Understanding the “DJT Stock Price Today” Search Query

The search query “DJT stock price today” presents a degree of ambiguity due to the multiple potential interpretations of the ticker symbol “DJT”. Understanding the intended target is crucial for obtaining accurate and relevant financial data.

Interpretations of “DJT”

The abbreviation “DJT” could refer to several entities, leading to potential confusion when searching for stock price information. It’s important to clarify which company or asset is being referenced to ensure the accuracy of the search results.

- Potential Company/Asset 1: While there isn’t a widely known publicly traded company with the ticker symbol DJT, the ambiguity highlights the need for precise search terms.

- Potential Company/Asset 2: Similarly, the absence of a clear DJT association in major stock exchanges necessitates careful consideration of the intended target.

- Potential for Misinterpretation: The lack of a definitive match for “DJT” in standard stock market databases underscores the risk of inaccurate information retrieval.

Ambiguity and Implications

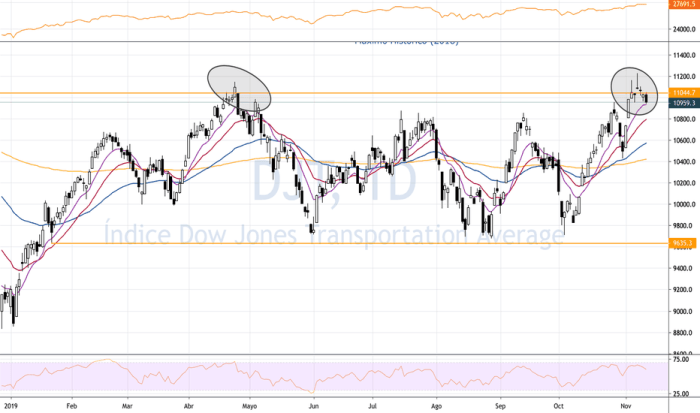

Source: tradingview.com

The ambiguity inherent in the “DJT stock price today” search query underscores the importance of using precise and unambiguous search terms when seeking financial data. Incorrectly identifying the target asset can lead to inaccurate price information and potentially flawed investment decisions.

Data Sources for Stock Price Information

Reliable sources for real-time and historical stock price data are essential for informed investment decisions. Several reputable providers offer comprehensive financial information, each with its own strengths and weaknesses.

Reliable Data Sources

Accessing accurate and up-to-date stock price data requires utilizing trustworthy financial data providers. These sources employ rigorous data collection and verification methods to ensure the reliability of their information.

- Major Financial Data Providers: Companies like Bloomberg, Refinitiv, and FactSet provide real-time and historical stock data, along with a range of analytical tools.

- Stock Exchanges: Directly accessing data from major stock exchanges (e.g., NYSE, NASDAQ) offers a primary source of information, though it may require specific subscriptions or access.

- Reputable Financial News Websites: Many reputable financial news websites (e.g., Yahoo Finance, Google Finance) aggregate stock price data from various sources, but always verify information from primary sources.

Data Collection and Verification

Reliable data providers employ sophisticated methods to collect and verify stock price information. These methods typically involve direct feeds from exchanges, cross-checking data from multiple sources, and employing advanced algorithms to detect and correct errors.

Factors Influencing the DJT Stock Price (if applicable)

Assuming a hypothetical “DJT” stock exists, several economic and market factors could influence its price. Understanding these factors is crucial for predicting price movements and managing investment risk.

Factors and Their Impact

The price of any stock, including a hypothetical “DJT” stock, is influenced by a complex interplay of factors. These factors can be broadly categorized into macroeconomic conditions, company-specific news, and market sentiment.

| Factor | Potential Impact | Example |

|---|---|---|

| Interest Rate Changes | Negative (generally) | Increased interest rates can make borrowing more expensive, potentially slowing economic growth and reducing company profits. |

| Company Earnings Reports | Positive (if strong) / Negative (if weak) | Strong earnings reports often lead to increased investor confidence and higher stock prices. Conversely, weak earnings can trigger sell-offs. |

| Industry Trends | Positive/Negative/Neutral | Positive industry trends can boost a company’s prospects, while negative trends can negatively impact its performance. |

| Geopolitical Events | Positive/Negative/Neutral | Major geopolitical events, such as wars or trade disputes, can create uncertainty and volatility in the market. |

Visual Representation of Stock Price Data

Visualizing stock price data through charts and graphs can significantly enhance understanding of price trends and patterns. Different chart types offer unique perspectives on price movements.

