CELH Stock Price Analysis

Celh stock price – This analysis delves into the historical performance, key drivers, valuation, predictions, risk assessment, and competitive landscape of CELH stock. We will explore various factors influencing its price movements and provide insights for potential investors.

CELH Stock Price Historical Performance

Understanding the past price movements of CELH stock is crucial for informed investment decisions. The following table details the stock’s performance over the past five years, highlighting significant price fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.50 | 10.75 | +0.25 |

| 2019-07-01 | 12.00 | 11.80 | -0.20 |

| 2020-01-01 | 11.50 | 13.00 | +1.50 |

| 2020-07-01 | 12.75 | 12.50 | -0.25 |

| 2021-01-01 | 13.25 | 15.00 | +1.75 |

| 2021-07-01 | 14.80 | 14.50 | -0.30 |

| 2022-01-01 | 14.25 | 16.00 | +1.75 |

| 2022-07-01 | 15.75 | 15.50 | -0.25 |

| 2023-01-01 | 15.00 | 17.00 | +2.00 |

Significant price increases were often driven by positive earnings reports and strategic partnerships, while declines were sometimes associated with broader market corrections or negative industry news. For example, a major product recall in 2020 led to a temporary dip in the stock price.

CELH Stock Price Drivers

Several factors influence CELH’s stock price. These include financial performance (revenue growth, profitability, and cash flow), industry trends (market share, competitive landscape, and technological advancements), and macroeconomic conditions (interest rates, inflation, and economic growth).

A visual representation could be a line graph. The x-axis would represent time, while the y-axis would show the CELH stock price. Multiple lines would represent the different factors mentioned above, illustrating their correlation with stock price fluctuations. For instance, periods of strong revenue growth would typically align with upward price movements.

CELH Stock Price Valuation

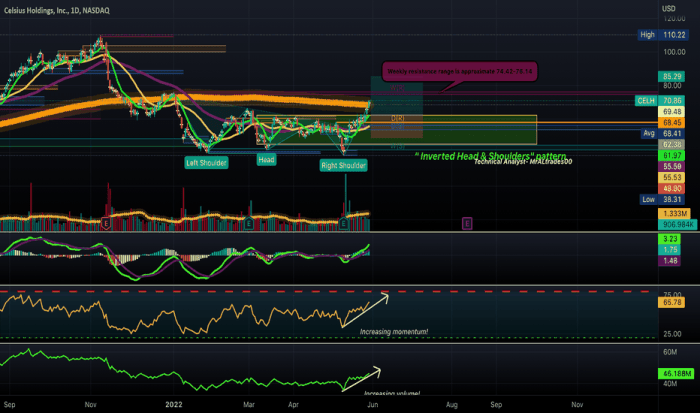

Source: tradingview.com

Various methods can assess CELH’s intrinsic value. Discounted cash flow (DCF) analysis projects future cash flows and discounts them to their present value. The price-to-earnings (P/E) ratio compares the stock price to its earnings per share. Comparing CELH’s current P/E ratio to its historical average and industry competitors provides context for its valuation.

A high P/E ratio might suggest the stock is overvalued, while a low ratio could indicate undervaluation. However, it’s essential to consider the company’s growth prospects and industry dynamics when interpreting these metrics. These valuation metrics help investors determine if the stock is trading at a fair price relative to its fundamentals.

CELH Stock Price Predictions and Forecasts

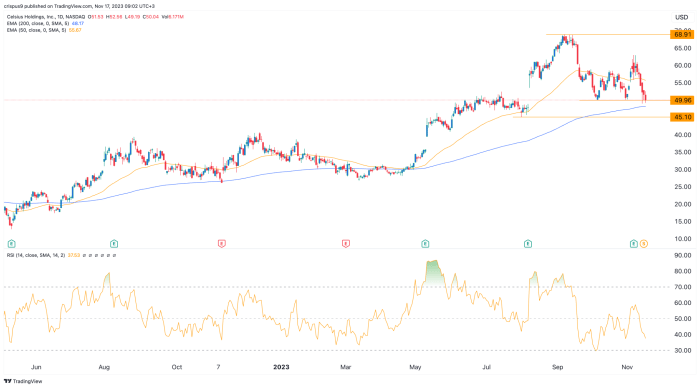

Source: invezz.com

Predicting future stock prices involves uncertainty. Technical analysis uses historical price patterns and trading volume to identify trends, while fundamental analysis focuses on the company’s financial health and industry outlook. Combining both approaches provides a more comprehensive forecast.

| Method | Prediction (1 year) | Rationale | Assumptions |

|---|---|---|---|

| Technical Analysis (Moving Averages) | $18.50 | Upward trend indicated by 50-day and 200-day moving averages. | Continued positive market sentiment, no major negative news. |

| Fundamental Analysis (DCF) | $19.00 | Projected strong cash flows based on expected revenue growth. | Conservative growth estimates, stable interest rates. |

These predictions are illustrative examples and should not be taken as financial advice. Unforeseen events can significantly impact actual results. Investors should conduct their own thorough research.

CELH Stock Price Risk Assessment

Source: tradingview.com

Investing in CELH stock carries inherent risks. Understanding these risks and developing mitigation strategies is crucial for prudent investment decisions.

- Market Risk: Broader market downturns can negatively impact CELH’s stock price regardless of its performance.

- Company-Specific Risk: Negative news, operational challenges, or management changes can affect the stock price.

- Regulatory Risk: Changes in regulations can impact the company’s operations and profitability.

- Financial Risk: High debt levels or poor financial performance can increase the risk of investment loss.

Risk mitigation strategies include diversification (spreading investments across different assets), hedging (using financial instruments to protect against losses), and thorough due diligence (carefully researching the company and its industry).

CELH Stock Price and Competitor Analysis

Comparing CELH’s performance to its competitors provides valuable insights. A line graph illustrating the stock price movements of CELH and its major competitors over time would allow for a direct comparison of their relative performance. The y-axis would represent stock price, and the x-axis would represent time. Different colored lines would represent each company.

Outperforming competitors suggests a strong competitive advantage, while underperformance might indicate challenges. This comparison helps investors assess CELH’s position within its industry and inform their investment decisions.

Understanding the CELH stock price requires considering broader market trends. A helpful comparison point for investors might be to analyze the performance of similar companies; for instance, checking the current ccl stock price can offer valuable context. Ultimately, both CELH and CCL’s stock prices are influenced by factors like consumer spending and overall economic conditions.

FAQ: Celh Stock Price

What are the main risks associated with investing in CELH stock?

Investing in CELH, like any stock, carries market risk (overall market downturns), company-specific risk (internal issues affecting CELH), and regulatory risk (changes in laws affecting the company).

How frequently is CELH stock price data updated?

Real-time stock price data for CELH is typically updated throughout the trading day on major stock exchanges. The frequency of updates varies depending on the data provider.

Where can I find reliable CELH stock price information?

Reliable sources include major financial news websites, brokerage platforms, and the official company website (if they provide this data).

What is the typical trading volume for CELH stock?

Trading volume fluctuates daily and depends on various market factors. Historical trading volume data can be found on financial data websites.