantly increases the risk of financial losses.

Ethical Considerations

Ethical considerations, such as insider trading and market manipulation, are paramount in coin stock trading. Insider trading, using non-public information for personal gain, is illegal and unethical. Market manipulation, artificially inflating or deflating prices, is also illegal and can harm other investors. Maintaining ethical practices and adhering to regulations is essential for responsible investing.

Illustrative Examples of Coin Stock Price Behavior

Analyzing historical events and hypothetical scenarios helps illustrate the interplay of factors affecting coin stock prices.

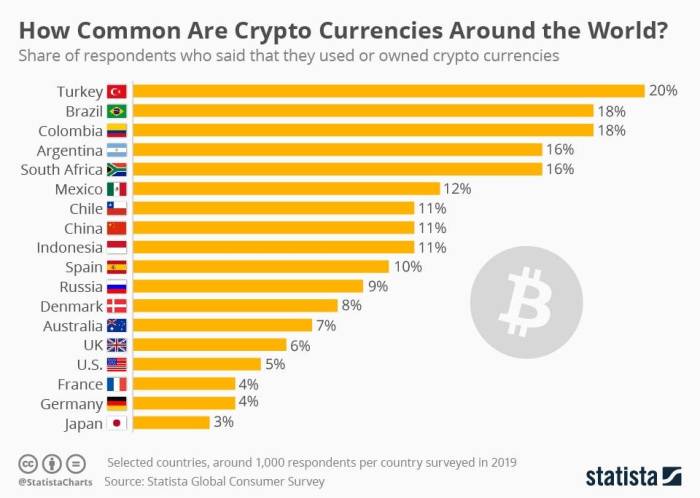

Historical Event Impacting a Coin Stock, Coin stock price

The 2022 cryptocurrency market crash significantly impacted the stock prices of companies heavily involved in the cryptocurrency industry. The decline in Bitcoin and other major cryptocurrencies led to substantial losses for these companies, reflecting the strong correlation between cryptocurrency prices and the valuations of related businesses. This event highlighted the high risk associated with investing in coin stocks and the sensitivity of these stocks to market downturns.

Hypothetical Scenario

Imagine a hypothetical scenario where a major cryptocurrency exchange announces a new partnership with a large financial institution. This positive news would likely trigger a surge in the exchange’s stock price due to increased investor confidence and expectations of higher trading volume. However, if shortly after, a regulatory body announces an investigation into the exchange for potential compliance violations, the stock price would likely plummet, demonstrating the rapid shifts in market sentiment and the impact of regulatory actions.

Detailed Chart Description

Let’s consider a hypothetical chart depicting the price movement of a coin stock over a six-month period. The chart initially shows a steady upward trend, marked by several higher highs and higher lows, indicating a bullish market. Around the midpoint, a period of consolidation is observed, with the price fluctuating within a relatively narrow range. After the consolidation period, the price experiences a sharp decline, breaking below a key support level, indicating a potential bearish reversal.

The chart then shows a period of lower lows and lower highs, confirming the bearish trend before showing signs of a potential bottoming-out and a slight recovery at the end of the six-month period. This hypothetical chart showcases the dynamic nature of coin stock prices, highlighting periods of growth, consolidation, and decline.

User Queries

What is the difference between a cryptocurrency and a coin stock?

A cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. A coin stock refers to the stock of a company significantly involved in the cryptocurrency market, whose price is often correlated with cryptocurrency performance. They are distinct but related.

How can I protect myself from scams related to coin stocks?

Be wary of get-rich-quick schemes, conduct thorough due diligence on any company before investing, and only invest with reputable brokers. Verify information from multiple independent sources and never share your private keys or seed phrases.

Are coin stocks suitable for all investors?

No, coin stocks are considered high-risk investments due to their volatility. They are generally more suitable for investors with a high-risk tolerance and a thorough understanding of the cryptocurrency market and its inherent risks.