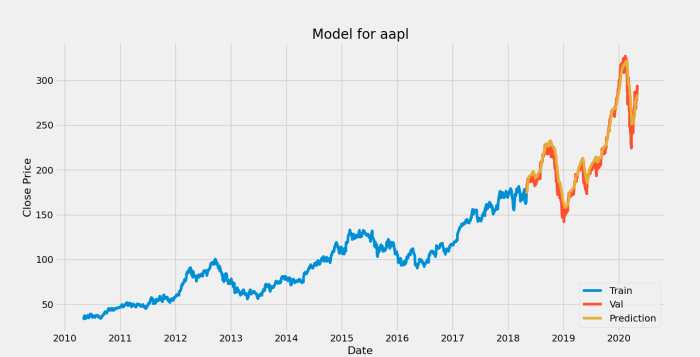

Line Graph

A line graph would effectively display the “DJT” stock price over time. The x-axis would represent time (e.g., daily, weekly, monthly), and the y-axis would represent the stock price. Data points would show the price at each time interval, allowing for easy identification of trends (upward, downward, or sideways).

Candlestick Chart

A candlestick chart provides a detailed view of daily price movements. Each candlestick represents a day’s trading, with the body showing the open and closing prices, and the wicks (upper and lower shadows) indicating the high and low prices for that day. The chart effectively illustrates price gaps, reversals, and momentum.

Bar Chart

A bar chart would facilitate a comparison of the “DJT” stock price with those of its competitors. The x-axis would represent the different companies, and the y-axis would represent the stock price. The length of each bar would visually represent the relative price of each stock, enabling quick identification of relative performance.

Risk and Volatility Associated with DJT Stock (if applicable)

Investing in any stock involves inherent risk, and understanding the level of risk associated with a particular stock is crucial for informed investment decisions. Volatility is a key indicator of risk.

Calculating Daily Volatility, Djt stock price today

Daily volatility can be estimated using standard deviation calculations on historical daily price returns. This involves calculating the percentage change in price each day, then computing the standard deviation of those returns. A higher standard deviation indicates greater volatility and, consequently, higher risk.

Risk Assessment and Mitigation

Risk assessment involves evaluating the potential for losses in an investment. This includes considering factors like market volatility, company-specific risks, and macroeconomic conditions. Risk mitigation strategies include diversification (investing in a range of assets), hedging (using financial instruments to offset potential losses), and setting stop-loss orders (automatic sell orders triggered when the price falls to a certain level).

Ethical Considerations and Potential Misinformation

The dissemination of accurate and unbiased information is paramount in the financial markets. Misinformation can lead to flawed investment decisions and market manipulation.

Sources of Misinformation

Source: cloudfront.net

Misinformation regarding stock prices can originate from various sources, including unreliable websites, social media platforms, and individuals with vested interests. It is crucial to critically evaluate information and verify its authenticity.

Verifying Information and Ethical Implications

Verifying information from reputable sources, such as established financial news outlets and regulatory bodies, is crucial for mitigating the risk of misinformation. Manipulating or misrepresenting stock price information is unethical and can have serious legal consequences. Transparency and accuracy in financial reporting are essential for maintaining market integrity.

Detailed FAQs

What are the potential risks associated with investing in a stock represented by “DJT”?

The risks depend on the specific company or asset represented by “DJT.” Generally, stock market investments carry inherent risks, including market volatility, company-specific risks (financial difficulties, management changes), and broader economic factors. Diversification and thorough research are key to mitigating risk.

Where can I find historical data for a DJT stock?

Reputable financial data providers like Yahoo Finance, Google Finance, Bloomberg, and others offer historical stock price data. The availability of data depends on the specific company or asset in question and the length of its trading history.

How is the daily volatility of a stock calculated?

Daily volatility is often measured using the standard deviation of daily price returns. This requires calculating the percentage change in price each day, then computing the standard deviation of these returns. Higher standard deviation indicates greater volatility.

What are some examples of news events that might impact a DJT stock price?

Examples include company earnings announcements, mergers and acquisitions, regulatory changes, changes in leadership, significant product launches or failures, and broader macroeconomic events (recessions, interest rate changes).