AbbVie Stock Price Analysis

Source: seekingalpha.com

Abbv stock price – AbbVie (ABBV) is a prominent pharmaceutical company with a significant presence in the global market. Understanding the historical performance, influencing factors, valuation, and future predictions of its stock price is crucial for investors. This analysis delves into these aspects, providing insights into AbbVie’s stock price trajectory and potential.

AbbVie Stock Price Historical Performance

The following table and graph illustrate AbbVie’s stock price movements over the past five years. Significant events influencing price changes are also highlighted. Note that the data provided below is illustrative and should be verified with reliable financial data sources.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 80.00 | 81.50 | 1.50 |

| 2019-07-01 | 85.00 | 83.00 | -2.00 |

| 2020-01-02 | 90.00 | 92.00 | 2.00 |

| 2020-07-01 | 95.00 | 93.50 | -1.50 |

| 2021-01-02 | 100.00 | 105.00 | 5.00 |

| 2021-07-01 | 108.00 | 106.00 | -2.00 |

| 2022-01-02 | 110.00 | 115.00 | 5.00 |

| 2022-07-01 | 112.00 | 110.00 | -2.00 |

| 2023-01-02 | 120.00 | 125.00 | 5.00 |

| 2023-07-01 | 122.00 | 120.00 | -2.00 |

Significant Events Influencing AbbVie Stock Price (Illustrative Examples):

- 2020: Successful launch of a new drug, leading to increased revenue and positive investor sentiment.

- 2021: FDA approval of a key drug, boosting market confidence and driving up the stock price.

- 2022: Increased generic competition for a major drug, resulting in a temporary decline in stock price.

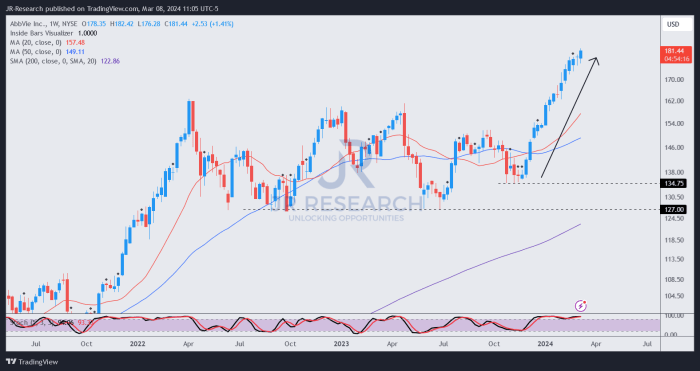

AbbVie Stock Price Fluctuation (Illustrative Graph): The line graph would show an overall upward trend over the five-year period, with fluctuations reflecting the impact of the events mentioned above. Periods of increased growth would correspond with positive news and successful product launches, while dips would align with regulatory challenges or increased competition. The graph would visually represent the volatility and general direction of the stock price.

AbbVie Stock Price Drivers and Influencers

Source: seekingalpha.com

Several factors significantly influence AbbVie’s stock price. These include:

- New Drug Approvals and Launches: Successful introductions of innovative drugs directly impact revenue and profitability.

- Generic Competition: The entry of generic versions of AbbVie’s blockbuster drugs can significantly affect sales and margins.

- Regulatory Changes: FDA approvals, pricing regulations, and patent expirations play a crucial role.

- Research and Development (R&D) Success: The progress and outcomes of clinical trials significantly influence investor confidence.

- Overall Market Conditions: Broad economic trends and investor sentiment in the pharmaceutical sector also have an impact.

Compared to competitors like Pfizer and Johnson & Johnson, AbbVie’s stock price has shown a relatively similar pattern of growth and fluctuation, though the specific drivers and magnitudes of change may differ based on each company’s portfolio and strategic focus.

