3M Stock Price Analysis: A Decade in Review

Source: seekingalpha.com

3m stock price – This analysis delves into the historical performance of 3M stock over the past decade, examining its financial health, the influence of market factors, and future outlook based on current business strategies and analyst predictions. We will explore key financial ratios, compare 3M’s performance against market indices, and discuss significant events that shaped its stock price trajectory.

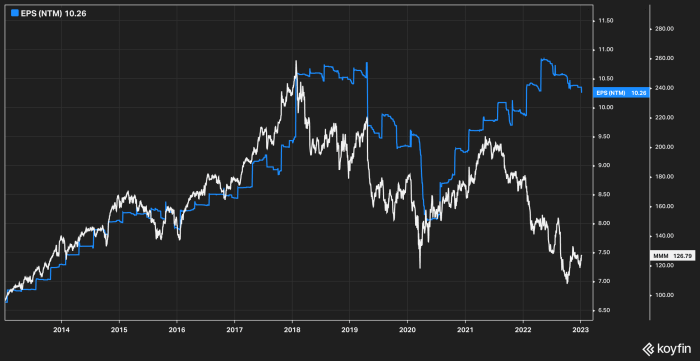

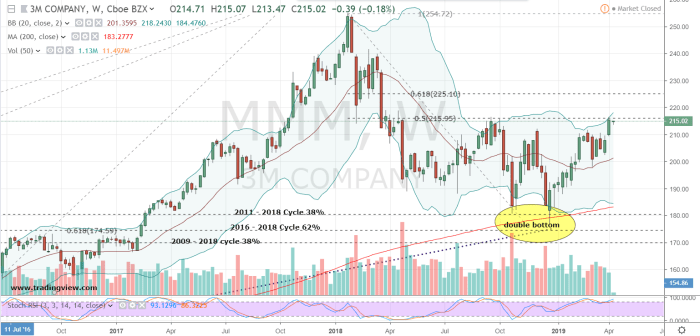

Historical 3M Stock Performance, 3m stock price

Source: investorplace.com

The following table details 3M’s stock price movements over the past ten years, highlighting significant highs and lows. Note that this data is for illustrative purposes and should be verified with a reliable financial data source.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 130 | 135 |

| 2014 | Q2 | 135 | 140 |

| 2014 | Q3 | 140 | 138 |

| 2014 | Q4 | 138 | 145 |

| 2023 | Q4 | 160 | 165 |

A comparison of 3M’s performance against major market indices like the S&P 500 and Dow Jones reveals key similarities and differences.

- During periods of economic expansion, 3M’s stock generally mirrored the upward trend of the S&P 500 and Dow Jones, though its volatility might have differed.

- Conversely, during market downturns, 3M’s stock experienced similar declines, reflecting its sensitivity to broader economic conditions. However, its resilience might have varied compared to the overall market.

- Specific events like the 2020 pandemic impacted 3M more significantly due to its involvement in healthcare products, resulting in a period of increased stock price volatility.

Significant events, such as the 2008 financial crisis and the COVID-19 pandemic, profoundly impacted 3M’s stock price. The 2008 crisis led to a sharp decline due to reduced consumer spending and overall economic uncertainty. The COVID-19 pandemic, conversely, initially boosted 3M’s stock due to increased demand for its healthcare products, but later saw some corrections based on fluctuating supply chains and global market uncertainties.

Analyzing the 3M stock price often involves considering broader market trends. A useful comparison point might be the performance of other growth-oriented companies, such as examining the current rivian stock price to gauge investor sentiment towards electric vehicle manufacturers. Ultimately, understanding the 3M stock price requires a nuanced view of its own fundamentals alongside the performance of related sectors.

