AMD Stock Price Today: An Analysis

Source: businessinsider.com

Amd stock price today – This report provides a comprehensive overview of AMD’s current stock price, recent market performance, and future outlook. We will examine recent news impacting the stock, AMD’s financial performance, a competitor analysis, and a technical analysis of the stock chart. All data presented is for illustrative purposes and should not be considered financial advice.

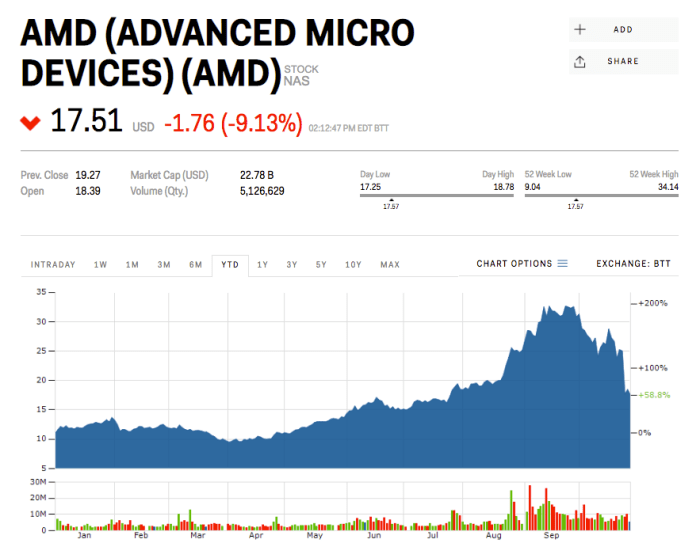

Current AMD Stock Price & Market Context

As of [Insert Current Date and Time], AMD’s stock price is [Insert Current Stock Price]. This represents a [Insert Percentage Change] change from the previous closing price of [Insert Previous Closing Price]. The overall technology sector is currently experiencing [Describe Current Market Conditions – e.g., moderate volatility due to concerns about interest rates, or strong growth driven by AI advancements].

Today’s trading volume for AMD is [Insert Trading Volume]. Market sentiment towards AMD is currently [Describe Market Sentiment – e.g., cautiously optimistic due to recent product launches, or bearish due to concerns about competition].

Recent News Impacting AMD Stock

Several recent news events have significantly influenced AMD’s stock price. These events and their impact on investor sentiment are detailed below.

| Date | Event | Impact on Price | Volume |

|---|---|---|---|

| [Date 1] | [Event 1, e.g., Strong Q2 Earnings Report] | [Impact, e.g., Stock price increased by X%] | [Volume] |

| [Date 2] | [Event 2, e.g., New Ryzen Processor Launch] | [Impact, e.g., Positive market reaction, slight price increase] | [Volume] |

| [Date 3] | [Event 3, e.g., Partnership Announcement with a Major OEM] | [Impact, e.g., Moderate positive impact on investor confidence] | [Volume] |

AMD’s Financial Performance & Future Outlook, Amd stock price today

AMD’s recent financial performance has been [Describe Performance – e.g., strong, showing significant revenue growth and increased profitability]. Key metrics for the last quarter include revenue of [Insert Revenue], earnings per share of [Insert EPS], and [Insert Other Relevant Metric]. AMD’s future product roadmap includes [List Key Products and Technologies – e.g., new generation of GPUs and CPUs, advancements in AI processing].

These developments are expected to [Describe Expected Impact – e.g., drive further revenue growth and market share gains].

- Analyst Prediction 1: [Prediction and source, e.g., Morgan Stanley predicts a 15% increase in stock price within the next year based on their analysis of AMD’s market position and product pipeline.]

- Analyst Prediction 2: [Prediction and source]

- Analyst Prediction 3: [Prediction and source]

Competitor Analysis

AMD’s main competitors in the CPU and GPU markets are Intel and NVIDIA. A comparison of their market positions and recent stock performance is provided below.

| Company | Market Share (Illustrative) | Recent Stock Performance (Illustrative) | Key Strengths |

|---|---|---|---|

| AMD | [Approximate Market Share] | [Describe Recent Performance] | [List Key Strengths, e.g., Strong CPU and GPU performance, competitive pricing] |

| Intel | [Approximate Market Share] | [Describe Recent Performance] | [List Key Strengths, e.g., Established brand recognition, strong presence in the data center market] |

| NVIDIA | [Approximate Market Share] | [Describe Recent Performance] | [List Key Strengths, e.g., Dominance in the GPU market, strong presence in AI] |

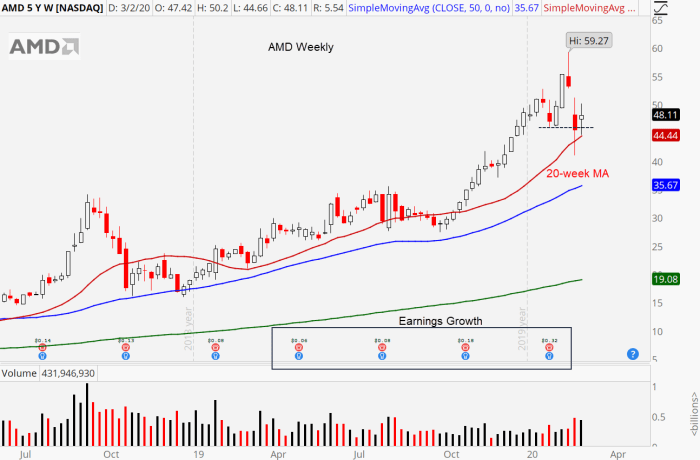

Technical Analysis of AMD Stock Chart

Source: investorplace.com

Over the past month, AMD’s stock price has shown a [Describe Trend – e.g., generally upward trend with periods of consolidation]. Over the past quarter, the trend has been [Describe Trend]. The year-to-date trend is [Describe Trend]. Key support levels appear to be around [Price Level(s)], while resistance levels are observed around [Price Level(s)]. While no specific chart patterns like head and shoulders or double tops/bottoms are explicitly mentioned in this analysis, the chart exhibits [Describe Chart Appearance – e.g., a gradual upward sloping trendline with minor corrections, suggesting a bullish momentum.

Key price points include a significant rally following [event] and a period of consolidation around [price level]. The trendline suggests potential further upside, but caution is advised due to market volatility.].

FAQ Explained: Amd Stock Price Today

What are the major risks associated with investing in AMD stock?

Investing in AMD stock, like any stock, carries inherent risks. These include volatility due to market fluctuations, competition from established players, and the cyclical nature of the semiconductor industry. Technological disruptions and macroeconomic factors also pose significant risks.

Where can I find real-time AMD stock price data?

Keeping an eye on AMD stock price today requires constant monitoring. To understand the current fluctuations, it’s helpful to check a reliable source for the amd stock price and then compare it to previous days’ closing values. This allows for a more informed assessment of AMD stock price today and potential future trends.

Real-time AMD stock price data is readily available through major financial websites and brokerage platforms. Many provide live quotes, charts, and detailed historical data.

How does AMD’s dividend policy affect its stock price?

AMD’s dividend policy, or lack thereof, impacts investor perception. Companies that pay dividends often attract investors seeking income, potentially influencing stock price. AMD’s reinvestment strategy, focused on growth, may appeal more to growth-oriented investors.