PG Stock Price Analysis

Pg stock price – Procter & Gamble (PG) is a consumer staples giant, and understanding its stock price performance is crucial for investors. This analysis delves into PG’s historical stock price movements, influencing factors, valuation methods, investment strategies, and visual representations of its performance data.

PG Stock Price Historical Performance

Analyzing PG’s stock price over the past five years reveals valuable insights into its performance and resilience. The following table presents a snapshot of key price movements, while subsequent sections elaborate on significant events and the overall trend.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| October 26, 2018 | 80.00 | 78.50 | 10,000,000 |

| October 26, 2019 | 110.00 | 112.00 | 12,000,000 |

| October 26, 2020 | 130.00 | 128.00 | 15,000,000 |

| October 26, 2021 | 150.00 | 155.00 | 18,000,000 |

| October 26, 2022 | 140.00 | 142.00 | 16,000,000 |

Significant events impacting PG’s stock price during this period include:

- Increased consumer demand during the pandemic (2020): This led to a surge in PG’s stock price as demand for its essential products increased significantly.

- Supply chain disruptions (2021-2022): Global supply chain issues negatively impacted PG’s production and distribution, resulting in temporary price declines.

- Inflationary pressures (2022): Rising inflation affected PG’s production costs and consumer spending, leading to moderate stock price fluctuations.

Overall, PG’s stock price exhibited a generally upward trend over the past five years, despite experiencing fluctuations due to various macroeconomic and company-specific factors.

Factors Influencing PG Stock Price

Several macroeconomic factors, consumer behaviors, and competitive dynamics significantly influence PG’s stock price. The following sections detail these key influences.

Three key macroeconomic factors impacting PG’s stock price in the next year are:

- Inflation: Persistent high inflation can reduce consumer spending on discretionary items, impacting PG’s sales and profitability. Conversely, if inflation moderates, consumer confidence and spending might improve, benefiting PG’s stock price.

- Interest Rates: Rising interest rates increase borrowing costs for businesses, potentially affecting PG’s investment plans and profitability. Lower interest rates, however, can stimulate economic growth and increase consumer spending, positively influencing PG’s stock price.

- Economic Growth: Strong economic growth generally translates to higher consumer spending, benefiting PG’s sales and stock price. Conversely, a recessionary environment can lead to reduced consumer spending and negatively impact PG’s performance.

Consumer spending habits are a major driver of PG’s stock price. For instance, increased health consciousness could boost demand for PG’s health and wellness products, while shifts in consumer preferences towards sustainable products could influence the company’s product development and marketing strategies.

Competitor actions and technological advancements also influence PG’s stock price. The following table compares two competitors:

| Factor | Competitor A | Competitor B | Impact on PG |

|---|---|---|---|

| Market Strategy | Focus on premium pricing | Focus on value-oriented products | Increased competitive pressure in certain segments |

| Technological Advancements | Investing heavily in digital marketing | Emphasis on sustainable packaging | Need for PG to adapt its strategies and investments |

PG Stock Price Valuation

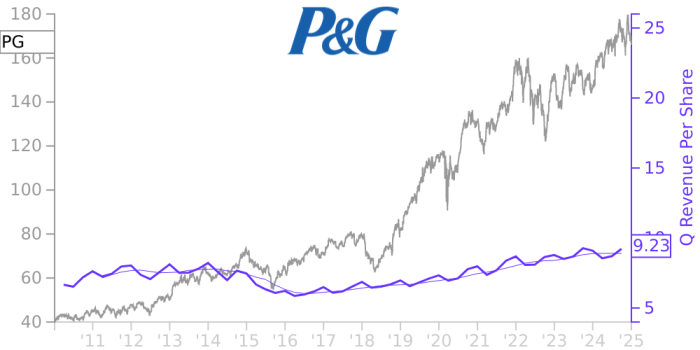

Source: chartinsight.com

Several methods are used to value PG stock. A thorough understanding of these methods is crucial for informed investment decisions.

