Amazon Stock Price Today: A Comprehensive Analysis

Source: thestreet.com

Amazon stock price today – This report provides a detailed analysis of Amazon’s stock price today, considering various factors influencing its performance, recent financial results, analyst predictions, and long-term prospects. We will examine the current market context, key economic factors, competitor actions, and Amazon’s strategic initiatives to provide a comprehensive overview.

Current Amazon Stock Price and Market Context

As of [Insert Time and Date], Amazon’s stock price is [Insert Current Price]. This represents a [Insert Percentage Change] change from the previous closing price of [Insert Previous Closing Price]. The current market capitalization of Amazon stands at approximately [Insert Market Cap]. Today’s trading volume is [Insert Trading Volume].

| Day | High | Low | Open | Close |

|---|---|---|---|---|

| [Day 1] | [High 1] | [Low 1] | [Open 1] | [Close 1] |

| [Day 2] | [High 2] | [Low 2] | [Open 2] | [Close 2] |

| [Day 3] | [High 3] | [Low 3] | [Open 3] | [Close 3] |

| [Day 4] | [High 4] | [Low 4] | [Open 4] | [Close 4] |

| [Day 5] | [High 5] | [Low 5] | [Open 5] | [Close 5] |

Factors Influencing Today’s Price

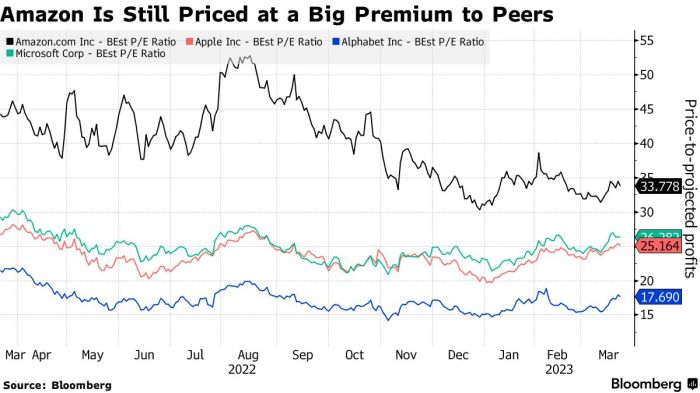

Source: bwbx.io

Several interconnected factors contribute to Amazon’s daily stock price fluctuations. These include macroeconomic conditions, recent news, and competitive dynamics within the tech sector.

Three major economic factors potentially impacting Amazon today are: [Factor 1, e.g., inflation rates], [Factor 2, e.g., interest rate hikes], and [Factor 3, e.g., consumer spending trends]. Recent headlines regarding [Specific News Headline 1, e.g., new regulatory scrutiny] and [Specific News Headline 2, e.g., a successful new product launch] have likely influenced investor sentiment. Competitor actions, such as [Competitor Action 1, e.g., a new pricing strategy from a major rival] and [Competitor Action 2, e.g., a significant technological advancement by a competitor], also play a significant role.

Compared to other major tech companies, Amazon’s performance today is [Comparative Performance, e.g., slightly underperforming compared to Google but outperforming Meta].

Amazon’s Financial Performance

Amazon’s most recent quarterly earnings report revealed [Summary of Key Metrics, e.g., strong revenue growth but slightly lower-than-expected profits]. Key metrics included [Specific Metric 1, e.g., revenue figures] and [Specific Metric 2, e.g., net income]. Projected earnings for the current quarter are [Projected Earnings Current Quarter] and for the upcoming year are [Projected Earnings Upcoming Year]. Revenue growth remains robust, primarily driven by [Major Revenue Stream 1, e.g., Amazon Web Services] and [Major Revenue Stream 2, e.g., e-commerce sales].

- Key Investment 1: [Investment Description and Potential Impact, e.g., Expansion into new markets, leading to increased revenue streams].

- Key Investment 2: [Investment Description and Potential Impact, e.g., Investments in AI and machine learning, enhancing operational efficiency and customer experience].

- Key Investment 3: [Investment Description and Potential Impact, e.g., Development of new technologies, potentially disrupting existing markets and driving future growth].

