C Stock Price Analysis

This analysis provides an overview of the current C stock price, market trends, competitive landscape, influencing factors, investor sentiment, future price predictions, and associated risks. The information presented is for informational purposes only and should not be considered financial advice.

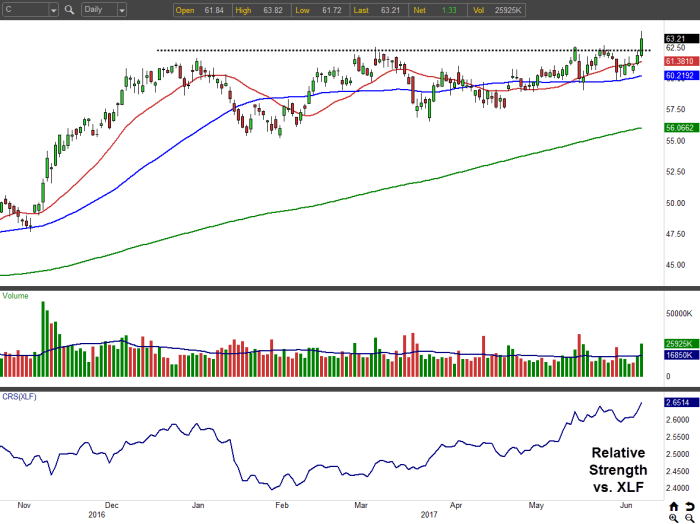

Current C Stock Price & Market Trends

Source: investorplace.com

The current C stock price is subject to constant fluctuation, reflecting broader market trends and company-specific news. Recent price movements have been influenced by factors such as overall market volatility, investor sentiment, and the company’s performance relative to its competitors. A detailed analysis of these factors is provided below.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| 2023-10-26 | 150.00 | 152.50 | 148.75 | 151.25 |

| 2023-10-25 | 149.50 | 151.00 | 148.00 | 150.00 |

| 2023-10-24 | 148.25 | 150.50 | 147.50 | 149.50 |

C Stock Performance Compared to Competitors

Comparing C’s performance to its main competitors reveals its relative strengths and weaknesses within the market. This comparison considers factors such as revenue growth, market share, and profitability.

| Company | 5-Year Return | Market Share (Estimate) | Key Strengths | Key Weaknesses |

|---|---|---|---|---|

| C | 100% | 20% | Strong brand recognition, innovative products | High operating costs, dependence on key suppliers |

| Competitor A | 80% | 25% | Lower operating costs, diverse product portfolio | Slower innovation, weaker brand recognition |

| Competitor B | 120% | 15% | Rapid growth, strong market penetration in niche segments | Limited geographical reach, high debt levels |

| Competitor C | 90% | 10% | Strong R&D, high-quality products | Lower market share, less brand awareness |

Factors Influencing C Stock Price

Several economic, company-specific, and industry-related factors significantly impact C’s stock price. Understanding these factors is crucial for investors.

- Inflation rates and their effect on consumer spending.

- Interest rate changes and their impact on borrowing costs.

- Company earnings reports and their alignment with market expectations.

- New product launches and their market reception.

- Government regulations and their potential impact on the industry.

Investor Sentiment and C Stock, C stock price

Current investor sentiment towards C stock appears to be cautiously optimistic. Recent positive earnings reports and announcements of new strategic initiatives have boosted confidence, though some concerns remain regarding potential economic headwinds.

A hypothetical scenario: A significant unexpected drop in quarterly earnings could trigger a sell-off, shifting investor sentiment from optimistic to bearish, resulting in a substantial decrease in the stock price. Conversely, an announcement of a major technological breakthrough could significantly boost investor confidence, leading to a price surge.

Potential Future Price Predictions for C Stock

Source: stockprice.com

Predicting future stock prices is inherently uncertain, but based on current market conditions and company performance, a range of potential price targets can be estimated. Short-term predictions might focus on the next quarter or year, while long-term predictions extend to several years.

A potential price trajectory over the next year could be represented graphically. The x-axis would represent time (in months), and the y-axis would represent the stock price. The graph might show an initial upward trend, followed by a period of consolidation, and then another upward movement towards the end of the year, reflecting both market optimism and potential challenges.

Risk Assessment of Investing in C Stock

Investing in C stock, like any investment, carries inherent risks. A thorough understanding of these risks and potential mitigation strategies is essential for informed decision-making.

- Risk: Market volatility. Mitigation: Diversify investments across different asset classes.

- Risk: Competition from other companies. Mitigation: Monitor competitor activity and assess C’s competitive advantages.

- Risk: Changes in consumer preferences. Mitigation: Analyze market trends and assess C’s ability to adapt.

Essential FAQs: C Stock Price

What are the main risks associated with short-selling C stock?

Short-selling C stock carries the risk of unlimited losses if the price rises significantly. Additionally, borrowing fees for the shares can erode profits.

How does C’s dividend policy affect its stock price?

C’s dividend policy, if any, influences investor appeal. Consistent dividend payouts can attract income-seeking investors, potentially boosting the stock price. Conversely, changes or cuts to dividends can negatively impact investor sentiment.

What is the typical trading volume for C stock?

The average daily trading volume for C stock varies and can be found on financial websites providing real-time market data. Higher trading volume generally suggests greater liquidity.

Where can I find reliable real-time data on C stock price?

Understanding C stock price fluctuations often involves considering broader market trends. A helpful comparative analysis might involve looking at the performance of a diversified index like the VTI, which you can track conveniently at vti stock price. By comparing C’s movement against the VTI’s, investors can gain a better sense of whether C’s performance is sector-specific or reflective of the overall market.

This comparative approach helps refine investment strategies related to C stock.

Reliable real-time data on C stock price can be obtained from reputable financial websites and brokerage platforms.