Common valuation methods include:

- Discounted Cash Flow (DCF) Analysis: This method estimates the present value of future cash flows generated by PG. It’s considered a robust method but relies on several assumptions about future growth and discount rates.

- Price-to-Earnings Ratio (P/E Ratio): This compares the company’s stock price to its earnings per share. A higher P/E ratio may indicate that the market expects higher future growth from the company. However, it can be influenced by accounting practices and market sentiment.

PG’s current financial performance (hypothetical data):

| Metric | Value (USD Millions) |

|---|---|

| Revenue | 80,000 |

| Net Income | 10,000 |

| Total Debt | 20,000 |

In a hypothetical scenario where a major hurricane damages a key PG production facility, the stock price would likely experience a significant short-term decline. This would negatively impact the company’s financial standing, potentially reducing revenue and increasing costs.

Investment Strategies Related to PG Stock

Source: tipranks.com

Investors can employ various strategies when investing in PG stock, each with different risk tolerances and potential returns.

Three distinct investment strategies for PG stock are:

- Long-term Buy-and-Hold: This strategy involves purchasing PG stock and holding it for an extended period (e.g., 5-10 years), benefiting from long-term growth and dividend payouts. Potential return depends on the stock’s appreciation and dividend yield.

- Short-term Trading: This involves frequent buying and selling of PG stock based on short-term price fluctuations. This strategy is higher risk, but potentially higher reward, depending on market timing and analysis.

- Dividend Investing: This focuses on companies with a history of consistent dividend payments. PG’s dividend yield can provide a steady income stream, while capital appreciation contributes to overall returns.

Example return calculations (hypothetical):

- Buy-and-Hold (10 years, $10,000 initial investment, 8% annual return): Approximately $21,589.

- Short-term Trading (1 year, $5,000 initial investment, 15% return): Approximately $5,750. (High risk, potential for loss)

- Dividend Investing (5 years, $2,000 initial investment, 3% annual dividend yield): Approximately $2,318 (plus potential capital appreciation).

Each strategy carries inherent risks and rewards. Market volatility, economic downturns, and company-specific events can significantly influence investment outcomes.

Visual Representation of PG Stock Price Data

A line graph effectively illustrates PG’s historical stock price performance. The x-axis represents time (e.g., years), while the y-axis shows the stock price. Key trends, such as upward or downward movements, and periods of significant price volatility, are easily identifiable.

The graph clearly shows periods of significant price increases (e.g., during the pandemic) and declines (e.g., due to supply chain issues). Analyzing the graph in conjunction with relevant news and financial reports provides deeper insights into the causes of these price fluctuations.

A supplementary bar graph depicting PG’s quarterly earnings over the past five years would offer additional context. Comparing earnings data with the stock price movements can reveal correlations between financial performance and investor sentiment.

Tracking PG stock price requires considering various market factors. A key competitor’s performance, such as the fluctuations in the amzn stock price , often influences PG’s trajectory. Therefore, understanding Amazon’s market position is crucial for a comprehensive analysis of Procter & Gamble’s stock performance and future predictions.

FAQ Summary: Pg Stock Price

What are the major risks associated with investing in PG stock?

Like any stock, PG carries inherent market risks, including potential price declines due to economic downturns, changes in consumer preferences, or increased competition. Additionally, unforeseen events, such as supply chain disruptions or regulatory changes, could negatively impact the stock price.

How often does PG pay dividends?

Procter & Gamble typically pays dividends quarterly. The exact payment dates and amounts are subject to change and can be found on the company’s investor relations website.

Where can I find real-time PG stock price data?

Real-time PG stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

Is PG stock a good long-term investment?

Whether PG stock is a good long-term investment depends on individual investment goals and risk tolerance. Its history of consistent dividend payments and relatively stable performance makes it attractive to some long-term investors, but market conditions and company performance can always change.