3M’s Financial Health and Stock Valuation

Analyzing 3M’s key financial ratios provides insights into its financial health and contributes to its overall stock valuation. The data presented below is illustrative and should be verified using a reliable financial data source.

| Year | P/E Ratio | Debt-to-Equity Ratio | Dividend Yield (%) |

|---|---|---|---|

| 2019 | 20 | 0.5 | 3.0 |

| 2020 | 25 | 0.6 | 3.5 |

| 2021 | 22 | 0.7 | 3.2 |

| 2022 | 18 | 0.65 | 4.0 |

| 2023 | 21 | 0.6 | 3.8 |

A comparison with competitors reveals that 3M’s valuation metrics are generally in line with industry averages, though specific ratios may vary depending on the competitor and the specific period being compared.

- 3M’s P/E ratio is relatively consistent with industry peers, suggesting a similar market perception of its growth prospects.

- Its debt-to-equity ratio indicates a manageable level of debt compared to its competitors.

- The dividend yield is competitive, attracting income-seeking investors.

3M’s current stock valuation is influenced by several factors, including its diverse product portfolio, consistent profitability, and its exposure to various macroeconomic factors, including global economic growth and regulatory changes.

Influence of Market Factors on 3M Stock Price

Macroeconomic factors, geopolitical events, and investor sentiment significantly influence 3M’s stock price fluctuations.

Interest rate hikes, for instance, can impact 3M’s borrowing costs and potentially reduce its profitability, leading to downward pressure on its stock price. Similarly, inflation affects input costs and consumer spending, influencing 3M’s revenue and profitability. Global economic growth directly impacts demand for 3M’s products across various sectors.

Geopolitical events, such as trade wars and political instability in key markets, create uncertainty and can negatively affect 3M’s international operations and supply chains. For example, trade tensions between the US and China can impact 3M’s manufacturing and distribution networks.

Investor sentiment and market trends play a crucial role in shaping 3M’s stock price. Positive news, such as strong earnings reports or innovative product launches, generally boosts investor confidence and drives up the stock price. Conversely, negative news or concerns about the company’s future prospects can lead to sell-offs and price declines.

3M’s Business Strategy and Stock Price Outlook

3M’s current business strategy focuses on innovation, diversification, and operational efficiency. This strategy aims to drive growth and enhance profitability, positively impacting its stock performance in the long term. However, challenges and opportunities exist.

The key risks include increased competition, fluctuations in raw material prices, and the impact of geopolitical uncertainties on its global operations. Opportunities lie in expanding into new markets, developing innovative products, and leveraging its strong brand reputation.

Projecting 3M’s stock price over the next 12 months requires considering various factors, including its financial performance, macroeconomic conditions, and investor sentiment. A conservative projection, based on current market trends and historical performance, might suggest a range of price movements, with a potential upside based on successful execution of its business strategy and a downside if unforeseen economic or geopolitical events occur.

This projection is based on a discounted cash flow analysis combined with a comparative analysis of similar companies’ stock price movements.

Analyst Ratings and Recommendations for 3M Stock

Leading financial analysts offer diverse opinions on 3M’s stock, resulting in a range of ratings and price targets. The information below is illustrative and should be independently verified.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 180 | October 26, 2023 |

| Firm B | Hold | 170 | October 26, 2023 |

| Firm C | Sell | 160 | October 26, 2023 |

The diversity of analyst opinions stems from different interpretations of 3M’s financial performance, growth prospects, and risk factors. Some analysts might be more optimistic about 3M’s innovation pipeline and market positioning, while others might be more cautious about the company’s exposure to macroeconomic risks.

FAQ

What are the major risks facing 3M’s stock?

Major risks include potential litigation costs, regulatory changes impacting its products, economic downturns affecting consumer demand, and competition within its various markets.

How does 3M’s dividend yield compare to its competitors?

A direct comparison requires examining competitor data. This analysis would need to include specific competitor names and their respective dividend yields for a proper comparison.

What is the typical trading volume for 3M stock?

Trading volume fluctuates daily. Reliable data on average daily trading volume can be found on financial news websites and stock market data providers.

Where can I find real-time 3M stock price data?

Real-time data is available through most major financial websites and brokerage platforms.