Analyst Ratings and Predictions

Source: medium.com

Analyst ratings and price targets for Amazon stock vary, reflecting a range of opinions on its future performance. A summary of recent ratings shows [Summary of Ratings, e.g., a mix of “buy,” “hold,” and “sell” recommendations]. Price targets range from [Lowest Price Target] to [Highest Price Target]. The divergence in opinions stems from differing perspectives on [Reason 1, e.g., the impact of economic uncertainty] and [Reason 2, e.g., the success of new strategic initiatives].

Historically, analyst forecasts for Amazon have shown [Historical Accuracy, e.g., a mixed track record, with some predictions proving accurate while others have missed the mark].

Long-Term Outlook for Amazon Stock, Amazon stock price today

Amazon’s core businesses – e-commerce, cloud computing (AWS), and advertising – possess significant long-term growth potential. However, several risks and challenges exist.

| Year | Past Performance | Projected Performance |

|---|---|---|

| [Year 1] | [Past Performance Data] | [Projected Performance Data] |

| [Year 2] | [Past Performance Data] | [Projected Performance Data] |

| [Year 3] | [Past Performance Data] | [Projected Performance Data] |

| [Year 4] | [Past Performance Data] | [Projected Performance Data] |

| [Year 5] | [Past Performance Data] | [Projected Performance Data] |

Potential risks include increased competition, regulatory changes, and economic downturns. Amazon’s strategic initiatives, such as [Strategic Initiative 1, e.g., expansion into new markets] and [Strategic Initiative 2, e.g., investments in sustainable practices], are aimed at mitigating these risks and driving long-term growth.

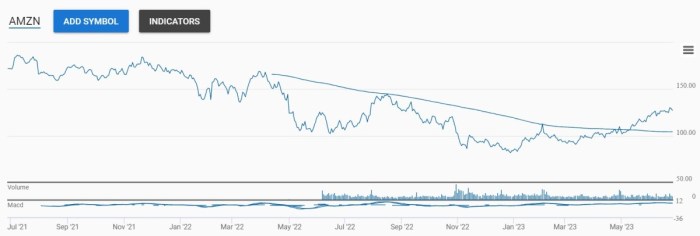

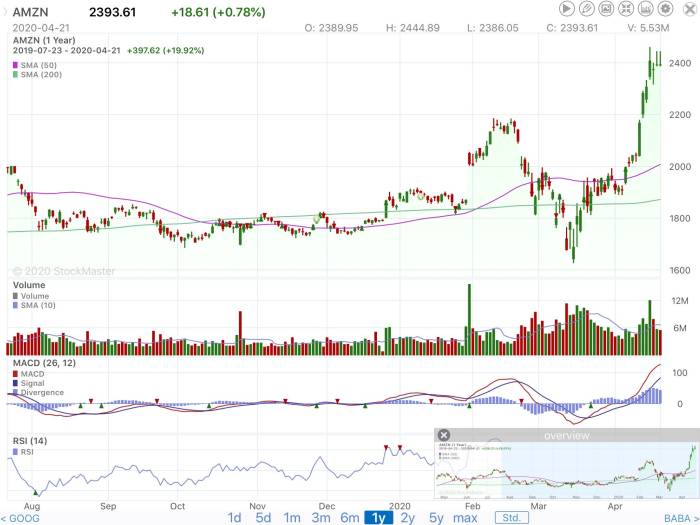

Visual Representation of Stock Performance

Over the past year, Amazon’s stock price has exhibited a [Overall Trend, e.g., generally upward trend] with significant highs around [High Price Point] and lows around [Low Price Point]. Daily price fluctuations have been [Volatility Description, e.g., relatively moderate, with occasional periods of increased volatility]. The stock price movement can be visualized as a curve that initially [Initial Movement, e.g., rose steadily], then experienced a period of [Middle Movement, e.g., consolidation], before resuming an [Later Movement, e.g., upward trajectory] with some minor corrections along the way.

The overall picture reflects a dynamic market response to both positive and negative news impacting the company.

FAQ Corner

What are the main risks associated with investing in Amazon stock?

Risks include competition from other tech giants, economic downturns impacting consumer spending, regulatory changes, and potential disruptions to its core business models.

How does Amazon’s stock price compare to its historical performance?

A comparison to its historical performance requires reviewing past years’ data to establish trends and identify periods of significant growth or decline. This analysis would provide context for today’s price.

Where can I find real-time Amazon stock price updates?

Real-time updates are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is Amazon’s dividend policy?

Amazon does not currently pay a dividend. The company typically reinvests profits into growth initiatives.