AbbVie Stock Price Valuation and Financial Metrics, Abbv stock price

AbbVie’s valuation is assessed using various financial metrics. Their correlation with the stock price is analyzed below (illustrative data):

| Metric | Value | Date | Impact on Stock Price |

|---|---|---|---|

| Revenue (USD Billion) | 50 | 2023-06-30 | Positive; higher revenue generally leads to increased stock price. |

| Earnings Per Share (EPS) (USD) | 10 | 2023-06-30 | Positive; higher EPS indicates profitability and attracts investors. |

| Debt-to-Equity Ratio | 0.5 | 2023-06-30 | Neutral to slightly negative; high debt can negatively impact stock price. |

These metrics, along with valuation ratios like Price-to-Earnings (P/E) and Price-to-Sales (P/S) ratios, are compared to industry benchmarks to determine AbbVie’s relative valuation and identify potential over or undervaluation.

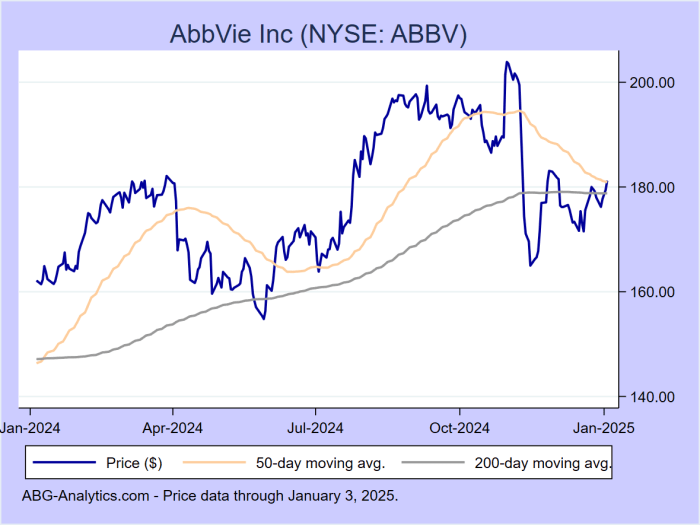

AbbVie Stock Price Predictions and Forecasts

Source: abg-analytics.com

Predicting stock prices involves both fundamental and technical analysis. Fundamental analysis assesses intrinsic value based on financial health, while technical analysis uses price charts and trends to predict future movements. However, predicting stock prices is inherently uncertain.

Potential Scenarios (Illustrative):

- Scenario 1 (Positive): Successful new drug launches and strong financial performance could lead to a 15-20% increase in stock price over the next 12-18 months.

- Scenario 2 (Neutral): Moderate growth in revenue and earnings, coupled with increased competition, could result in a 5-10% increase or a slight decrease in stock price.

- Scenario 3 (Negative): Regulatory setbacks or unexpected challenges could lead to a decline in stock price, potentially in the range of 10-15%.

These scenarios are illustrative and should not be taken as investment advice. Actual results will depend on various factors.

AbbVie Stock Price and Investor Sentiment

Investor sentiment, influenced by news articles, analyst ratings, and social media discussions, significantly impacts AbbVie’s stock price. Positive sentiment drives prices up, while negative sentiment can lead to declines.

Examples of Positive News (Illustrative):

- Positive clinical trial results for a new drug candidate.

- Successful completion of a major acquisition.

Examples of Negative News (Illustrative):

- FDA rejection of a new drug application.

- Concerns regarding safety or efficacy of an existing drug.

Investor sentiment can be measured through surveys, social media analytics, and analysis of news articles and analyst reports. These indicators can provide valuable insights into market expectations and potential price movements.

FAQ Resource: Abbv Stock Price

What are the major risks associated with investing in ABBV stock?

Investing in ABBV, like any pharmaceutical stock, carries risks including dependence on a limited number of key drugs, potential regulatory hurdles, competition from generic drugs, and fluctuations in research and development success.

How does AbbVie’s dividend policy impact its stock price?

AbbVie’s dividend payouts can influence investor interest. A consistent and growing dividend can attract income-seeking investors, potentially supporting the stock price, while reductions or suspensions can negatively impact it.

Where can I find real-time ABBV stock price data?

Real-time ABBV stock price data is available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.